The US Securities and Exchange Commission has approved the start of trading of spot ethereum exchange-traded funds just six months after spot bitcoin EFTs launched in January this year.

Tom Duff Gordon, VP international policy at Coinbase, said in an email that the approval marks a significant milestone in the crypto ecosystem, emphasising the ongoing shift towards the global transition to digital assets. He added: “This development highlights that crypto is not merely a trend; it illustrates the transformative digital shift in the financial system. We’re proud to be the custodian for eight of the nine newly approved ETH ETFs, entrusted by many leading financial institutions as a reliable,safe, and secure partner.”

History often happen gradually, then suddenly. Crypto is no exception. The approval of spot ETH ETFs today is yet another one of those moments. And it validates what we’ve been saying for years: ETH is not a security. https://t.co/1OGfaNr6ro

— paulgrewal.eth (@iampaulgrewal) July 22, 2024

The SEC approved the launch of bitcoin EFTs in January this year when 10 new ETFs began trading and digital asset manager Grayscale Investments also converted its the Grayscale Bitcoin Trust into an ETF. In May this year the SEC also approved spot ethereum ETFs with market participants expecting trading to begin on 23 July 2024. Ether’s $420bn market cap was second only to bitcoin’s $1.3 trillion market cap as of 19 July 2024, according to data provider Morningstar.

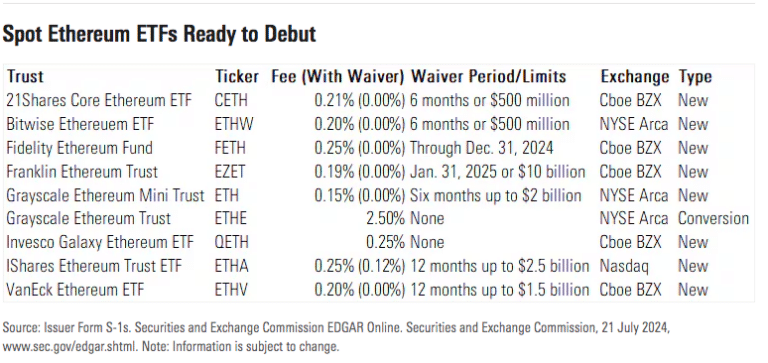

Issuers of ethereum ETFs have already listed bitcoin ETFs – Fidelity, iShares, Bitwise, VanEck, 21Shares, Invesco Galaxy, Franklin Templeton, and Grayscale added Morningstar. The data provider said in a report that WisdomTree and Valkyrie are the two spot bitcoin issuers missing from the spot ethereum list, while 21Shares is issuing its ethereum ETF alone, after joining forces with Ark Invest on its bitcoin ETF. Grayscale Investments will convert its Grayscale Ethereum Trust into an ETF, as it did with its bitcoin trust.

Regardless of your feelings about ether or crypto, this kind of first class TradFi treatment (translating benefits into Boomer-ese and and delivering it in the most preferred inv vehicle on Planet (the ETF) is a major deal. These issuers have over $15T in collective aum. pic.twitter.com/uXR1AL1BxX

— Eric Balchunas (@EricBalchunas) July 22, 2024

1/ Hello, X! This is Jenny Johnson, CEO of Franklin Templeton, taking over the account. Our lawyers help keep me measured in my comments, but to say the least, I am THRILLED about $EZET, our second crypto ETF to launch in the market. 🧵 pic.twitter.com/SFyfyDj5Xj

— Franklin Templeton (@FTI_US) July 23, 2024

“If spot bitcoin ETFs are an indicator, expect iShares and Fidelity to quickly take over Grayscale as the top ethereum ETFs by assets and volume,” added Morningstar.

BlackRock said in statement that the registration statement for BlackRock’s iShares Ethereum Trust ETF (ETHA), has been declared effective by the SEC and is expected to begin trading on Nasdaq on 23 July 2024. The ETF carries a 0.25% sponsor fee with a one-year waiver reducing the fee to 0.12% on the first $2.5bn assets under management. The asset manager described ethereum, a global technology platform, as similar to an app store that generates value for ether as usage increases and more applications are built on top of it.

Jay Jacobs, U.S. head of thematic and active ETFs at BlackRock, said in a statement: “Our clients are increasingly interested in gaining exposure to digital assets through exchange-traded products which provide convenient access, liquidity and transparency. Ethereum’s appeal lies in its decentralized nature and its potential to drive digital transformation in finance and other industries.”

