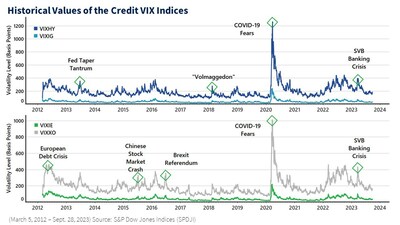

- Four new Credit Volatility Indices (Credit VIX) developed based on Cboe’s proprietary VIX® Index methodology and S&P Dow Jones Indices’ CDX and iTraxx Indices

- Designed to provide a VIX Index-like measure for credit market volatility

- New indices added to Cboe’s growing volatility index suite

Cboe Global Markets, the world’s leading derivatives and securities exchange network, and S&P Dow Jones Indices, the world’s leading index provider, announced plans to launch four new Credit Volatility Indices (Credit VIX) on Friday, October 13, 2023.

Credit Volatility Indices (Credit VIX)

- CDX/Cboe NA High Yield 1-Month Volatility Index (ticker symbol: VIXHY)

- CDX/Cboe NA Investment Grade 1-Month Volatility Index (ticker symbol: VIXIG)

- iTraxx/Cboe Europe Main 1-Month Volatility Index (ticker symbol: VIXIE)

- iTraxx/Cboe Europe Crossover 1-Month Volatility Index (ticker symbol: VIXXO)

This new series of indices, jointly developed by Cboe Labs, the company’s product innovation hub, and S&P DJI, are based on Cboe’s proprietary VIX® Index methodology and S&P DJI’s CDX and iTraxx Indices and aim to track the expected level of volatility across the North American and European credit markets.

The Cboe Volatility Index® (VIX®) is considered by many to be the world’s premier barometer of U.S. equity market volatility. The VIX Index is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors’ consensus view of future (30-day) expected U.S. stock market volatility. The new Credit VIX Indices aim to provide a comparable benchmark index for the credit markets, so investors will have a broader view of volatility in this important additional asset class.

“As we celebrate the 30th anniversary of the VIX Index this year, we couldn’t be more excited to continue our track record of innovation and collaboration with S&P DJI by extending the VIX Index methodology into the fixed income space,” said Rob Hocking, Senior Vice President and Head of Product Innovation at Cboe. “Interest in this asset class continues to grow amidst a rising rate environment, and we expect these indices will help investors better track credit market volatility, manage corporate credit risk, or implement yield-enhancement and hedging strategies. With the VIX family of volatility indices covering equities, credit and various other asset classes, investors can also look across our diverse product set to compare trends and correlations across different markets in a more consistent manner.”

“This launch further strengthens our ongoing collaboration with Cboe while providing additional insights into the level of expected volatility for the fixed income marketplace,” said Frans Scheepers, Head of Fixed Income, Currency and Commodity Products at S&P Dow Jones Indices. “The Credit VIX Indices are expected to provide new clear signals on bond market sentiment, and act as a new barometer of corporate credit risk in North America and Europe. Designed to track the level of uncertainty in global credit markets over various time horizons, this new suite of indices is expected to allow market participants to better track credit market volatility and manage corporate credit risk.”

Similar to the VIX Index, the new Credit VIX Indices are designed to track near-term uncertainty around corporate credit risk by measuring the market’s expectation of how volatile credit default swap (CDS) index spreads will be over the next 30 days. Options with varying strikes convey different information about the expected future movement in credit spreads; the Credit VIX Methodology is designed to extract information from available options strikes and distill it to one number that represents a consensus view on near-term CDS index spread volatility.

Cboe’s planned launch of the new Credit VIX Indices adds to its suite of forward-looking option-implied volatility indices. The new indices follow Cboe’s recent launch of the Cboe 1-Day Volatility Index (VIX1D) and the Cboe S&P 500 Dispersion Index (DSPX), which were also developed in collaboration with S&P DJI. To learn more about Cboe Labs, visit https://www.cboe.com/labs/.

Source: Cboe