Private credit is one of the areas where JPMorgan Chase sees opportunity for growth in commercial and investment banking.

Troy Rohrbaugh, co-chief executive of commercial and investment banking, said at JPMorgan Chase’s investor day on 20 May in New York, that the bank has a leading markets franchise but still has many opportunities for growth in individual clients segments and products. In January this year JP Morgan combined its wholesale businesses – global investment banking, commercial nanking, corporate banking, markets, securities services and global payments – into the commercial & investment bank division.

Rohrbaugh described the markets business as a top global franchise with a consistent market share of 11.4% and a wallet that remains elevated.

“However, this higher wallet has intensified competition from both banks and non-banks,” he added. “Despite being number one in fixed income, currencies and commodities, our share is lower than pre-pandemic levels due to both renewed focus from our peer banks and changes in the overall wallet mix.”

In equities last year the bank fell to number two, which Rohrbaugh said was due to relative underperformance in both derivatives and cash. He stressed that in equities the bank has been on a multi-year investment journey and market share has grown by 120 basis points since 2019.

Rohrbaugh identified potential growth areas as expanding product offerings across select geographies and asset classes, including financing, energy, and private credit.

“Private credit is a very important growing space and we believe we have an advanced strategy across the entire commercial and investment bank,” he added. “We believe we are uniquely positioned to be an important part of all aspects of the ecosystem.”

He continued that the bank is the largest financier of private credit portfolios and will remain a significant player in the space. In addition, the bank already has dedicated capital on its balance sheet to put to work in direct loans for corporate borrowers.

“We are also developing a co-lending programme to enhance the amount of capital we can put to work in the space,” said Rohrbaugh. “So whether it’s a broad, direct or broadly syndicated loan, we can be truly agnostic to our corporate clients’ borrowing needs.”

Jamie Dimon, chairman and chief executive of JPMorgan Chase, said at the investor day that the bank will compete in private credit.

“We have seen 10 or 15 deals where the client got out of private credit and went back into the syndicated loan market to save 20 basis points, which they are very sensitive about at higher rates,” he added.

He continued that private credit has some advantages, such as lending for a longer time period – but there are some negatives. For example, loans are not marked to market with the same discipline as at JP Morgan.

“I think some private credit people are very smart and know exactly what they are doing,” said Dimon. “But my experience of life is that it is not true for all of them. The problem isn’t caused by the good ones but by the bad ones.”

He argued that private credit has not dealt with high interest rates, a recession and high spreads. However, Dimon does not think private credit is big enough to cause a systemic problem by itself but could cause a market panic, which could then become systemic.

Basel III endgame

Rohrbaugh also believes that the US Basel III endgame will involve participating in private credit on both sides of the market by lending and borrowing. In July 2023, the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation proposed capital rules known as the US Basel III ‘endgame’ based on the global minimum regulatory capital standards developed by the Basel Committee on Banking Supervision (BCBS).

“We believe this will not only benefit our clients, but certainly be beneficial to our business,” said Rohrbaugh. “Against all these growth opportunities we will have capital headwinds given the Basel III endgame, but we are anticipating a more measured and manageable rule outcome versus the original proposal.”

Financial trade organizations, such as ISDA, have said the original US Basel III proposal will have a significant negative impact on trading activity and the liquidity and vibrancy of the US capital markets, with adverse effects on derivatives end users, investors, businesses and consumers.

Dimon questioned the regulators and asked what they are trying to achieve with the Basel endgame.

“Do they want private credit to grow dramatically ?,” said Dimon, “Do they understand the risk of private credit ?”

He continued that the firm has $80bn of capital deployed to trading but has only lost money trading on 30 days in the last 10 years. Under Basel III, Dimon said the capital allocation to trading would increase from $80bn to $120bn.

“We make $100m a day and our average loss was $92m,” added Dimon. “Even in the worst quarter ever during the great financial crisis with Lehman Brothers collapsing, we lost $1.7bn.”

Dimon argued that regulators are overlooking the biggest risk in the financial system today which is cybersecurity, especially as people go to the cloud.

Growth opportunities

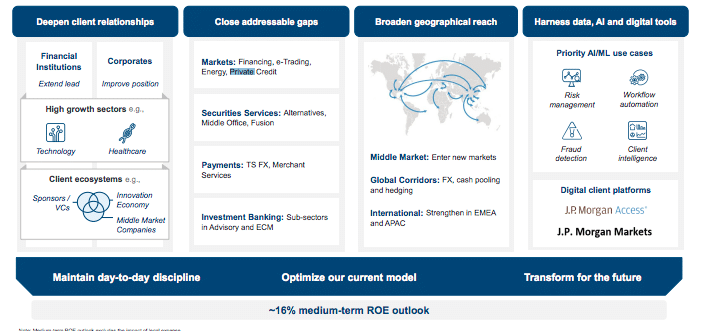

Jennifer Piepszak, co-chief executive of commercial and investment banking, said at the investor day that combining these businesses made sense as they serve a diverse client base ranging from corporates to financial institutions of all sizes, across sectors and regions with products ranging from daily trading and transaction processing to strategic events and actions.