Announcement: Today, the Bitwise Ethereum ETF (ETHW) became the first U.S. ETP to publish its Ethereum addresses and set ENS subnames for each address.

1.ethw.bitwise.eth -> 0xa15c…2A69

2.ethw.bitwise.eth -> 0xEd92…b4eF

3.ethw.bitwise.eth -> 0x3339…7cB5

4.ethw.bitwise.eth… pic.twitter.com/SdOGiXkyqP— Bitwise (@BitwiseInvest) July 23, 2024

Many of the largest tradfi asset managers in the world are launching crypto ETPs.

It's one of the best things that has happened to the space. They bring a huge endorsement to the validity of this asset class to mainstream investors who were unsure, and they have incredible… https://t.co/vO61qd63mF

— Hunter Horsley (@HHorsley) July 22, 2024

On the eve of the launch of the first spot Ethereum ETFs, a look at the current state of play in #bitcoin ETFs.

Most striking (but least surprising) to me is just how much these have traded.

Since they listed, this group's turnover (total value traded/avg. daily assets) has… pic.twitter.com/hQ8KKzIBZO

— Ben Johnson, CFA (@MstarBenJohnson) July 22, 2024

💥BREAKING💥

BlackRock’s #Bitcoin ETF has surpassed the Nasdaq ETF $QQQ in flows this year

Most successful ETF launch ever! pic.twitter.com/C4zY9Ps5cB

— Quinten | 048.eth (@QuintenFrancois) July 22, 2024

Morningstar added that SEC only approved ether ETF filings after staking was disallowed, and the average annual reward for ether staking is roughly 2%-4%. As a result, unlike bitcoin, holding ether directly could hold a meaningful performance edge over spot ether ETFs for investors willing to engage in staking.

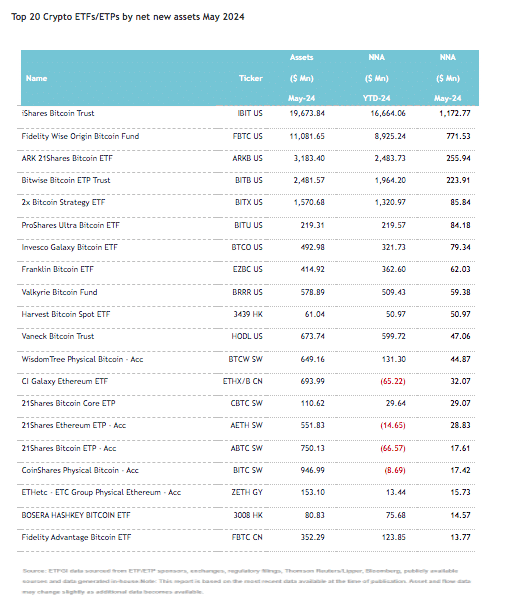

Crypto ETFs and ETPs listed globally gathered net inflows of $44.5bn through to the end of May this year according to ETFGI, the independent research and consultancy firm. ETFGI said in a report that this is a contrast to the $135.6m of net outflows at the same time last year.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $3.1bn during May according to ETFGI. BlackRock’s iShares Bitcoin Trust (IBIT US) had the largest individual net inflow of $1.2bn in May.

Blockworks Research said in a report that the majority of the eight issuers filing for the ether ETF have set fees between 0.19% and 0.25%, with the exception of Grayscale. The Grayscale Ethereum Trust ETF will maintain a fee of 2.5%, and the mini trust will offer a 0% fee for the first six months of trading, up to $2bn in assets under management. Then the mini trust will then charge 0.15%, undercutting all the competitors’ currently advertised rates.

“Interestingly, the mini trust will be seeded with 10% of trust’s current AUM, and investors will receive a proportional distribution of the mini product at creation,” added Blockworks. “Grayscale is likely moving some of its client’s capital into this lower fee product in an attempt to dampen the exodus of funds that was observed with bitcoin trust’s conversion to an ETF. As trading begins, we’ll get our first glimpse into how well this strategy may work for them.”

Law firm Foley & Lardner said in a blog that the ether ETF approval is a significant milestone for increased institutional and retail investments in crypto ETFs.

“The approval of these applications occurred without much resistance, which is a notable departure from the contentious process that preceded the approval of bitcoin ETFs,” added the law firm.

