In September this year Eurex allowed US introducing brokers to become direct exchange members and the derivatives arm of Deutsche Börse also expanded into the US dollar credit index futures market.

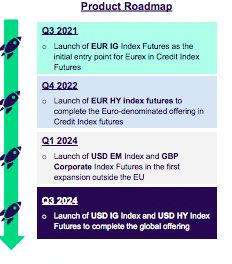

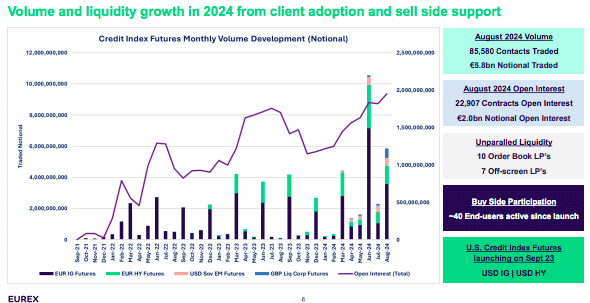

Just over three years ago in September 2021, Eurex launched its credit index futures with a Euro investment grade contract. The standardized, exchange-traded contracts allow market participants to hedge or take synthetic exposures on a Bloomberg fixed income index. Eurex said that the contract traded a total notional volume of €26.7bn as of August 2024.

Eurex then expanded the credit index futures into Euro high yield, GBP corporates and US dollar emerging market sovereigns. In September this year credit index futures traded over 142,000 contracts according to Eurex, with 50,000 in Euro high yield index futures.

Lee Bartholomew, global head of fixed income and currencies product development at Eurex, told Markets Media: “This is a nascent market and our team is excited because we feel that we are first to have a global product. We have built up enough credibility with portfolio managers and portfolio construction teams that the product works and meets their needs and requirements.”

Eurex launched futures on the Bloomberg US corporate index and the Bloomberg US high yield liquid index on 23 September 2024.

Davide Masi, fixed income ETD product design at Eurex, told Markets Media: “We expect that clients who have a global portfolio will start using a global product suite to take either a long or short leveraged exposure on fixed income index benchmarks.”

The exchange added that market participants can gain significant portfolio margin savings through clearing contracts through the Eurex Clearing Prisma risk management system. For example, clients can be long Euro investment grade and short US dollar investment grade credit index futures. A large part of the risk is offset and this is reflected in the lower margins clients would have to post according to Masi.

“We will deliver further risk optimization by the end of the year based on offsetting interest rate risk exposure of credit index futures against our fixed income futures and options, thereby creating a compelling value proposition for clients,” Masi added.

Bartholomew argued that the listed credit market is not big enough to bifurcate across multiple exchanges at this stage.

“Clients want a multi-currency approach with products that are fungible with their rate risk and their correlation risk, and we are well placed to offer it to them,” Bartholomew said.

Potential growth

Bartholomew claimed that credit futures is a market where Eurex has been the leading exchange with a very selective, targeted approach. He said: “We are the incumbent exchange with regards to volume and open interest.”

On 17 June this year CME Group launched US credit futures and said they traded 415 contracts in the first week. CME Group said the contracts were the first futures to help market participants manage duration risk through an intercommodity spread with US Treasury futures and that clients could benefit from automatic margin offsets against CME’s interest rate and equity index futures.

Matthew Angelucci, portfolio manager at PGIM Fixed Income, said in a statement: “The opportunity to isolate credit or duration risk while benefiting from margin offsets with CME Group’s deeply liquid futures markets enables us to hedge our portfolios and provide greater liquidity to a greater number of clients.”

Umesh Gajria, global head of index linked products at Bloomberg Index Services Limited, said in a statement that demand for credit derivatives is driven by the end user and real money, multi-strategy, asset managers and pension funds who want to allocate additional beta or hedge risks on a tactical basis.

Bartholomew agreed there is real money demand. He said: “Davide and the team have done a great job nurturing clients and getting sell-side institutions confident that listed credit products can complement the existing ecosystem.”

He expects foreign exchange and credit markets to increasingly adopt an equity-like model in terms of electronification, trading functionality and algorithmic execution.

“We see opportunities for exponential growth in credit index futures, and a US dollar product suite will help accelerate adoption of our entire product suite,” said Bartholomew.

Masi said the Euro products mostly appeal to a European client base but the US dollar market is completely different and appeals to a global client base, which widens Eurex’s potential customer base.

“We do expect the US dollar products to have a stronger growth trajectory than just the European products over the longer term,”said Masi. “The US is a prime target but we are also very much looking at the Asia Pacific region.”

In addition, Bartholomew added that a natural extension of the credit index futures achieving critical mass would be to consider options.

“I think this will complement the existing product suite and work alongside what we do in fixed income ETF options,” he added.

Bartholomew is excited by what the team can deliver in the next 12 to 18 months. He said: “They have done a brilliant job to get to where we are, and now the focus is on execution.”

Access for introducing brokers

As of 16 September 2024, US introducing brokers were able to become direct exchange members of Eurex. This allowed US market participants executing to access the European derivatives exchange for the full US trading day.

Introducing brokers generally act as intermediaries between clients and brokers. Eurex had previously only been allowed to provide access to introducing brokers outside the US, many of whom were not available after markets closed in Europe.

The change follows the Commodity Futures Trading Commission approving final rules in July which allowed CFTC-registered foreign boards of trade to give US introducing brokers direct access to their electronic trading systems.

Eurex said in a statement that a wide range of European and global benchmark derivatives can be traded on the exchange until the end of the US trading day, including its flagship derivatives such as Euro STOXX 50, STOXX Europe 600, German Bond Futures or a broad range of MSCI derivatives.

Robbert Booij, chief executive of Eurex, said in a statement: “Providing clients with easy access to our markets is a top priority for us. This latest move offers US market participants greater choice and will provide them with greater efficiency in terms of trading and risk management.”