The Securities and Exchange Commission has proposed an expansion of central clearing for US Treasuries, while a number of regulators have warned that Treasury basis trades may destabilise financial markets due to hedge funds building up leveraged short positions in US Treasury futures.

US Treasury markets currently consist of transactions which are either bilaterally cleared or centrally cleared transactions though Fixed Income Clearing Corporation (FICC), part of US financial market infrastructure DTCC.

Following periods of increased market volatility, the SEC proposed in September 2022 that more of the US Treasury cash and repo markets should be centrally cleared to reduce settlement risk and provide standardised risk management, centralised default management and increased transparency. FICC has estimated that the SEC proposal could add $1.63 trillion in daily activity – $500bn in indirect participant Treasury repo activity, $520bn of indirect participant Treasury reverse and and $605bn of indirect participant Treasury cash activity.

FICC conducted a voluntary, anonymous survey of Treasury market participants between 25 April and 30 June 2023 and found that nearly three quarters of FICC members who responded submit 50% or less of their indirect participant Treasury activity to FICC, which suggests that the remainder clears and settles bilaterally.

Laura Klimpel, DTCC General Manager of FICC & Head of SIFMU Business Development, wrote about the survey in a blog and said the proposal requires more firms to either become direct FICC members or clear their Treasury activity through a member, as FICC is currently the only regulated central counterparty for outright purchases and sales and repo transactions in US Treasury securities. The proposal would also require significant changes to margin collection and account segregation.

“Currently, FICC generally does not require members’ proprietary, or ‘house,’ activity be segregated from the cleared activity of the members’ customers,” said Klimpel. “However, the SEC proposal, as written, would require FICC to calculate, collect and hold house and customer margin separately, although there would be an option to calculate and collect margin on a gross or net basis, depending on the clearing model the member selects.”

Basis trade

One of the reasons that the SEC wants to expand clearing is to increase transparency about possible risks building up in the Treasury market. In September 2023 Man Institute noted that the Bank for International Settlement (BIS), had become the fourth institution to highlight concerns about the build-up of leveraged short positions in US Treasury futures by hedge funds.

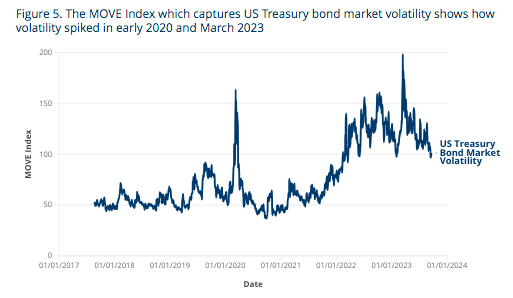

The BIS followed the SEC, the Federal Reserve and the Bank of England in warning that these Treasury basis trades may potentially destabilise financial markets. A Treasury basis trade seeks to arbitrage the price difference between Treasury futures and Treasury cash bonds. Hedge funds use leverage to magnify their returns, which could trigger instability if there is a sudden spike in volatility requiring them to quickly close out their positions.

The BIS Quarterly Review in September 2023 estimated that leveraged funds have built up net short positions in US Treasury futures of about $600bn, with more than 40% of the net “shorts” concentrated in two-year contracts. This is a comparable level of net shorts in the run-up to the repo market turmoil of September 2019 and the US Treasury market dislocations of March 2020.

“Given these experiences, the current build-up of leveraged short positions in US Treasury futures is a financial vulnerability worth monitoring because of the margin spirals it could potentially trigger,” added BIS. “Margin deleveraging, if disorderly, has the potential to dislocate core fixed income markets.”

An additional concern is the large amount of Treasury issuance that is expected to come to the market. Man Institute said: “The risk is that if the current trend of asset managers going long and hedge funds shorting Treasury futures (through the basis trade) continues as more Treasuries are issued, any unforeseen events may spark a rerun of the 2020 and March 2023 scenarios.”

In August this year the Federal Reserve analysed hedge funds’ Treasury futures and repo positions using the Commodities Futures and Trading Commission’s Traders in Financial Futures data and the Office of Financial Research’s Cleared Repo Collection. The US central bank said trends in these two data sources are consistent with hedge funds increasing their positions in the Treasury cash-futures basis trade.

The Fed said hedge fund repo borrowing in the sponsored segment rose by $120bn between 4 October 2022 and 9 May 2023, and was higher on 9 May 2023 than its previous peak in 2019. Hedge fund short futures positions in the 2-year, 5-year, and 10-year contracts rose by $411bn over the same period, consistent with increased trading in the cash-futures basis. The analysis emphasised that these developments are not enough to conclusively determine the scale of hedge fund basis trade activity, but they are similar to those that prevailed in 2018 and 2019 when hedge fund basis trades grew rapidly.

“Should these positions represent basis trades, sustained large exposures by hedge funds present a financial stability vulnerability,” added the Fed. “While the contribution of sales from the basis trade to March 2020 Treasury market liquidity remains debated, several papers suggest that absent prompt intervention by the Federal Reserve, the situation may have been far worse.”

CME Group, which has a large suite of Treasury derivatives, was asked about potential regulation of the basis trade during the exchange’s third quarter results call. Terry Duffy, chairman and chief executive of CME, said on the results call that there is no problem with the basis trade, and it actually keeps the markets in line.

“We feel very strongly that this is going to continue to keep the market efficient,” added Duffy. “Additional regulation could take people out of that trade which widens the basis, so regulators may not like that outcome.”