She said: “For example, a typical middle market client relationship often begins with payments and working capital solutions, then extends to broader financing and hedging needs as well as early stage fundraising. As they grow in size and complexity that can lead to an IPO and beyond and we can do all of it.”

Piepszak agreed that the competitive landscape has continued to intensify from traditional peers in areas like middle market banking, as well as non-banks in areas like private credit.

For example, in EMEA the division lost share from 9% in 2019 to 8.8% in 2023 as competition has increased in the region, although it gained share over the same time period in the Americas and Asia Pacific.

“We still have plenty of opportunities to gain share, particularly in areas where we are not number one like security services and cash equities,” Piepszak added.

Filippo Gori, co-head of global banking and chief executive of Europe, Middle East and Africa, said at the investor day that investment banking still has enormous potential for growth despite being ranked number one in fees for 15 years. Gori identified growth opportunities as financial sponsors, whose scale and role is expanding each year; the innovation economy which is a high growth global ecosystem and the middle market, where the bank continues to deepen relationships in existing markets and expand its US footprint.

“We have identified the green economy, healthcare services and software as areas in which to focus more of our time and intellectual capital,” Gori added.

Doug Petno, co-head of global banking, agreed at the investor day that JP Morgan has the potential to grow market share across many segments in the investment bank.

Petno said: “In particular, financial sponsors is a large market opportunity that plays directly to our strengths. There is $3 trillion of dry powder across this asset class, as well as several trillion dollars of invested capital that will need liquidity at some point.”

Over the last five years, about half of the investment banking wallet from sponsors has come from middle market size transactions within global banking according to Petno. He argued this gives JP Morgan a competitive advantage as the bank has relationships with over 28,000 middle market companies and covers more than 1,000 financial sponsors.

“To support our growth we’ve expanded our teams globally with a dedicated focus on infrastructure, middle market private equity, and sponsor M&A,” added Petno. “We’ve continued to build our private credit and direct lending capabilities and we’ve been actively deploying our balance sheet over the past few years.”

In the innovation economy, Petno said the bank has accelerated its strategy to be the best financial partner across the entire ecosystem, serving venture capital firms and partners to startups and their founders in a coordinated way across the firm.

Petno said JP Morgan added more than two years worth of clients in only a matter of months as a result of the bank’s acquisition of First Republic. To support this growth, JP Morgan had hired over 200 bankers, expanded its presence internationally and set up dedicated teams for high potential sub-sectors such as software, applied tech and climate tech.

“We launched our team focused on early stage startups, and it now allows us to acquire clients at a much earlier stage in their growth cycle,” said Petno. “Our investments have driven strong client acquisition and accelerated revenue growth with last year being a complete step change in our market position, and we’re just getting started.”

Technology spend

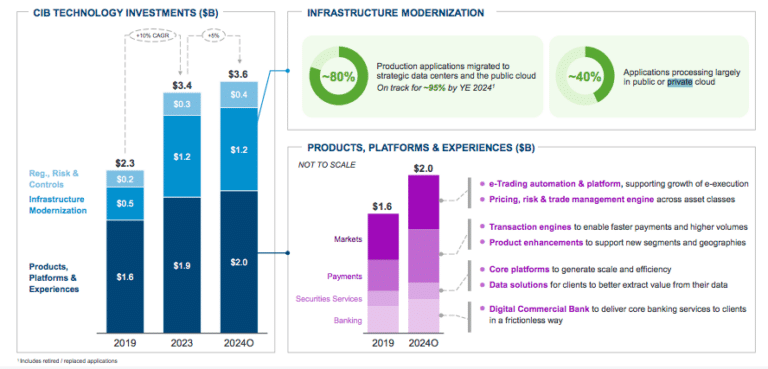

The commercial & investment bank division.expects to increase technology investments from $3.4bn in 2023 to $3.6bn in this year, and maintain spending on digital, data and artificial intelligence/machine learning at $400m.

Technology spending will be spread across three broad categories according to Piepszak. The first is regulatory risk and controls; the second is infrastructure modernization which includes migration to new data centres, public and private cloud enablement; and cybersecurity and resiliency.

Piepszak said: “We expect to largely complete the data centre migration by the end of this year. Nearly half, 40% of applications are now running in the cloud against a target of closer to 60%.”

The third category is approximately $2bn of investments in products, platforms and experiences which includes markets, pricing, risk, trade management engine, payments, transactions engines, as well as data solutions in security services and the digital commercial bank.

Investing in automation has also allowed securities services to reduce cost per trade in custody by 7% since 2019, and for trading services to reduce in cost per trade by 74%.

Succession

Analysts also asked Dimon how much longer he intended to remain as chief executive, and if he would stay beyond the next two and a half years. Dimon replied that the decision on his departure is up to the board, which will also choose his successor.

“I have the energy that I have always had,” he added. “We are moving people around and they have been all over the company, so there are there good potential successors.”