Traders Magazine spoke with Vidya Guruju, CFA, Director, Product Management at Charles River Development, which won Best OEMS at the 2023 Markets Choice Awards.

Please tell us about your OEMS and its most important features.

Charles River’s multi-asset order and execution management ecosystem was built on an open architecture that provides interoperability with global liquidity venues, transaction cost analysis (TCA) providers and third-party trade analytics tools.

Clients can also source internally produced algos, data and analytics to help meet the unique demands of their investment process and asset class mix. Integrated with reference and pricing data, our OEMS enables desks to work more efficiently and facilitates closer collaboration between traders and portfolio managers.

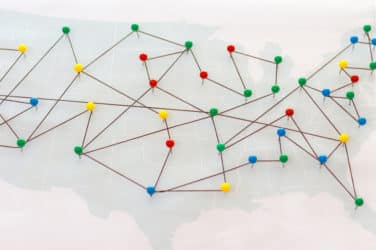

Our OEMS is tightly coupled with the Charles River FIX Network, enabling fast and reliable direct access between buy-side clients and sell-side brokers. It supports global electronic trading, provides access to over 600 global liquidity venues and enables broker neutral, low-latency connectivity to all major trading destinations worldwide.

Traders can send orders directly from the OEMS to multi-broker trading venues, crossing networks, broker algorithms, program desks, alternative trading systems, dark pools, and smart routers.

How does your OEMS differentiate in a competitive landscape?

Downsized trading desks, liquidity shocks and heightened volatility all prove increasingly challenging for buy-side trade desks. Our focus on improving trader productivity with increased automation and innovative analytics across asset classes and geographies serves to differentiate our OEMS.

How have OEMS users’ needs evolved over the years and how has Charles River adapted?

Large multi-asset investment firms increasingly look to simplify their operating models by leveraging enterprise trading platforms instead of niche, asset-class specific solutions. Charles River has been in the vanguard of this trend, creating a fully integrated platform complete with liquidity aggregation, FIX connectivity, analytics and desktop interoperability tools that support workflows across the trade lifecycle. The integration of new trading protocols and support for portfolio trading in our OEMS have also significantly enhanced productivity for fixed income traders.

What are recent accomplishments for Charles River?

Charles River has recently completed integrations with two new partners. LTX, a Broadridge company, leverages AI and data science to help traders source liquidity more efficiently. DirectBooks provides a venue for streamlining primary issuance workflows. Taken together, these new integrations provide important new functionality for fixed income traders using our OEMS.

What are your current initiatives at Charles River?

We continue to focus on two of our key strengths, a tightly coupled OEMS and our open architecture. They enable us to be agile, from helping us easily integrate third party liquidity providers, staying on top

of advances in primary market trading, or aggregating market data to not only help support trading decisions but also to drive portfolio/security selection decisions. Another key priority for us this year is direct dealer integration, enabling our clients to connect with their brokers directly to receive liquidity indicators, negotiate, and trade.