AsiaNext has regulatory licences for security token offerings and crypto derivatives and the Singapore-based institutional digital asset exchange is aiming to launch its first product this year.

Neil Thomas, chief commercial officer at AsiaNext, told Markets Media that the exchange has licences for security token offerings, which could be launched imminently, and crypto derivatives, which it is looking to launch in the coming months.

“We will be delivering our first product in 2023 and our roadmap will evolve over the next 12 months,” he added.

AsiaNext was formed as a joint venture by Japan’s SBI Digital Asset Holdings and Switzerland’s SIX Group in 2021 to launch an institutional-grade digital exchange. Thomas described AsiaNext as creating a more efficient way to move assets around the world and said a large part of that will be tokenization.

The Monetary Authority of Singapore (MAS) officially licensed AsiaNext as a Recognised Market Operator (RMO) from 6 September 2023.

The license allows AsiaNext to operate an organised market for securities and collective investment schemes and sits alongside its in-principle approval Capital Markets Services licence from MAS granted in June this year. AsiaNext now has the necessary approvals to provide integrated listing, trading, and post-trade services for digital assets.

“SDX, SIX’s digital asset exchange, and SBI are already deep in this space and within our group we cover the process end-to-end from issuance through to custody,” Thomas added. “Our custody is off-venue and there is independent segregation of client assets.”

Chong Kok Kee, chief executive of AsiaNext, told Markets Media that the collapse of crypto exchange FTX was a wakeup call and extended the crypto winter, the fall in prices of crypto assets. However, there is a silver lining for mainstream adoption by institutions when regulators step in.

“We are a solution for institutions to access the asset class and they have been impatient for us to launch,” Chong added.

Digital assets are a global market and other venues have already launched, but Chong said AsiaNext is very focused on institutions and wants to operate like trusted traditional exchanges in Asia with innovation.

“Our shareholders SIX and SBI Digital Asset Holdings, our 24/7 technology platform and our licences from MAS are the ingredients that go into the construct of a unique institutional grade exchange,” Chong said.

Another differentiator, according to Thomas, is that crypto-native exchanges were largely designed and built for retail adoption but AsiaNext has been built by institutions for institutions. Thomas also highlighted that AsiaNext is based in Singapore which is good for the Asian timezone, but the exchange also wants to be attractive to Western institutions.

Thomas believes AsiaNext’s underlying technology solves for global liquidity as the exchange links with SDX, SIX’s Digital asset exchange in Switzerland and ODX, Osaka Digital Exchange, in Japan.

“We want to broaden that network over time,” said Thomas. “Down the line we will look to be regulated in other jurisdictions, which could mean the UK and Europe.”

In 12 months time AsiaNext would like to increase trading volumes in digital assets and create efficiencies in listing according to Thomas. AsiaNext aims to be able to list assets in Switzerland, which can then appear in Singapore, Tokyo and London with the benefit of its network.

Chong said liquidity has always been the lifeblood of an exchange so AsiaNext wants to set up a venue that is a trusted marketplace attracting worthy issuances and members who bring flows into a “well-oiled machine,” He added: “Hopefully we have the right ingredients, the right market and the right time to launch.”

Thomas continued that AsiaNext is built for the next decade, not the next 12 months.

“We are taking a long term view but the infrastructure to enable institutional adoption has to be created today,” he said.

Consultancy Coalition Greenwich said in a report that banks and infrastructure firms are not waiting to build tokenization infrastructure, especially in Singapore, Dubai, Switzerland, and other locales. In addition, the European Blockchain Regulatory Sandbox is seen as a safe place to experiment, and the Financial Conduct Authority in London is also being relatively hospitable and engaging on the tokenization and securities front.

“For banks, there is no need to wait,” said Coalition Greenwich. “Opportunities to build are present now.”

