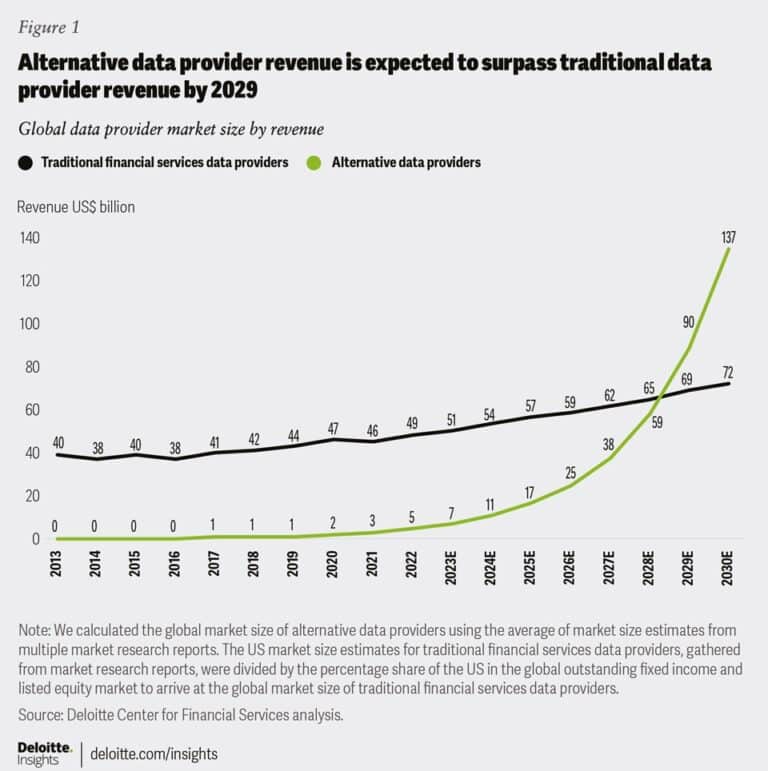

Revenue generated by alternative data providers globally is expected to overtake traditional financial services data providers by 2029, with the majority of spending from investment managers, according to Deloitte’s 2023 Financial Services Industry Predictions.

The report estimated that revenue may increase at a compound annual growth rate of 53% to reach $137bn by 2030 as advances in storage, capture, and analysis technology are expected to boost growth in the volume and availability of alternative data. The study classified alternative data as novel types and forms of unstructured data including satellite images, social media posts, geolocation data, credit card transactions, and mobile application data that are different from structured financial data.

“Vast growth in new data sources and types could be a boon for the investment management sector, where access to the fastest, most reliable, and most relevant information has been important to generating alpha,” said Deloitte. “Some might consider data as the new oil, a ubiquitous resource that fuels many processes—except much more abundantly available.”

Deloitte cited recent surveys which found that nearly all, 98%, of investment professionals agree or strongly agree, that alternative data is becoming increasingly important to identify innovative ideas to boost alpha and four out of five plan to increase their budget. In addition, alternative data sets that are relevant to financial services have increased by one third, 36%, over the last two years and the number of providers also grew by 29% over the same timeframe. As a result, fund managers who do not use the full potential of alternative data could operate at an information disadvantage, which could put them at risk of falling behind their peers in their quest for growth in assets according to Deloitte.

However, Deloitte also warned that investment management firms still struggle to combine alternative data from different sources and struggle with data analytics capabilities and it could take several years to fully integrate alternative data across an organization.

“When an increasingly higher proportion of information becomes available through alternative sources than through traditional financial data, organizations that haven’t gone the extra mile to institutionalize alternative data could make less-informed decisions than their more data-centric competitors,” added Deloitte. “Less-informed decisions may lead to a loss of alpha and lower Sharpe ratios, which could negatively impact organization profitability and competitiveness.”

Other predictions in Deloitte’s report include –

Carbon credit offset financing:

Global consumers will purchase $115bn of carbon offsets a year by 2030 and increased demand could produce new trading networks that offer tailored, localized and niche options for climate change mitigation projects.

“Banks could be instrumental in developing and supporting the back-end infrastructure that connects brands’ payment processes to the carbon credit market,” said Deloitte. “And banks can play an instrumental role in developing and supporting the carbon credit market.”

Funding for climate hardtech:

An additional $2 trillion in private hardtech investment is needed to help slow climate change. Deloitte continued that most funding is likely to come from the private sector and financial services organizations can play a lead role in bridging the funding gap.

Generative AI:

Deloitte predicted the top 14 global investment banks could boost their front-office productivity by an average of 25% by using Generative AI. As a result, they could earn additional revenue of $3m per front-office employee in 2026, up from an average of $11.3m between 2020 and 22.

In addition, financial services’ spending on quantum computing capabilities is expected to grow 233x from just $80m in 2022 to $19bn in 2032, a 10-year compound annual growth rate of 72%.