The use of JP Morgan’s JPM Coin token on Broadridge’s distributed ledger repo (DLR) platform allows faster and more flexible settlement, so participants can manage their liquidity and capital more efficiently.

The DLR platform uses blockchain technology to offer clients intra-day, overnight and term repo capabilities. Broadridge Financial Solutions launched its distributed ledger repo (DLR) platform in 2021 and the cash leg has been settled using traditional finance payment rails, which is slower than the instantaneous, or atomic, settlement that is possible on-chain.

Repos allow one firm to sell a security to another firm with a simultaneous promise to buy the security back at a later date at a specified price, which has the economic effect of a collateralized loan, as they are mainly used to borrow cash using securities as collateral.

Broadridge is incorporating JPM Coin as a digital cash alternative to provide digital atomic settlement for both the cash and securities legs of a repo.

Horacio Barakat, head of digital innovation at Broadridge, said in an email to Markets Media that cash-on-chain will become part of the mainstream. Offering JPM Coin as a digital cash settlement alternative provides increased transparency and velocity to the cash leg to match the digitized securities settlement velocity.

“By providing true atomic digital settlement, repo counterparts can improve their capital utilization and liquidity management by having a flexible settlement cycle that can be as short as they want to for each repo trade,” added Barakat.

He highlighted the increase in flexibility of the settlement cycle, which he said is important as speed. The settlement can be as short as the counterparties agree to, down to a minute, which allows for the most efficient use of collateral and improved liquidity management.

DLR currently processes over $1 trillion per month in notional value across multiple use cases for eight entities, and Barakat said the firm is in the process of onboarding several more for intraday repo.

He expects the interoperability between DLR and JPM Coin will be another catalyst for further development of the intraday repo market.

“This is because of the flexibility that we can provide for both the on-leg and the off-leg of intraday repo transactions based on the needs and specific agreement between trade counterparts,” he said.

Nelli Zaltsman, head of platform settlement solutions, Onyx by J.P. Morgan, said in an email to Markets Media that the bank is already exploring the use of digital assets as collateral and believes the capabilities are there.

“This will continue to improve over time as the industry finds increased paths to interoperability,” said Zaltsman.

For example, BlackRock and Franklin Templeton have launched tokenized money market funds, which could eventually be able to be used as collateral.

“ Last year, we facilitated the tokenization of BlackRock MMF shares for this purpose on the Onyx Digital Assets platform through our Tokenized Collateral Network application, and we continue to explore such use cases,” added Zaltsman.

JPM Coin

JP Morgan started a blockchain group in 2015 with a handful of people to think about how blockchain could be beneficial or disruptive to the bank. The team carried out between 70 to 90 proofs of concepts and in 2020 the bank decided that it had enough proof points to see that the technology would be meaningful for the bank and that it needed to set up a business unit.

Onyx is a business unit in JP Morgan’s corporate and investment bank, but it also works across the firm with other businesses such as the retail bank and asset and wealth management. The business has four stripes – the Onyx Digital Assets platform for tokenizing traditional financial assets; Link, which is focused on information flows and cross-border payments; Coin Systems which is a value transfer business; and finally, Blockchain Launch which is related to Web3 innovations that are relevant for a bank.

The JPM Coin system was launched in 2020 to provide better treasury solutions for corporate clients with complex global treasury needs. Zaltsman said the bank believed that blockchain technology had the potential to uplift payments across any use case.

Zaltsman described the JPM Coin system as a 24/7 system that offers near-instant settlement, as well as liquidity management across borders, and that can be triggered programmatically. As a result, the system allows accounts to be funded, and payments to be initiated programmatically. Therefore, these tools can be used to manage liquidity required for capital markets activity in a manner benefiting from automation that is most optimal.

“With the addition of synchronized settlement capabilities to JPM Coin, we can now bring the efficiency of JPM Coin to the broader financial ecosystem for settlement of a wide range of transactions, particularly for users of transactional platforms benefiting from quick and efficient technology for one leg of a transaction, like an asset movement, that need a payment solution to match in speed and timing,” she added.

As digital asset transactions rise in the institutional space and develop across multiple platforms, JPM Coin is looking to offer a universal payment solution, available in trusted major currencies, across diverse use cases according to Zaltsman.

“Clients won’t be forced to fragment their liquidity or engage in cumbersome repeated onboarding to pay for such transactions – just as today, we wouldn’t expect anyone to open up a new banking relationship every time they wanted to buy something,” she added.

