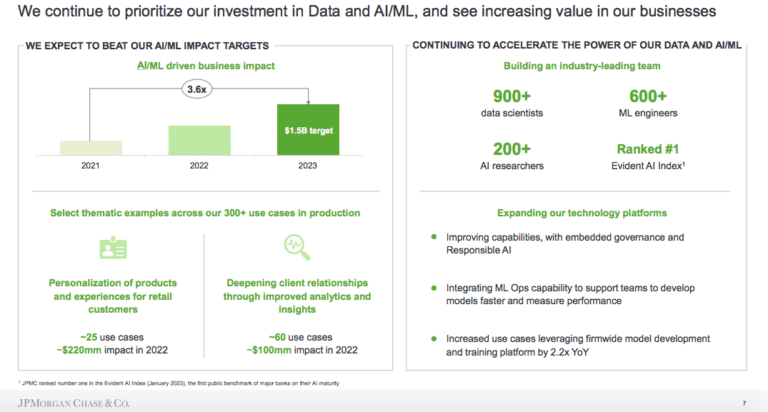

JPMorgan Chase has increased its target of realising $1bn in business value from artificial intelligence this year to $1.5bn.

Lori Beer, chief information officer of JPMorgan Chase, said at the bank’s Investor Day on 22 May that the firm is ahead of plan on the commitment made last year to realise $1bn in business value from artificial intelligence.

“We continue to embed data and insights into everything we do and we are ahead of our plan on our commitment to drive $1bn in business value through AI investments by the end of this year,” she added. “I am confident we will hit our new target of delivering $1.5bn of value by the end of this year, demonstrating our leadership position in AI.”

The number of AI use cases in production has increased by one third, 34%, year-on-year to more than 300 in production for risk, prospecting, marketing, customer experience and fraud prevention. The bank is actively evaluating opportunities with large language models and Beer believes unlocking the power of data and AI will be a competitive advantage for JPMorgan Chase.

Beer said the bank has more than 900 data scientists, 600 machine learning engineers and about 1,000 people involved in data management.

“We also have a 200 person top-notch AI research team looking at the hardest problems and the new frontiers of finance,” added Beer.

In retail, for example, AI helps the bank to offer more personalised products and experiences to customers, such as credit card upgrades, which delivered over $220m in benefit in the last year according to Beer. The firm is also leveraging AI to deepen relationships with clients across all lines of business, such as the commercial bank, where AI provides growth signals and product suggestions for bankers, which Beer said delivered $100m of benefit in 2022.

Beer said: “We couldn’t discuss AI without mentioning ChatGPT and large language models. We have a number of use cases leveraging ChatGPT and other open source models under testing and evaluation.”

Spending

Beer continued that the bank is investing in AI while continuing to make progress on a multi-vendor public cloud strategy and optimising its data centres.

The team of more than 57,000 technology employees has delivered product features 20% faster than last year as the bank continues to modernise applications, leverage Software-as-a-Service (SaaS) and retire legacy applications.

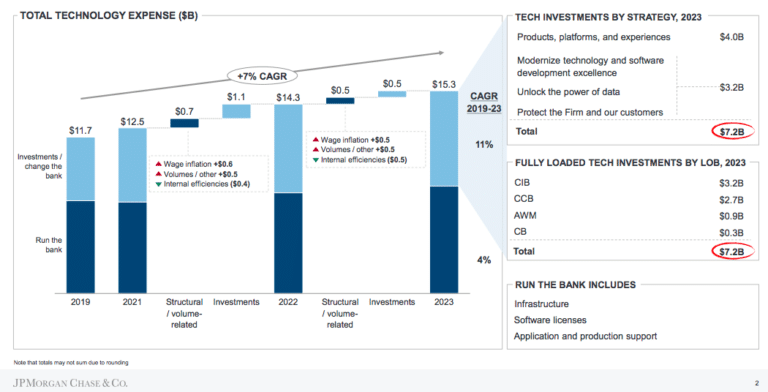

In 2022 the bank spent a total of $14.3bn on technology, which was a little higher than anticipated due to structural headwinds from labour inflation. This year total spend is expected to be $15.3bn which is driven by increased volumes, wage inflation and targeted investments, primarily in Consumer and Community Banking.

Total investment will be $7.2bn this year with $4bn to support delivering customer and client experiences and product development. The remaining $3.2bn will be on firm-wide platforms that provide scale including development, data, public cloud and cybersecurity.

On the efficiency side $300m has been saved through modern engineering practices and labour productivity while infrastructure modernization efforts have yielded an additional $200m.

“Adoption of industry leading SaaS is an important driver of application modernization,” Beer added. “We have more than 560 SaaS solutions, a 14% increase since 2022.”

For example, the bank will have migrated nearly 60% of its communication and collaboration tools to SaaS by the end of this year. Beer said this will allow the firm to rapidly scale new products to more than 290,000 employees.

The bank will also continue to retire legacy applications, with more than 2,500 decommissioned since 2017.

Infrastructure is being modernised by migrating applications to more efficient data centres.The bank has moved about 60% of installed applications to new data centres, which are 30% more efficient and translates to 16,000 fewer hardware assets.

Applications are also being migrated to utilise the benefit of public and private cloud. More than one third, 38%, of the bank’s infrastructure is now in the cloud which is 8% higher year-over-year.

“Over the next three years we have line of sight to have nearly 80% on modern infrastructure,” said Beer. “Our cloud journey will ultimately create a faster and more efficient environment for businesses.”

She continued that infrastructure expenses have remained relatively flat while compute and storage volumes have increased 50% since 2019, and tripled since 2015.

“This strategy will be critical as we continue to scale in new areas such as AI,” added Beer.

Productivity

Another pillar of the bank’s modernization strategy is equipping the 43,000 engineers with the capabilities and tools they need to optimise their work and boost productivity.

“We targeted 80% adoption of our Enterprise Toolchain by the end of 2022,” Beer said. “We are currently at 84% with a plan to reach 100% by the end of this year.”

Engineering performance is also tracked across speed, agility and stability. Over the past year the firm has achieved 60% framework adoption and 20% year-over-year improvement in the speed to move features from backlog into production.

More than half, 60%, of teams have adopted agile practices and measurement frameworks. As a result change volumes have increased 60% year-on-year, which means the bank is making many more frequent changes.

“Despite this increase we have a 99.9% success rate at executing those changes,”added Beer.

She gave the example of the markets regulatory reporting platform to show how modernization has created value for the firm. The platform is a public cloud-hosted data warehouse operating in more than 15 locations which provides global regulatory reporting across cash equities, futures and options.

Beer said: “The platform is scalable to 2.5 billion trades per day versus 500 million when hosted in our data centres, with monthly running costs decreasing more than 50%.”