Tom Staudt, chief operation officer at ARK Invest, said the European exchange-traded fund market could experience an even steeper growth curve as the US ETF issuer enters the market through an acquisition.

Staudt told Markets Media: “I am incredibly excited by what I see in the European ETF market.”

On 19 September ARK Invest, the investment manager led by chief executive Cathie Wood, said in a statement that it had acquired Rize ETF, Europe’s first specialist thematic ETF issuer, which has been renamed ARK Invest Europe. Staudt said Rise ETF was attractive because the team creates proprietary strategies using its own research, rather than distributing off the shelf products, and the firm shares a common culture with ARK.

Detlef Glow, head of EMEA research at data provider Refinitiv Lipper, said in a note that the £5.25m deal makes a lot of sense for ARK Invest since it acquired an up-and-running ETF platform.

“Even though the overall ETF business of Rize ETF might not be profitable, it is significantly more expensive to build an ETF platform and create all necessary connections to market makers, authorized participants, and trading platforms from scratch,” added Glow. “This acquisition helps ARK Invest avoid that.”

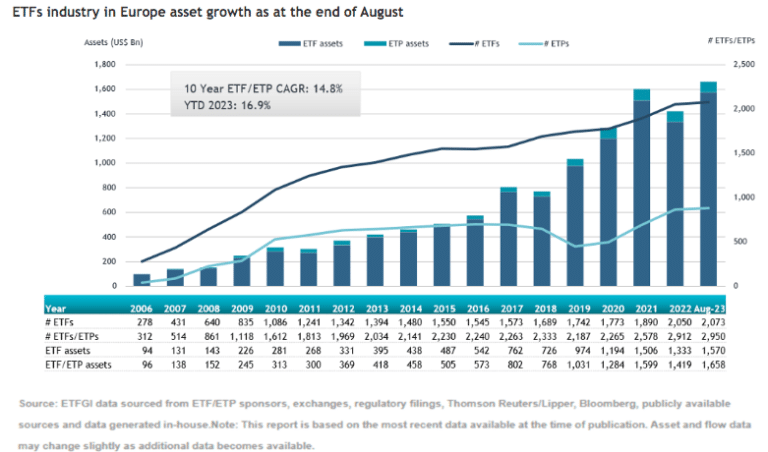

The European ETF market has had a 10-year compound annual growth rate of 14.8% according to ETFGI, the independent research and consultancy firm covering trends in the global ETFs ecosystem. Staudt believes the growth rate could accelerate because of tailwinds such as the emergence of online digital distribution platforms opening up the market to new investors, especially younger investors with longer time horizons who are more focused on innovation, which happened in the US.

“The ARK innovation suite is very differentiated and very attractive to that type of investor, and so is the existing range of products from Rize, now ARK Invest Europe,” he added.

ARK is already working on bringing its US strategies to Europe as quickly as possible, but will also be working with the European team to identify opportunities for new products that are specific to the region.

Staudt highlighted that he is very cognizant of the fact that the US ETF market skews towards retail investors, while Europe has been dominated by institutions. However, technology will remove friction and allow more retail investors to access the market.

When ARK entered the US market, there were comments that there was no demand for actively managed equity ETFs but the firm believed it could build share and democratise access.

“I feel very strongly that has always been part of our culture, ethos and mission,” added Staudt.

ARK Invest has been looking at Europe for quite a while as the amount of incoming calls from the region indicated there was unmet demand and it also provides an opportunity to expand the firm’s international exposure. Nikko Asset Management owns a minority stake in the asset manager and Staudt said the partnership has been particularly meaningful in Japan.

Staudt continued that the UCITS wrapper from the European Union is very attractive for opening up other international markets such as Latin America, the Middle East and some countries in Asia, where UCITS is an acknowledged regulatory standard.

Glow said: “This transaction can be seen as a major step for the global expansion strategy of ARK Invest, as this will enable them to launch UCITS ETFs on an existing ETF platform.”

Concentration

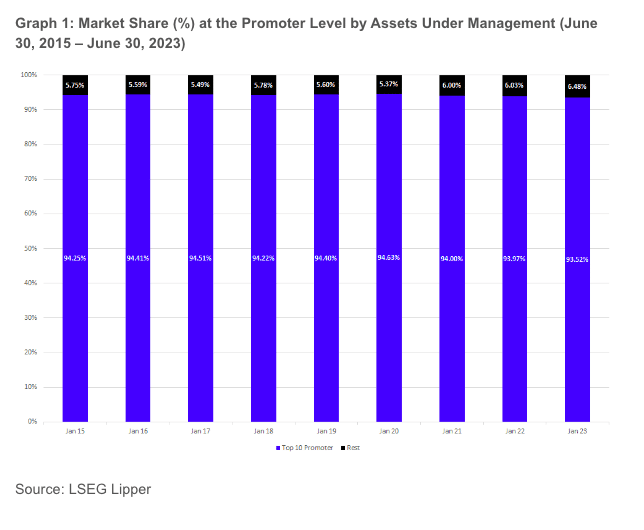

The European ETF industry is highly concentrated. The 10 top promoters in Europe held 93.25% of the market as at 30 June 2023 according to a report from Glow.

Despite this concentration, Glow said the high competitiveness of ETF promoters in Europe has led to a high product quality, low management fees, and value when it comes to total expense ratios. In addition, new participants have been able to gather significant amounts of inflows at the ETF level, especially those with innovative investment solutions for core and niche markets.

“This means that the barriers to enter the market are not too high for new ETF promoters,” Glow added. “Despite all of this, one needs to ask whether all of the new market participants will be able to survive in such a competitive environment.”

Staudt argued that ARK ETF does not feel the need to compete for the same dollar as the incumbents, because its strategies are very different. In addition, by expanding the overall ETF market through providing access to new investors, ARK Invest Europe can gain assets, even if the incumbents also grow.

“ETF providers are not fighting over the same pie,” Staudt added. “We haven’t even seen the inflection point of growth yet.”

As of 31 August 2023 Rize ETF managed $452m in assets in 11 ETFs, all categorized as SFDR Article 8 or 9 compliant for sustainability, domiciled in Dublin and distributed throughout Europe. ARK managed approximately $25bn in ETFs and other products globally.

Glow said: “Even as the setup of ARK Invest Europe looks promising, history has shown that it takes—even for well-known asset managers—a lot of effort to build a successful ETF brand in Europe.”

ETFs industry in Europe gathered year-to-date net inflows of $96bn at the end of August, the second highest on record according to ETFGI. In the US the equivalent net inflows were $300bn, the third highest on record.