The buy-side equity trading community is gathering for the annual TradeTech Europe conference in Paris from 18 to 19 April.

The themes of the conference reflect the greatest market structure challenges faced by investors, which remain a lack of liquidity and venue fragmentation according to a recent survey by Coalition Greenwich. The consultant’s study, Globalization of Algorithmic Equity Trading: A Buy-Side View, found that the challenges cited varied across regions.

Jesse Forster, who advises on market structure and technology globally at Coalition Greenwich, said in the report: “Buy-side traders share a common thread, desiring to rely on quality data, experience and intuition to make the best decisions on where and how to trade, while navigating an increasing amount of market structure and regulatory- driven challenges. While like themes emerge, there are regional preferences toward trading styles, tools and venues.”

In addition to a general lack of liquidity and fragmented venues, U.S respondents also mentioned payment for order flow and access fees as top concerns. EU respondents also cited the lack of a consolidated tape in the region, and the war in Ukraine as top concerns. The absence of a consolidated tape and Brexit were also given as top concerns in the U.K

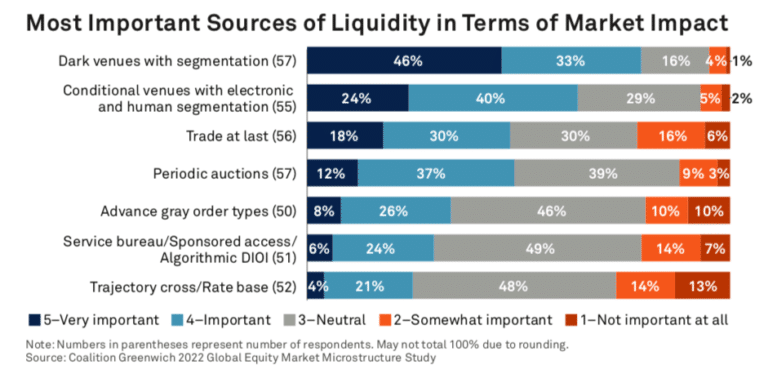

There were also regional differences in sourcing liquidity. Nearly half of all traders in North America and EU/U.K regions feel that dark venues with segmentation are a key factor in decreasing market impact for their orders. However EU/U.K.-based asset managers rank trade-at-last and periodic auctions much higher than their North American counterparts at 27% and 18% respectively. In North America trade-at-last ranked 12% and periodic auctions 9%.

Coalition Greenwich also found that the buy side’s biggest obstacle in evaluating best execution is around analyzing data—algo, venue and overall transaction cost performance. The majority of respondents, 58%, said transaction cost analysis (TCA) overall is one of their top two challenges, while 48% said venue selection/performance analysis, and 47% named algo performance analysis. As a result, TradeTech Europe is hosting a Data Innovation Day on 17 April, before the main conference begins, as asset managers look for an information edge.

Data is becoming increasingly critical as reduced commission rates, constrained budgets and smaller team sizes have left both asset managers and brokers facing greater pressure to automate their trading workflows and accomplish more with less. As a result, Coalition Greenwich found that electronic trading has grown to 42% of U.S. and 44% of the European equity market commissions and estimated this will rise to 48% and 50% respectively in three years’ time.

Regulation

In addition to data, regulation is likely to be a hot topic as the European Union trilogues on the Markets in Financial Instruments Regulation (MiFIR) Review are about to begin. Discussions may cover the prospect of European consolidated tapes for equities and fixed income, the UK diverging from the EU and the impact of the US shortening its settlement cycle by one day.

The Securities and Exchange Commission has approved reducing the securities settlement from two business days after the trade date (T+2) to one (T+1) by 28 May 2024, which is earlier than expected and will have repercussions outside the US.

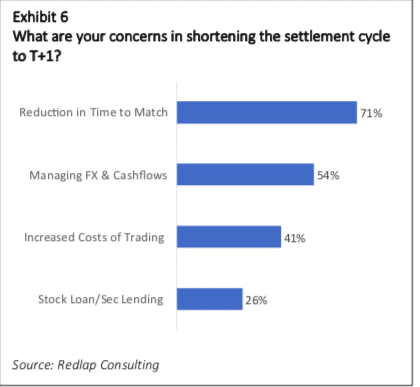

A recent survey for Plato Partnership by Redlap Consulting found that nearly all, 83%, of respondents believe they will be negatively impacted by the US move.

“The SEC’s view is that a shorter settlement cycle will reduce margin and collateral requirements thereby encouraging liquidity, but as market makers now need to consider the additional costs of borrowing securities or financing in a higher interest rate environment to avoid settlement failure, the result could be wider bid-ask spreads or providers electing not to offer these services to clients at all,” said the report.

For example, Redlap highlighted that clients based in Asia investing in the US typically book out trades T+1, and may also need to execute a foreign exchange for settlement which can only be calculated once the trade has occurred. In addition, European asset managers typically only receive cash for an investment three days after an investment is made and so need to pre-fund trades.

“Just 17% of respondents’ fund settlement cycles currently match market settlement for all funds,” added Redlap Consulting. “For material fund inflows and outflows this can have significant ramifications.”

The situation will become significantly exacerbated when trading global portfolios across asset classes such as exchange-traded funds by increasing the cost of long natural inventory. The report said T+1 creates the risk of regulatory fund breaches for UCITS funds regulated by the European Union.

“Currently baskets of global stocks benchmarked against the US are traded in tandem to ensure clients are treated fairly, segregating out trades that need to settle T+1 versus T+2 risks trading at different times, likely leading to different execution outcomes,” added the report. “If trades are required to settle T+1, asset managers will have to mandate brokers to settle T+1 with market settlement T+2, rather than risk the fund being overdrawn or holding cash positions that would create a regulatory breach as with single stocks, but now with global portfolios.”