Blue Ocean Technologies’s venue for overnight trading of US stocks was forced to cancel trades on 5 August after a spike in volumes, just a few weeks ahead of its planned migration to a new technology platform.

Blue Ocean clients can trade US National Market System stocks between 8pm and 4am ET from Sunday to Thursday, which allows Asian investors to buy and sell US stocks during their trading day. Last year the Tokyo Stock Exchange acquired a stake in Blue Ocean and the firm also has partnerships with brokers in South Korea and Hong Kong.

Volumes increased after the Bank of Japan increased its benchmark interest rate on Wednesday 31 July for only the second time since 2007. Volatility was exacerbated after a press conference from Jerome Powell, chair of the US Federal Reserve, on the same day and the subsequent poor US jobs report on Friday 2 August.

Blue Ocean ATS faced trading issues on Aug 5 at 1:45 am EST due to high US equity volumes. Trades between 1:45-3:06 am were canceled, and trading was halted. The team is minimizing impact and will update soon. A new tech system will be live by month-end. pic.twitter.com/g3fIhM02XT

— Blue Ocean ATS (@BlueOceanATS) August 6, 2024

Brian Hyndman, president, and chief executive of Blue Ocean Technologies, told Markets Media in February that the firm’s ATS would be migrating its technology to a platform provided by MEMX, the US equities and options exchange operator, this year. He said that Blue Ocean was convinced that MEMX’s technology was the right fit in terms of scalability, reliability, stability, redundancy and compliance features.

A number of brokers are connected to Blue Ocean in order to provide extended trading hours and Robinhood was forced to suspend overnight trading in its 24 Hour Market.

Robinhood 24 Hour Market's execution venue, Blue Ocean ATS (BOATs), has suspended overnight trading for tonight. 24 Hour Market orders that are open as of approx. 8 PM ET will be routed for execution starting at approx. 4 AM ET tomorrow. You may cancel your order at any time, and…

— Robinhood Help (@AskRobinhood) August 5, 2024

Blue Ocean said in an email to Markets Media: “After discussions with all Blue Ocean subscribers, Blue Ocean ATS decided to resume trading operations 6 August 6th at 8pm ET for the 7 August session with a limited number of symbols enabled for trading. All Blue Ocean staff will be monitoring operations carefully and we will continue to be in communication with subscribers.”

We are resuming overnight #trading tonight at 8pm ET for the August 7th trading session with a limited number of symbols including: $GG $DIA $DOG $EEM $EFA $EWA $EWJ $FXI $GLD $IAU $IJH $IWM $PSQ $QQQ $RWM $SGOL $SH $SLV $SPY $TLT $TQQQ $UNG $USO $VTI $XLE $XLF $XLK $BITO $SQQQ pic.twitter.com/bT2qPTxTFs

— Blue Ocean ATS (@BlueOceanATS) August 6, 2024

The Blue Ocean ATS currently operates only on those calendar days when the NYSE Trade Report Facility (TRF) is open for reporting the following morning. The ATS does not open on Friday or Saturday evenings, because the NYSE TRF is not available for reporting of trades the following day.

One market participant said that as trades are not reported until 8:15 ET the following day, they can simply be cancelled and refunded since it is a gray area in the regulations.

Here is an explanation of how the Robinhood overnight trading venue Blue Ocean ATS (BOATS) works and my thoughts on it at the end:

1) Order Entry: Orders are submitted by subscribers through a FIX connection. BOATS is not unique to Robinhood, but is mostly used for…

— TheUltimator5 (@TheUltimator5) August 6, 2024

“It is my opinion that being able to operate in this gray area where trades are all hand-waved for multiple hours and can simply be reversed if there is a problem is a MASSIVE flaw in the system,” they added. “Halting the trading tonight and even reversing some of the trades last night shows just how flawed the system is and that 24h overnight trading should NOT exist under the current regulations since there is a big gap.”

Derivatives

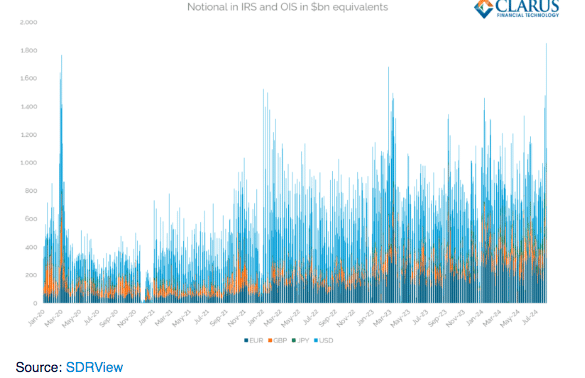

In addition to the spike in equity volumes, increased volatility also led to more derivatives trading. Chris Barnes at derivatives analytics provider Clarus, said in a blog that record volumes were reported to swap data repositories (SDRs) in a single day on 5 August 2024. On that day, overnight index swaps (OIS) also had record daily trading volumes according to Barnes.

“Volumes were at least double the average daily volumes we have seen since 2023, with euro volumes 2.8 times greater than ‘normal’,” he added. “Shockingly, the spike in volumes was higher even than the Covid-induced volatility.”

Across both overnight index swaps and interest rate swaps, volumes reported to swap data repositories also reached nearly $2 trillion on 5 August in euros, sterling, Japanese yen and US dollars according to Barnes.

He said: “This is the highest cleared notional I have seen in the past four years, which by extension I think makes it the largest volume day ever reported to SDRs.”

Barnes argued that over the counter swap markets have benefitted from the central clearing infrastructure that has been put in place since the financial crisis, including SDRs and swap execution facilities (SEFs).

“Clearing scales up in times of stress, transparency proves that markets continue to function, and whilst it is very likely that the price of liquidity increased on 5 August through wider bid/offer spreads, there is no evidence that liquidity was in short supply (albeit at an increased cost),” he added.