Catherine Clay has just finished her first 100 days in the newly created role of global head of derivatives at Cboe Global Markets. Her 100-day plan included a listening tour where the resounding message was that overseas investors want access to US derivatives markets.

Clay began her career as an options trader and joined Cboe in 2015. She was previously global head of data and access solutions at Cboe and took on her new role in October 2023.

David Howson, global president of Cboe, said in a statement in October that Clay successfully led the global expansion of Cboe’s data and access solutions business. He added: “Her track record at Cboe, coupled with her depth and breadth of experience in the trading industry and derivatives space specifically, make her the ideal leader to assume this new position.”

The first 40 days of Clay’s 100-day plan were a listening tour which involved sitting in client meetings and internal stakeholder meetings, which Clay described as “just being a sponge.”

She told Markets Media: “Part of my listening tour took me to other parts of the globe, and the resounding message that I heard was an appetite to get access to the US derivative markets. There is a lot of pent-up demand to participate in the uniquely US creation of very liquid transparent markets.”

Global structure

Cboe launched a derivatives exchange in Europe (CEDX) in September 2021. However, prior to Clay’s appointment in her new role, CEDX existed as a separate entity.

“CEDX did not benefit from the collective wisdom, experience, ideas and creativity that would come from being under one umbrella,” she added.

There is now one umbrella covering US derivatives, European derivatives and Cboe Labs, the product development team led by Rob Hocking, that also used to sit outside the derivatives business.

Clay said: “We are all in one team, united for the single purpose of bringing our derivatives expertise, presence, ideas and transparent liquidity to the end investor on the global stage.”

In addition to Europe, Cboe also operates exchanges in Canada, Australia and Japan following a series of acquisitions. In Europe, Cboe first launched an equities market before moving into derivatives in the region. Clay said the same strategy in other regions can be used to achieve Cboe’s long-term goal of bringing uniformity to the global marketplace.

“Typically you land in the cash market, start building data pipelines, use that equity data to build indices, launch futures on the indices, launch options on those futures and add single stock contracts,” she added. “It really is a repeatable and scalable blueprint.

Another blueprint for global expansion was provided in Clay’s previous role as global head of data and access solutions. In 2021 Cboe put its information solutions division together with its market data and access services division and put Clay in charge of the combined business. The rationale for the integration was that as Cboe expanded globally, customers would want greater efficiency in market infrastructure services and harmonised access to global data and analytics.

“That was the roadmap, or blueprint, to thinking about how we stop just thinking about US opportunity and think about the global opportunity,” said Clay. “After the success of data and access solutions becoming a global presence, we need to do the same in derivatives.”

To achieve this aim in derivatives, Cboe is considering how to give overseas investors easier access to the consolidated OPRA (Options Price Reporting Authority) feed and easier access into Cboe’s US exchanges.

“It is basically solving an access problem,” Clay added. “The world looks at the US derivatives markets as a place where they can deploy their systematic strategies and be really comfortable with the transparency and strong regulation.”

Cboe reported that total volume across its four options exchanges in 2023 was 3.7 billion contracts, the fourth consecutive record-breaking year. Average daily volume reached an all-time high of 14.6 million contracts. At the start of 2023 the group also introduced the Cboe One Options feed to provide a real-time view of U.S. options pricing through a single market data feed.

Europe

CEDX initially offered trading in futures and options based on Cboe Europe single country and pan-European indices, with clearing provided by Cboe Clear Europe. In 2023 CDEX launched single stock options, which Clay described as key for creating a pan-European marketplace.

She added that Cboe had been successful in growing market share in cash equities in Europe to more than 20%, and then adding derivatives in a pan-European clearing house.

“We are providing this nice stack for capital optimization by allowing equities trading and options trading in one clearing house,” Clay said. “Clients in Europe see the success in the US and would like to see this in the EU.”

