BGC Group, the brokerage and financial technology firm, said that its new futures venue is ready to launch in September this year and that its partnership with LCH will have the opportunity to offer greater capital savings than CME Group.

Howard Lutnick, chairman and chief executive of BGC Group, said on the second quarter results call on 30 July that FMX Futures is scheduled to launch SOFR futures in September this year. US treasury futures will follow in early 2025 with full approval from the Commodity Futures Trading Commission.

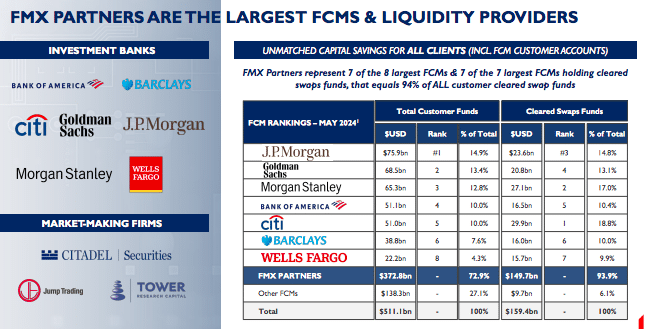

Lutnick said: “Together with our 10 partners, the world’s largest banks and market-makers, we look forward to the launch of SOFR futures, the largest notional futures contract in the world, in September.”

Jason Chryssicas, head of investor relations at BGC Group, said on the call that he wanted to address some recent inaccurate statements made about FMX by Terry Duffy, chairman and chief executive of CME Group.

Duffy said on CME’s second quarter results call on 24 July 2024 that there is no regulatory agreement to clear US sovereign debt futures in an overseas jurisdiction.

Chryssicas said: “Duffy spoke of FMX seeking to clear US treasuries in the UK but we are not. FMX, just like the CME’s BrokerTec, clears US treasuries at the FICC in the United States.”

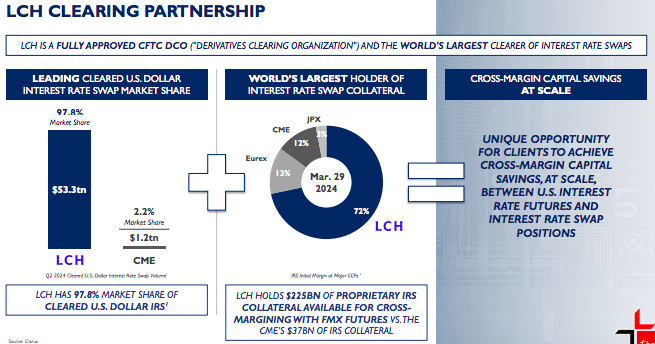

FMX Futures has partnered with LCH, the clearing arm of the London Stock Exchange Group. Chryssicas highlighted that LCH is a fully approved CFTC derivatives clearing organization and the world’s largest clearer of interest rate swaps. LCH has approximately 98% market share in clearing US dollar swaps, with volumes of $53.3 trillion in the second quarter.

“LCH holds $225bn of interest rate swap margin, which is available for cross-margin efficiencies against futures, while the CME holds approximately $37bn of margin,” added Chryssicas.

He argued that SOFR futures are “near perfect” offsets for interest rate swaps and will produce “enormous” cross-margin efficiencies against the larger LCH collateral pool, which CME cannot access.

“Over time, we expect our cross-margin efficiencies to be many multiples of CME,” said Chryssicas.

Duffy said on the CME’s second quarter results call that the group provides unmatched capital efficiencies for customers, with margin savings of nearly $20bn per day for clients through offsets within the exchange group’s rates futures and options franchise.

“To walk away from a potential $20bn of margin savings on a daily basis to go to an unproven model seems to be a bit of a fiduciary stretch for people, so we are in a strong position today to compete with anybody, including the announced competitors,” said Duffy.

Lutnick added that LCH has at least 6.5 times as much collateral as CME in US dollars.

“We think that will create enormous efficiencies and that has nothing to do with clearing US Treasuries,” said Lutnick. “I couldn’t figure out whether it was just a complete misunderstanding, or just a confusing set of statements to try to baffle people as we open, because we got lots of phone calls.”

Growth of FMX Futures

Lutnick described the launch of FMX Futures as a marathon, not a sprint. In the first year the new exchange aims to “get all players on the field.”

There are approximately 50 FCMs (futures commission merchants) in the world that have to be onboarded, together with their clients.

“After a year, it is our expectation that we will have record open interest for a new exchange,” said Lutnick.

In the second year, FMX Futures aims to build volume and connectivity. In the third year, once everyone is connected, Lutnick expects FMX Futures to be fully competing with CME.

“Our opening week is the beginning of a process of bringing fundamental competition to a market that is 100% at the CME today,” added Lutnick. “I think you’re going to see extraordinary competition, but it will be delivered over three years.”

Financials

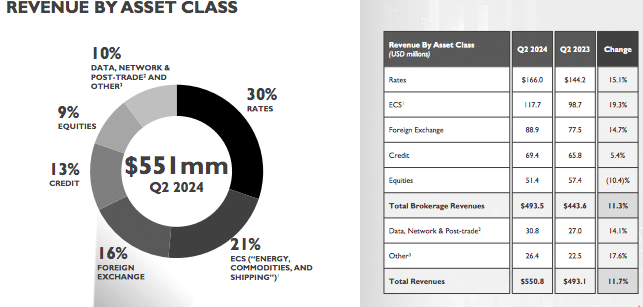

Lutnick continued that BGC delivered record second quarter revenues and adjusted earnings, with continued growth across businesses and geographies.

BGC’s second quarter revenues grew by 11.7% to $550.8m, with strong double-digit revenue growth across its three largest businesses, rates, ECS (energy, commodities, and shipping) and foreign exchange. Profitability increased across all earnings metrics during the quarter.

BGC’s FMX segment includes its cash US treasuries marketplace and a spot foreign exchange platform, alongside the new FMX Futures venue.

FMX US treasury volumes rose 37% in the second quarter to a record $47bn. The market had record market share of 30% for the second quarter according to BGC, up from 23% a year ago. Average daily volume in FX rose by over 30% from a year ago to a record $8.1bn in the second quarter.

Sean Windeatt, chief operating officer at BGC, said on the call: “FMX FX continues to grow faster than the overall market and is expected to significantly grow its market share in the enormous global foreign exchange market.”

Windeatt added that BGC is also excited about the ECS segment, which will provide future electronic growth opportunities for its Fenics markets business.