The Bank for International Settlements (BIS) and the Bank of England have concluded Project Meridian, the first experiment to be carried out by the BIS Innovation Hub London Centre.

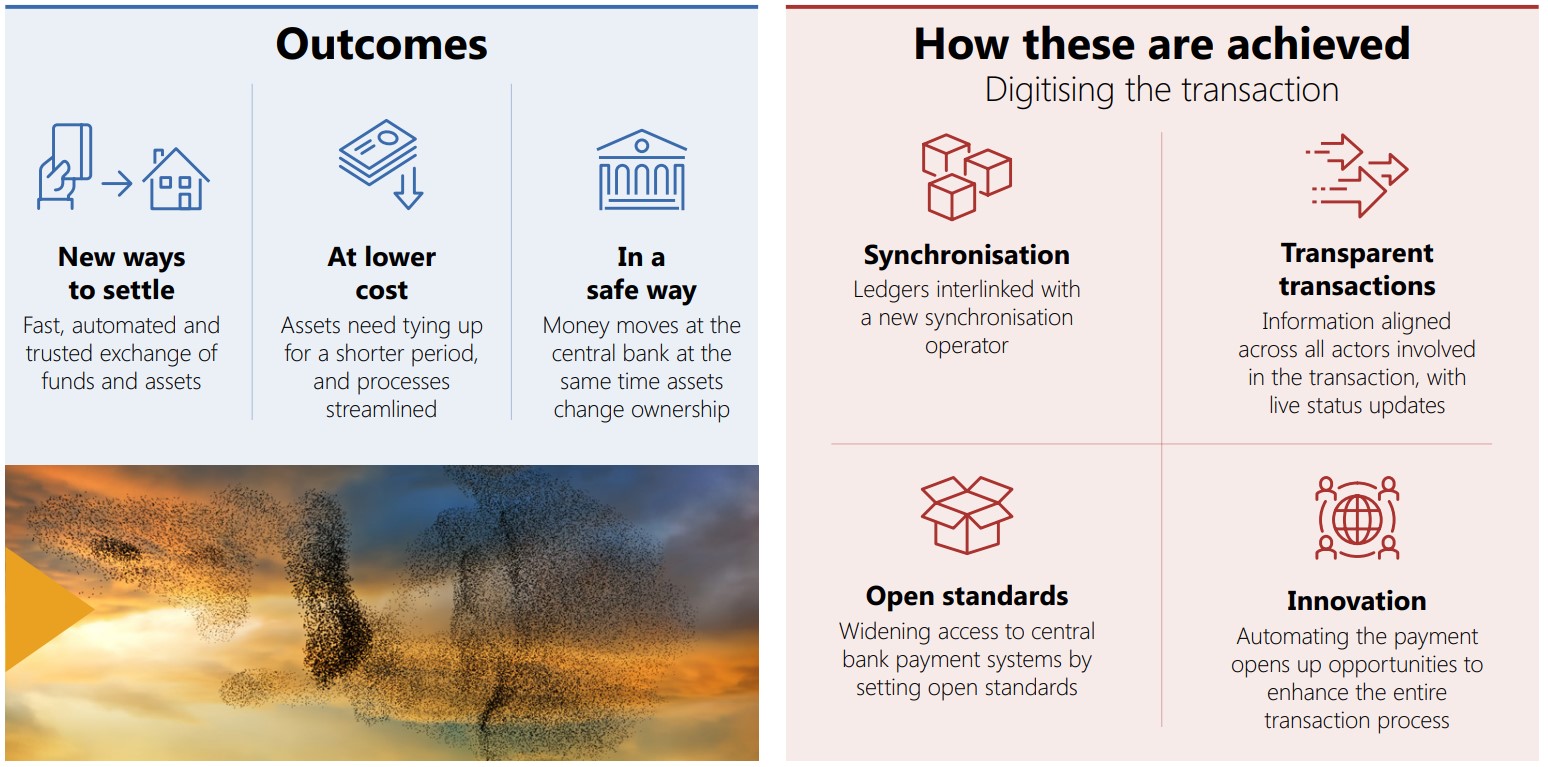

The project experiments with the concept of synchronisation, in which transactions settle using central bank money (reserves kept by commercial banks in the central bank) in an RTGS system. Funds are transferred from a buyer to a seller only if a corresponding asset on another ledger (a real estate registry in the project’s use case, but this could also be any ledger or registry for other types of assets such as equities or bonds) moves at the same time in the opposite direction, reducing transaction costs and risks and increasing efficiency.

This is achieved via a new entity, the synchronisation operator, which in the experiment uses distributed ledger technology (DLT) to interlink the central bank’s settlement (RTGS) system with other financial market infrastructures and ledgers, automatically orchestrating the exchange in ownership of funds and assets in a resilient and secure way.

Synchronous settlement in central bank money

The Meridian prototype would offer a new fast and secure way to settle, so that assets are tied up for the shortest possible period.

Synchronisation using central bank money eliminates such risks as a counterparty failing to hand over ownership of an asset (“settlement risk”) or a payment not being completed. It could also reduce complexity and liquidity costs by cutting the amount of time and assets needing to be reserved for a specific transaction. One example is the management of escrow accounts, which temporarily hold the buyer’s funds in a “neutral” third-party account.

The Meridian prototype demonstrates how to orchestrate synchronised settlement in central bank money using housing transactions as an exploratory use case. Applying the prototype to other asset classes, such as foreign exchange, was a principal design consideration. The generic interface could offer a standard way for synchronisation operators to connect multiple types of asset ledger to an RTGS system and settle in central bank money.