London Stock Exchange Group completed its acquisition of data provider Refinitiv two years ago and chief executive David Schwimmer said the firm is shifting from integration to transformation.

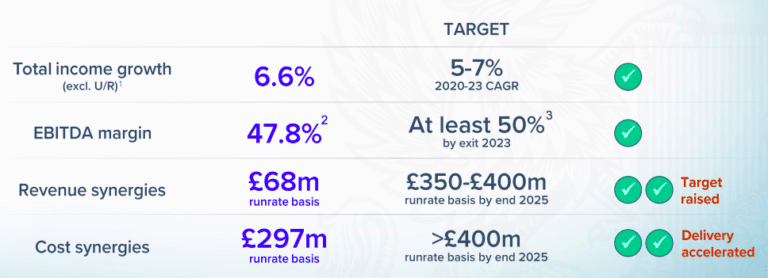

Schwimmer said on the results call that the success of the Refinitiv integration means the group can bring forward delivery of the cost synergy programme by two years, and significantly increase the revenue synergy target.

“We started the year in a strong position and we are not stopping here,” he said. “As we transition from integration to transformation, to building an even stronger platform for long term growth, to investing in our market leading infrastructure and venues, the benefits will become more visible over the course of this year and beyond.”

Schwimmer highlighted LSEG’s partnership with Microsoft which he said will revolutionize workflow for financial market participants, introduce new products and make it easier for users to gain insight and interact with data. LSEG and Microsoft announced a 10-year strategic partnership last December .

Today, @Microsoft and @LSEGplc announced a 10-year strategic partnership to architect LSEG’s data infrastructure using Microsoft’s @Azure cloud technology. https://t.co/B0vhBrCFdS

— Microsoft Stories and News (@MSFTnews) December 12, 2022

Schwimmer said the partnership has three main work streams. The first is working with Microsoft Azure’s cloud technology to consolidate LSEG’s datasets, which will enable customers to access data faster, more easily and provide greater resilience.

LSEG will also combine Microsoft’s expertise in machine learning and cloud infrastructure with its analytics and modelling capabilities to develop a new suite of solutions for the financial industry. Schwimmer said: “This will revolutionize how businesses that rely on analytics build, access and scale those capabilities.”

The third stream is integrating LSEG Workspace so that the data and analytics workflow solution works seamlessly with Microsoft Teams to create an all-in-one data analytics workflow and collaboration solution.

“We are working with Microsoft to transform Workspace for financial market participants and I don’t use that word transform lightly,” said Schwimmer. “I am trying to capture the revolutionary nature of the change to work that will result from our partnership with Microsoft.”

The rollout of the enhanced Workspace is expected to be significantly complete by the end of 2024.

“At the same time Workspace is not a static product and there were 200 updates last year, including the addition of sentiment data for transcripts, sustainable investing analytics, and a custom index sandbox,” added Schwimmer.

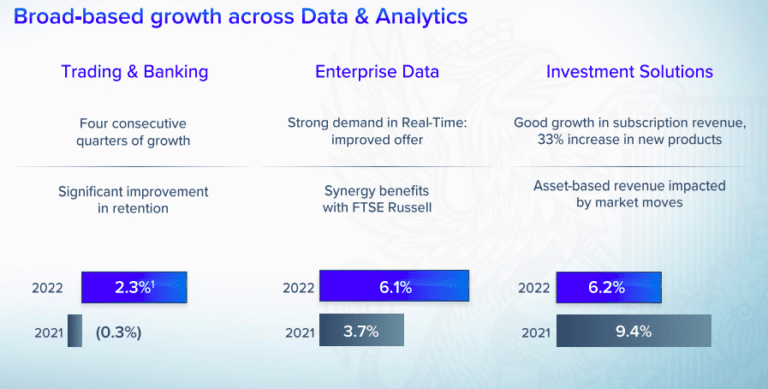

He also highlighted that LSEG’s data and analytics business has significantly accelerated its historical growth rate since the Refinitiv acquisition and is materially improving customer retention.