The SEC was forced to approve bitcoin ETFs after losing a lawsuit against Grayscale Investments, which had challenged their previous rejections. However, the SEC approved ethereum ETFs without a lawsuit.

“While this maneuver might have been to avoid more litigation and public scrutiny, the approval shows a steady departure from “regulation by enforcement” and a movement toward actions that promote growth in the cryptocurrency industry and investor freedom,” added the law firm.

Foley & Lardner highlighted that the SEC noted the high correlation between spot ether prices and the CME’s futures market. Morningstar also added that the SEC is unlikely to approve another spot cryptocurrency ETF without them first having a regulated market, which has so far been the CME futures market.

“The CME doesn’t currently list any other cryptocurrency futures,” said Morningstar. “It stands to reason that ETF approval is distant for cryptocurrencies other than bitcoin and ethereum.”

Institutional interest

Foley & Lardner said: “In the coming years, it is very possible we will view the SEC’s decision to approve ether ETFs as an important step in what became a trend of integrating cryptocurrency assets into traditional finance networks through ETFs and other financial instruments.”

Crypto ECN Finery Markets said in its second quarter over-the-counter (OTC) review that the recent approval of crypto-related vehicles has sparked institutional interest in adopting crypto for the long term, demonstrated by the increase in crypto OTC flows. In the first half of this year, the OTC institutional crypto market’s total spot transaction volume rose 95% from the first six months of last year.

“The approval of ETH ETFs may further drive institutional participation in the market,” added Finery Markets “However, we believe that the full impact of ETF approvals on the market may not be fully realized until six to nine months later, as it typically takes this amount of time for innovative products to be fully integrated into financial players’ product portfolios and widely adopted.”

Finery Markets noted that the recent launch of a bitcoin ETF in Australia, and similar launches in the US and Hong Kong, reflect global interest in crypto investment vehicles. In addition, issuer VanEck’s recent application for a Solana ETF highlights this growing trend.

We at @vaneck_us are pleased to announce that @CBOE just filed our 19b-4 to list and trade shares of the FIRST Solana exchange-traded fund in the US!

We look forward to engaging with the SEC during the review period.

— matthew sigel, recovering CFA (@matthew_sigel) July 8, 2024

“These developments signify a changing regulatory environment that is becoming more favorable towards digital assets,” added Finery. “This shift is important as it provides traditional financial institutions with a clear path to enter the crypto space using established financial instruments, taking advantage of current market conditions.”

Future trends

Nate Geraci, president of The ETF Store, said:

Prediction…

An ETF issuer will file for combined spot btc, eth, & sol ETF in next few months.

We’re quickly heading down path towards index-based & actively managed crypto ETFs.

— Nate Geraci (@NateGeraci) July 22, 2024

Brett Harrison, founder and chief executive of Architect Financial Technologies, said:

Now that spot ETH ETFs are set to begin trading next week, a question remains — what is holding the SEC back from approving spot BTC ETF options?

Options on BTC future ETFs were available within days of their underlying ETFs’ listings, but to list options on spot commodity ETFs…

— Brett Harrison (@BrettHarrison88) July 17, 2024

In May this year the New York Stock Exchange said in a statement it is collaborating with CoinDesk Indices to launch cash-settled index options tracking the CoinDesk Bitcoin Price Index, which has been operating since 2014.

The XBX index benchmarks $20bn in ETF assets under management, and tracks the spot price of bitcoin, denominated in U.S. dollars, in real time across multiple crypto exchanges. It is calculated and published once per second, 24 hours per day, 365 days each year.

Andy Baehr, head of product, CoinDesk Indices, said in a statement at the time: “Collaborating with the NYSE to launch XBX index options opens a new chapter in digital assets, placing important and familiar risk-management tools in the hands of U.S. and global investors.”

In July this year Eurex said it is expanding its crypto derivatives portfolio with the launch of FTSE Ethereum index futures and options as of 12 August 2024. The derivatives arm of Deutsche Börse Group launched FTSE Bitcoin Index futures and options in 2023 and more than 100,000 contracts, equivalent to over $3.5bn in notional, have been traded.

FTSE Russell developed the index with Digital Asset Research. The index captures data from vetted assets and exchanges to meet EU Benchmarks. The final settlement rate of the Eurex contracts is determined as the volume time-weighted average of the FTSE DAR Digital Asset Price over a 15 minute period prior to the fixing time.