Digital asset infrastructure

On 18 September 2023 three financial market infrastructures (FMIs) – DTCC, Clearstream, and Euroclear – released a paper calling for increased collaboration in the digital asset ecosystem that currently includes fragmented standards, varying regulatory treatment, limited integrations with institutional-grade payment rails and siloed liquidity. They highlighted that two constraints of scale and interoperability must be addressed as priorities.

For example, 74% of DLT projects across the capital markets in 2023 involved fewer than 6 participants.

“These challenges, if unaddressed, will perpetuate a fragmented landscape, and run counter to the very efficiencies of DLT that the industry set out to capture initially,” said the paper.

Jennifer Peve, global head of strategy & innovation at DTCC, said in a statement that the industry is at an inflection point for DLT and digital assets, which are forecast to grow to $16 trillion over the next 15 years.

Peve said in a blog that the three FMIs aim to connect the industry and to break down barriers to digital asset security adoption (with a focus on real-money assets) by facilitating:

- Reduced costs of connectivity and entry for existing and new market entrants.

- Standardization of processes across the digital asset lifecycle — and hence, reduced operating risk and costs.

- Consistent operating standards for platforms, assets and smart contracts within a well-regulated framework.

- Increased optionality and choice of platforms, facilitating connectivity through greater industry consensus on integration and standards.

- Improved interoperability between traditional securities and payment infrastructures, supporting ongoing automation across the asset lifecycle.

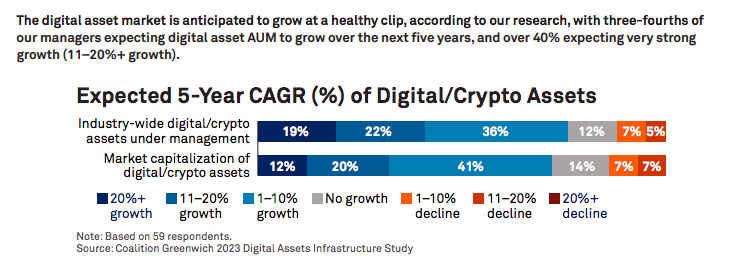

Coalition Greenwich said in a report, Digital Assets: Managers Fuel Data Infrastructure Needs, that fund managers see an opportunity to expand their digital assets under management at a faster rate than the overall market with 44% expecting digital assets to be a growing business line over the next three to five years. One quarter, 25%, of buy-side firms have a specific digital assets strategy and 13% plan to launch within the next two years

The survey was conducted between May and June 2023. Coalition Greenwich conducted interviews with 60 buy-side professionals from asset managers, hedge funds and other investors in the United States and the United Kingdom/European Union in partnership with Amberdata.

The report said there are a range of estimates for total crypto market capitalization, but it stands at about $1.2 trillion in assets as of August 2023.

“Add to that the growing opportunity for tokenized financial and real-world assets (RWA), which Bernstein estimates at $5 trillion, and digital assets reflect a burgeoning asset class,” added Coalition Greenwich. “Moreover, while much of the $5 trillion reflects tokenized cash or cash-like instruments (i.e., central bank digital currencies (CBDCs), stablecoins and tokenized deposits), additional opportunities are available in private funds, securities, commodities, real estate, and other RWA.”

David Easthope, who advises on market structure and technology globally for Coalition Greenwich, said in the report: “Asset managers and hedge funds are positive and upbeat about the growth opportunity of the asset class as well as the commercial opportunity to offer a range of investment funds, exchange-traded funds (ETFs) and even new digital asset securities.”

The report highlighted that infrastructure, including well-regulated custody, is critical to the development of the ecosystem.

“However, the next arms race is going to be centered on data, analytics and tools to support front-office professionals (portfolio managers, analysts and traders) in their never-ending request for higher returns and the ever-elusive alpha,” added Easthope. “Spending on crypto market data, on-chain data, as well as portfolio and risk systems are very much on the radar for the next 6 to 12 months, suggesting firms will be on firmer ground when the clouds clear and sunny skies appear next.”