Zaltsman believes this is how to achieve a truly composable, interoperable financial ecosystem that is accessible to the regulated financial services industry.

Cash on chain

Broadridge expects to make other broadly adopted cash-on-chain alternatives available on DLR, in addition to JPM Coin, and the bank also anticipates making JPM Coin available as a settlement option for transactions on other platforms.

JP Morgan’s Onyx Digital Assets (ODA) platform has native blockchain capabilities for both cash on ledger with the JPM Coin System and the tokenization of assets, in which assets are represented digitally on chain, and can be programmed using smart contracts.

“We have been uniquely able to support capital markets use cases with both assets and cash on the same ledger – first with intra-day repo, and more recently with the issuance of municipal bonds,” said Zaltsman.

She continued that these use cases highlight the benefits of having a payment leg that matches the speed and transparency of tokenized assets being settled – reducing settlement risk through atomic settlement, as well as allowing precise use of funds down to the minute, reducing the cost of capital.

“To our awareness, we were the first global bank to offer delivery versus payment (DvP) with both cash and assets on-chain, and we believe we remain the only major bank to do so at scale and on a continuous basis,” she added. “We look forward to exploring how this combination of features can further support capital markets activity.”

Onyx Digital Assets also offers intraday repo but Zaltsman argued there is no conflict of interest. She said JPMorgan is consistently a banking provider of choice to financial institutions and other parties that may engage in similar businesses, including other banks, broker-dealers, and asset managers.

“It is in the ordinary course of operation for us to serve internal and external clients alike irrespective of use case,” she said.

Central bank digital currencies (CBDCs)

Nearly all, 98%, of central banks around the world are also developing their own digital currency to issue as a type of digital money alongside cash, and there could be 24 live CBDCs by 2030, according to a report from The World Economic Forum in association with Accenture. The report said: “Wholesale markets demand secure and efficient settlement infrastructure from participants to promote financial stability, enable domestic and international trade, and create economic opportunities.

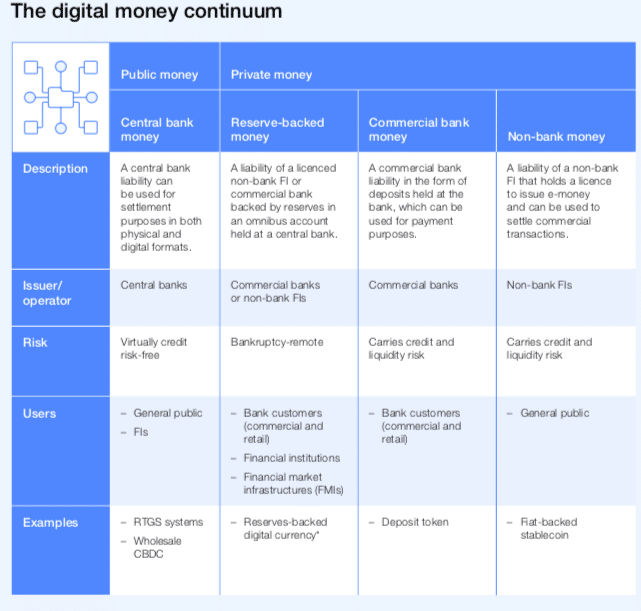

In contrast to CBDCs, cryptoassets are issued privately and not supported by a central bank or government as a lender of last resort in the event of a failure. CBDCs also aim to be more stable and retain their value over time.

Legal and regulatory elements will govern the possibility of widespread use of CBDC in wholesale markets and the timeframe is unknown, according to the report. Therefore, private-sector solutions may grow alongside CBDCs and the outcome of regulations will influence the future mix of payment instruments.

Zaltsman said it is possible that certain segments of the market may use CBDCs in the future, but JP Morgan does not currently believe that this will be a dominant means of settling digital assets.

She argued that a few factors may impact the use of CBDCs, including the available currency of available CBDCs. For example, the absence of a USD CBDC may prevent adoption in key markets. Use will also be affected by the structure of CBDC offerings (whether available to wholesale, retail or both), their scale and whether new digital asset markets bring about different, less domestically centralized settlement, requiring increased cross-border payments, which CBDCs may not seek to support.

In addition, Zaltsman added there is no universally agreed definition of the term “digital assets.”

“Certain assets may lend themselves to settlement with central bank money, which we typically associate with settlement in the market through clearinghouses,” she said. “However, tokenization may lead to a broader set of digital assets outside of securities, such as new forms of tokenized real world assets, that are more commonly aligned to commercial bank money, and that are possible to exchange in a more bilateral manner.”