Crossover Markets was named with the intention of bringing expertise from traditional finance into cryptocurrency and, in time, to deliver crypto expertise into TradFi, such as 24/7 trading. The firm has launched CROSSx which it said is the first execution-only crypto electronic communication network (ECN) for institutional participants and raised $12m in funding in June this year.

Brandon Mulvihill, co-founder and chief executive of Crossover Markets, told Markets Media: “We were the first ECN in the crypto space.”

He described the model of other crypto exchanges as client-facing brokers with a captive business model which means if investors open an account with an exchange, they have to buy and sell through that venue.

“That model is very good in retail and for small to medium-sized institutions as the customer is looking for simplicity,” Mulvihill added. “When you peek under the hood, crypto exchanges are actually involved in selling a collection of ancillary benefits such as custody, or staking protocols.”

However, the institutional space has the concept of fungibility where they can buy an asset from counterparty A, sell to counterparty B and have a net flat position, which reduces the cost of trading.

“We can bring the best practices from equities and FX into crypto with an ECN,” said Mulvihill. “CROSSx is not a counterparty to trades, and does not hold assets or coins.”

The Crossover team has specific expertise in trading micro-market structure. Mulvihill was previously global head of FX prime brokerage at Jefferies, and a former executive at FXCM. Vladislav Rysin, co-founder and chief technology at Crossover Markets has built, operated and sold venues across multiple asset classes, including FastMatch for foreign exchange, which was sold to Euronext for almost $200m.

One of CROSSx’s advantages, according to Mulvihill, is that it does not have a central limit order book with just one liquidity pool. Instead, the ECN uses quote-driven matching technology where all maker and taker interactions are customized based on flow characteristics and unique liquidity needs.

“The complexity scales exponentially and the barrier for entry is extraordinarily high,” he added. “We also remove the conflict of interest from the central limit order book model as we have different specs for market makers and liquidity takers.”

Mulvihill said CROSSx is in the game of competing, every second of every day, for trades from institutions based on the cost of trading and the venue’s low latency. CROSSx executes 99% of trades in between six and 11 microseconds, which he described as between 30 to 50 times faster than most institutional crypto exchanges.

Investors also need a credit sponsor to access CROSSx, which is currently Hidden Road. Mulvihill acknowledged that the lack of prime brokers and credit intermediation is an issue in crypto, but argued that the ecosystem is in its early innings.

“Hidden Road has done a great job because they’ve deployed the FX prime brokerage model, which I think works better than the equities model,” he added.

Clients are market makers using CROSSx for hedging in a precise way; hedge funds running electronic quantitative strategies and retail brokers who are looking to enter spot crypto, and really care about price according to Mulvihill.

“We have already seen a massive uptake in institutional demand this year,” he added. “We have onboarded almost 60 client institutional clients and have another 60 at various stages of joining which, for us, is ahead of schedule.”

Institutional interest was boosted by the launch of spot bitcoin ETFs in January, especially by traditional asset managers such as BlackRock, and trading platform Robinhood Markets acquiring crypto exchange Bitstamp.

Crossover Markets reported that in the first quarter it had executed more than $3.15bn in notional trading value, 415,450 trades, and processed over 141 billion quotes.

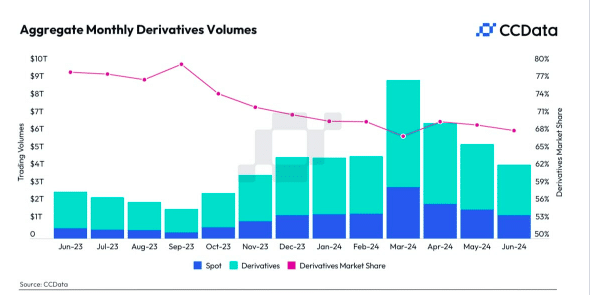

Data provider CCData said in a report that overall digital asset trading volumes dropped for the third consecutive month in June.

“In June, the combined spot and derivatives trading volume on CEXs continued to decline; a trend that has been ongoing since March 24, when digital asset volumes reached an all-time high of $9.05 trillion,” said CCData. “The combined trading volume fell 21.8% to $4.22 trillion as major crypto assets including bitcoin and ethereum remained largely rangebound and recorded major drawbacks in June.”

Fundraising

In June this year Crossover Markets said in a statement that it raised $12m in its Series A funding round led by Illuminate Financial, the venture capital firm specializing in financial technology, and DRW Venture Capital. They join strategic investors who include Flow Traders, Laser Digital, Two Sigma, Wintermute, and retail brokers such as Exness, Gate.io, GMO, Pepperstone, Trademax and Think Markets.

Mark Beeston, founder and managing partner of Illuminate Financial, said in a statement: “Crossover adds best-in-class execution capability to our portfolio, serving both the immediate and long-term needs of financial institutions that wish to trade digital assets with a future-proof 24/7 low latency infrastructure that traditional markets are increasingly moving towards.”

Beeston will join Crossover’s board of directors alongside Kevin Wolf, chief financial officer at American Financial Exchange and former chief executive of Euronext FX.

Mulvihill said the funds will be used to invest in technology and expand geographically, which will require capital for regulatory licences.

“We were the first ECN in the crypto space and we want to increase the distance of our technical capacity to our rivals,” he added. “We feel that we have come out of our MVP stage and have been able to prove to the market that we are the fastest venue globally.”

CROSSx also intends to introduce advanced order types such as flash or conditional orders and increase its use of artificial intelligence.