“This was a business that had been in decline for many years, losing both market share and revenue,” he said. “We stabilized the top line in year one and delivered positive underlying growth in all four quarters of this past year with better execution and sales, customer management and product.”

Data and analytics contributes approximately 70% to total group revenues, with the remaining 30% from capital markets and post-trade. Schwimmer said the business model involves earning revenues from data and analytics which are recurring, long-term in nature and growing. The remaining 30% is exposed to the markets that tend to benefit from times volatility in the market.

Post trade and capital markets

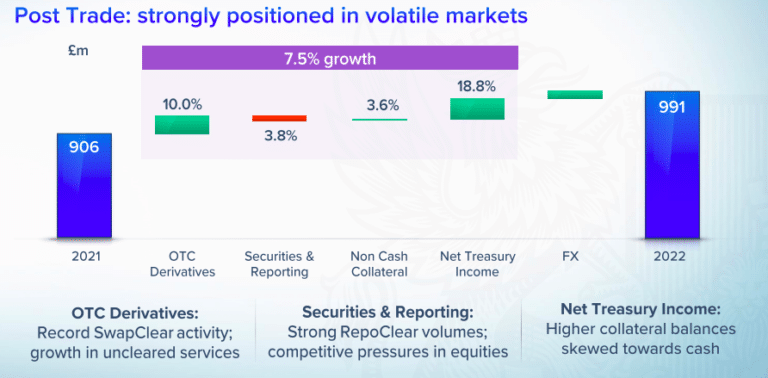

Schwimmer said post trade had a strong year in 2022 with LCH’s SwapClear clearing more than $1.1 quadrillion in interest rate swaps, and market share remaining above 90%.

Last December LSEG announced that it had agreed to acquire Acadia, a provider of automated uncleared margin processing and integrated risk and optimisation services for derivatives, and Schwimmer said the deal is expected to close shortly. In the same month LSEG completed its acquisition of Quantile, which eliminates gross notional of over-the-counter derivatives through compression and reduces margin through a counterparty risk reduction service.

“Our members want to optimize their capital and work towards balance sheet efficiency,” Schwimmer added. “We provide an increasing number of tools to allow them to do this across cleared and uncleared asset classes.”

In capital markets Schwimmer said LSEG will launch connectivity between Tradeweb, the electronic trading platform for government bonds, credit and interest rates, and FXall, the foreign exchange trading venue, later this year. This will give customers the ability to trade emerging market securities and currencies on a single screen.

“This brings significant workflow benefits and reduces customers’ execution risks,” added Schwimmer. “Imagine the potential if we scale this to all cross-border trading.”

In addition, LSEG is launching a new foreign exchange trading venue in Singapore for non-deliverable forwards and will introduce a new matching platform which is 10 times faster than the current platform.

#LSEG today announced the development of NDF Matching, a new fully cleared venue in Singapore, supported by the @MAS_sg. The venue will be open for integration testing later this year, with a full production launch in mid-2023. Find out more: https://t.co/JlYLSX3Cp9 #FX pic.twitter.com/GfNt1GZxE6

— LSEG (London Stock Exchange Group) (@LSEGplc) May 5, 2022

Peter Richardson, analyst at German financial services group Berenberg, said in a report that LSEG’s results provided incremental confidence about the company’s growth. He said: “Notably, data and analytics revenue growth has accelerated more than expected and lead indicators suggest that a further improvement is likely.”

Richardson added that trading and banking revenues, which had previously been in decline due to falling user numbers, have now grown for four consecutive quarters, helped by the roll-out of Workspace (which replaces Eikon).

“While initiatives to support LSE’s growth, including from its partnership with Microsoft, have led to modestly higher expenses, we believe this is a cost worth bearing,” he said. “Trading on 17.5x our FY 2024E EPS, we believe LSE’s structural growth remains undervalued.”