Growth strategy

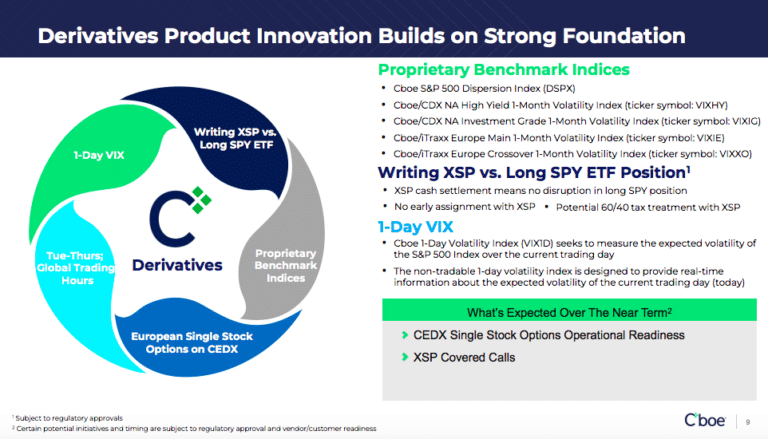

Clay said that growth has been driven by Cboe’s proprietary products and the group will continue to invest in that ecosystem and continue to innovate, which is why it was essential to bring Cboe Labs under the derivatives umbrella.

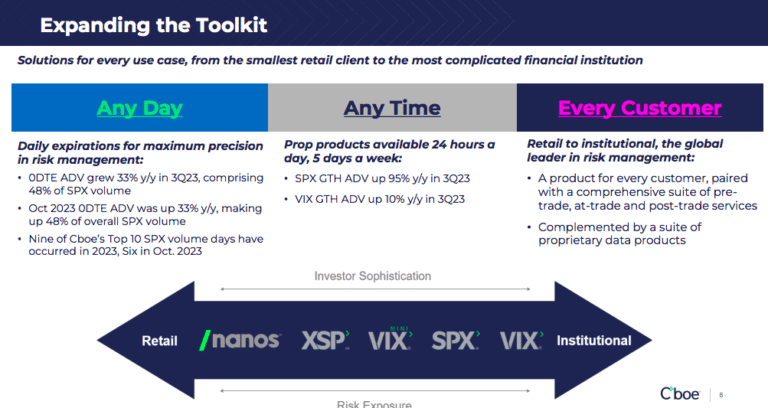

Cboe reported that its proprietary product suite set several volume records for 2023, including S&P 500 Index (SPX) options trading a total of 729.3 million contracts and Cboe Volatility Index (VIX) options trading a total of 185.7 million contracts. Trading in SPX options set a new single-day volume record on 14 December 2023 with 4.8 million contracts.

In 2023 there was also continued growth in short-dated options trading which allow investors to manage exposure to key events, sell premium more frequently, implement different calendar spreads or pursue any number of other varying risk/reward objectives. Clay said in her year-end letter for 2023 that same-day trading strategy is not new, but increased adoption points to a greater understanding of options strategies and more people participating in the options market.

In January this year Cboe launched Tuesday and Thursday-expiring Russell 2000 Index weekly options and Mini-Russell 2000 Index weekly options and Clay said Cboe will continue to grow through new product innovation, new functionality and new strikes to add more choice for the end investor.

In 2023 the group launched the Cboe S&P 500 Dispersion Index, to measure the expected dispersion in the S&P 500 over the next 30 calendar days and the Cboe MSCI Volatility Indices, providing a measure of the market’s expectation of 30-day implied volatility implied for the respective MSCI index option classes.

“New product innovation is a huge opportunity for us, but global expansion is also a key driver of growth in the next two to five years,” she added.

One barrier to potential growth may be proposed rules from US bank regulators that would increase capital requirements for derivatives clearing services that banks offer to their clients. FIA, the listed derivatives trade body, has estimated that these provisions would increase capital requirements for client clearing for the six largest US banks by more than 80%.

Clay agreed that if capital becomes constrained in ways that force changes in behaviour, that tends to reduce liquidity.

“We are always paying attention to opportunities to enhance our clients’ liquidity profile, to ensure that we are working towards optimal capital efficiencies,’ she added.

In addition, Cboe owns two clearinghouses – Cboe Clear Europe and Cboe Clear Digital in the US – and Clay said that clearing goes hand in hand with trading and capital efficiencies.

By the end of 2024 Clay would like to have a healthy, proprietary product ecosystem being offered to more global clients, and to have innovated and brought new products to life.

“I would like to say we are proving the market thesis in European derivatives through CEDX and I would like to be able to say that we have identified where we are going next in the world,” she added.