The management of Nasdaq stressed the importance of cloud migration and its ability to help implement generative artificial intelligence at the technology company and market operator’s investor day.

Adena Friedman, chair and chief executive of Nasdaq, presented at the investor day on 5 March in New York.

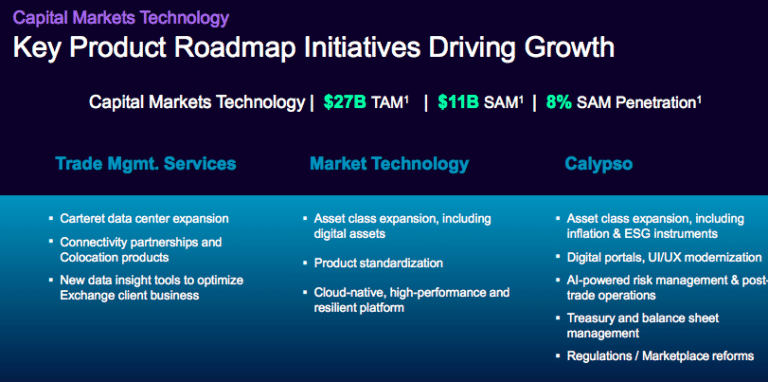

Nasdaq is formed of three divisions – capital access platforms; financial technology and market services. Most time on the investor day was spent on the financial technology division because Friedman said there had been some big changes in the business to broaden its capabilities. The financial technology division is expected to achieve at least $100m in incremental revenue through cross-sell opportunities by the end of 2027.

Friedman continued that one of Nasdaq’s key strategic differentiators is technology leadership as the firm has been a disrupter and an innovator for decades.

“We have been a deep investor in cloud over the last 10 years and we are driving and transforming our business into cloud-enabled services,” she added. “We now are a hyper-resilient, scaled, hyper low-latency cloud-native trade lifecycle technology provider.”

Nasdaq believes it has an advantage by using this technology in its own markets before rolling it out to market technology clients across trading, clearing and settlement.

“We are seeing great pickup across the world because customers know that we can make them more scalable, more nimble and more responsive to their investors and their clients,” said Friedman.

She continued that another differentiator is Nasdaq’s “gold source” data which she described as proprietary and unique because it is generated from the firm’s engines – its market engines, analytics engines, and financial crime management engines which can be transformed into actionable intelligence for clients to create value

Brenda Hoffman, chief technology officer of financial technology and market services, said at the investor day that it was the first global exchange operator to take a major regulated market to cloud technology. Nasdaq’s MRX Options Exchange and Nasdaq Bond Exchange (NBE) moved to AWS in 2022.

“Our 130 market operator clients wanted us to go first, so we assembled a team of engineers, business and lawyers to work with the regulator and AWS and we set out on a journey,” Hoffman said. “In just under 11 months, we were launching a market on cloud infrastructure.”

Hoffman said the migration created a blueprint that Nasdaq can use to continue to progress other markets to the cloud. Last November Nasdaq migrated GEMX, another options exchange, to AWS. Performance improved after the migration according to Hoffman with a 10% improvement in latency and tighter determinism.

Kevin Kennedy, head of North American market services, said at the investor day that cloud technology enabled Nasdaq to process four times as much message traffic as five years ago.

“We have reduced our cost per message by 80% which is an incredible asset for someone that is running a market,” he added.

Artificial intelligence

In addition, cloud infrastructure allows Nasdaq to adapt to emerging technologies such as artificial intelligence. Brad Peterson, chief technology and chief information officer at Nasdaq, said at the investor day that the group formed its AI organisation seven years ago

“We now have AI in every one of our businesses and in our products so we have made a lot of progress,” Peterson said. “It is an incredible opportunity for automation for our customers who have a lot of workflow that is human based.”

The capital access platforms division was an early adopter of AI and had success with investor sentiment studies before automating advisory services and reports, and the organisation and collection of environmental, social and governance (ESG) data.

“Things started to really take off in 2008 when there were open source language models, and we saw they produced good results,” he added. “We knew that this technology was advancing exponentially and so we weren’t surprised when ChatGPT delivered incredible capabilities and our view is that open source models will be the way to go.”

Hoffman highlighted that Nasdaq is launching Dynamic Midpoint Extended Life Order (M-ELO), its first AI-driven order type in the first half of this year.

Nasdaq has offered a midpoint extended life order (MELO) order type for several years. MELO introduced a fixed holding period to gather order interest before application for clients seeking larger trade sizes at the midpoint. After extensive testing and consultation, Nasdaq found trade execution could be improved under certain market conditions by applying adaptable holding periods.

Therefore, Dynamic MELO uses AI to adjust the length of holding periods throughout the trading day on a stock-by-stock basis to improve fill rates and reduce market friction. Nasdaq has said that in testing Dynamic M-ELO has achieved an improvement of more than 30% in average combined volume-weighted order fill rates.

Nelson Griggs, president of Nasdaq, said the firm’s products are on a modern cloud architecture with sophisticated API delivery capabilities.

“The advancements in generative AI are allowing us to go into the datasets and bring new insights to our clients and also to inform our own business decisions,” he added. “This is very important in the index business as we think about trends and new products that we are bringing to market.”

Griggs gave three examples of tools built on modern cloud architecture to provide enhanced data insights using AI that Nasdaq launched in 2023 – Nasdaq Metro which allows companies to capture, measure and report out ESG metrics to multiple stakeholders; Sustainable Lens which is an AI powered tool to help companies benchmark their ESG metrics and ESG Lens which allows our clients to monitor the ESG characteristics of their portfolio.

Kennedy gave the example of AI playing a role in the growth of index options trading.

“AI has played a small part because we have a strike optimization programme where we can tailor strikes to meet client demand,” he added.

Financials

Friedman said Nasdaq is uniquely positioned to grow its share of a $31bn serviceable addressable market opportunity.

Nasdaq has completed its acquisition of Adenza has already accelerated Nasdaq’s growth story by expanding Nasdaq’s total pro forma revenue, Solutions revenue, and non-GAAP operating margin. Nasdaq will continue to successfully integrate Adenza to expand its growth opportunities, unlock synergies, and drive operating leverage. The company expects to action approximately 70% of the targeted $80 million in net expense synergies ahead of plan, by the end of 2024, with a portion realized in 2024 and fully realized in 2025.

Executing the Adenza integration is a key 2024 strategic priority alongside using technology infrastructure to drive innovation, unlocking the value of the divisional structure to drive incremental revenue and enhancing shareholder value through a disciplined capital allocation strategy.

Nasdaq reaffirmed its previously stated medium-term financial outlook:

•Capital Access Platforms revenue growth of 5% to 8%.

•Financial Technology revenue growth of 10% to 14%.

•Total Solutions revenue growth of 8% to 11%.

•Non-GAAP operating expense growth of 5% to 8%.