Green equities typically underperform in a weak equity market, although over the long term the green economy has outperformed broader equity markets according to research from FTSE Russell.

The index provider said in a report that 2022 was a tough market for equities with the FTSE All World Index closing down 17.7% down following rises in inflation and interest rates.

“Our research shows that, in this type of weak equity market, green equities typically underperform,” said the report. “They have a higher beta, greater growth exposure and a lower yield than the broader market.”

FTSE Russell captures the performance of the green economy through the FTSE Environmental Opportunities All Share Index (EOASI. The green thematic index has been running since 2008 and only includes companies with at least 20% green revenues from the FTSE Global All Cap Index.

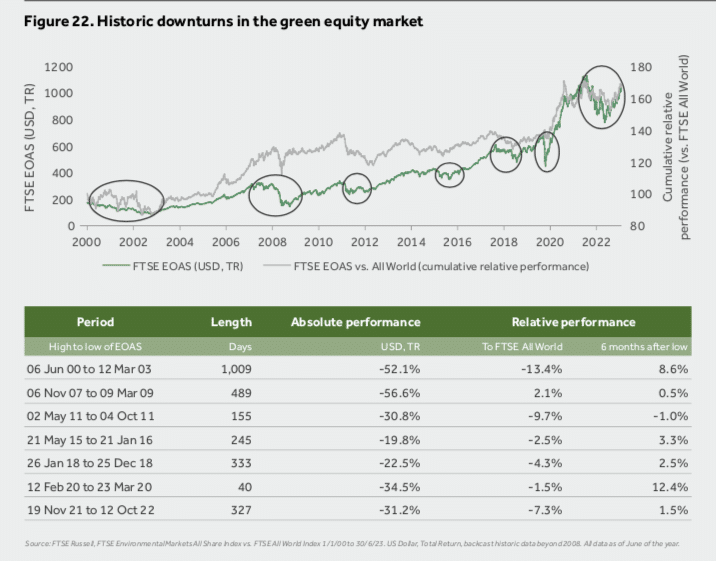

The research reviewed all seven periods where the EOAS index fell more than 15% since 2000, and found it underperformed the broader equity market in all but one of these periods.

The report said: “However, the good news is that it also outperformed the broader market in the six months following the downturn in all but one of the periods.”

In addition, EOAS outperformed broader equity markets over the long term. The index outperformed the FTSE Global All Cap by 76% on a US dollar total return basis from its inception in January 2008 to the end of June 2023. EOAS has also been the best performer of all FTSE Russell’s key sustainable investment equity indices over the last five years.

“However, we note that compared to these indices, EOAS is more concentrated with key exposures in certain industries, therefore it has the highest volatility and tracking error,” added FTSE Russell.

The report continued that for investment purposes, green equities can be divided in four separate sub sector indices. The largest sub sector index, the FTSE Energy Efficiency index, is also typically the most leveraged to economically cyclical activities, such as technology, automotives, housing or industrial. The sub sector had the weakest performance in 2022 and the strongest recovery in the first half of this year.