BlackRock had record net inflows into bond exchange-traded funds in 2022 and said every active fixed income investor is using ETFs in their portfolios.

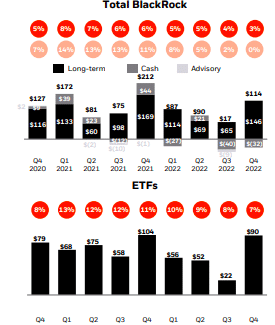

The asset manager reported a record $123bn of net inflows into bond ETFs in 2022 in its full-year results. In the fourth quarter of last year BlackRock’s bond ETFs had $47bn in net inflows, which was the second best quarter in its history.

Laurence Fink, chairman and chief executive of BlackRock, said on the results call that BlackRock launched more than 85 ETFs globally in 2022 alone.

“We had over 70 different iShares ETFs with annual net inflows surpassing $1bn,” he added. “Our growth was well diversified across core equity, fixed income, factors, sustainability and thematic product categories.”

In fixed income, Fink said BlackRock had six of the top 10 asset-gathering bond ETFs in 2022.

“More and more bond exposures are going to be utilized through ETFs, and I believe this is going to become one of the most important transformations in the entire capital markets,” he added.

Fink highlighted that most people make the mistake of thinking that ETFs are passive, but they are a liquid instrument that allow investors to navigate the exposures they are seeking. Therefore, active investors will used fixed income ETFs alongside their strategies and buying individual bonds is not going away. BlackRock expects the fixed income ETF industry to reach $5 trillion in the next few years, out of $15 trillion for the ETF industry overall.

“This is the beginning of a major expansion of bond ETFs as a component of the entire bond market.” Fink added. “In the US, ETFs only represent 2.3% of the bond market so we have a lot of runway.”

He continued that there are many opportunities for clients to capitalise on market disruption to rethink portfolio construction and consider the renewed income generation potential of bonds, or to reallocate to sectors that may be more resilient in the face of higher inflation.

Robert Kapito, president of BlackRock said on the results call that earlier this year investors used iShares bond ETFs to express preference for short duration treasuries. More recently high-yield corporate bonds and long duration ETFs have been leading the flows.

Capito continued that the role of bonds in a portfolio is increasingly relevant for the first time in years as investors can earn attractive yields without taking much duration or credit risk.

“Just a year ago the US two-year treasury note was yielding approximately 90 basis points and today they’re earning over 4%, with corporate bonds earning over 5% and high-yield earning 8%,” added Capito. “Clients are coming to Blackrock to help them pursue generational opportunities in the bond market. Our fixed income teams in both active and passive are ready.”

In total, iShares had $220bn of net inflows in 2022, representing 7% organic asset growth and 3% organic base fee growth.

Private markets

In 2022 BlackRock raised $35bn of capital for its private markets platform, with particular strength in private credit and infrastructure.

Gary Shedlin, chief financial officer, said on the results call: “We now have approximately $34bn of committed capital deployed for institutional clients in a variety of strategies, representing approximately $260m dollars of future annual base fees.”

Fink added that investors’ need for income and uncorrelated returns against the backdrop of higher inflation, together with a more challenged market for public equities will continue to drive demand for private markets.

One of the largest opportunities in infrastructure investing over the coming years will be renewable energy in the US following the passage of the Inflation Reduction Act. In addition, in Europe the supply shocks at 2022 have sharpened the focus on energy security and renewable energy investments.

Staff severance

BlackRock took a charge of $91m which primarily comprised of severance and accelerated amortisation of previously granted deferred compensation awards for approximately 500 employees, 2.5% of the global workforce.

Shedlin said that since last July BlackRock has been aggressively managing the pace of its discretionary spend in order to be better prepared for 2023 and focus resources on areas of greatest opportunity.

“We recently restructured the size and shape of our workforce to free up investment capacity for our most important growth initiatives by taking a targeted and disciplined approach to how we shape our teams,” said Shedlin. “We will not only increase investment capacity for these initiatives, but also create opportunities for incredible talent.”

BlackRock currently expects headcount to be broadly flat in 2023 and it will expand its Innovation Hubs in all regions.

Larry Fink shares his insights on BlackRock’s Q4 earnings results https://t.co/k7QXvP8EnX pic.twitter.com/bWLwFgcWn4

— BlackRock_News (@BlackRock_News) January 13, 2023

Financial results

BlackRock reported an 8% decrease in full-year revenue from 2022m to $17.9bn, which the asset manager said was primarily driven by the impact of significantly lower markets, dollar appreciation on average assets under management and lower performance fees. Operating income of $6.7 billion and earnings per share of $35.36 both declined 13% over the same time period.

Full year long-term net inflows were $393bn, reflecting 4% organic asset growth and positive organic base fee growth, led by record flows into bond ETFs, significant outsourcing mandates and growth in private markets.

Fink said the firm generated $230bn of long-term net inflows in the US, and flows were positive across all three regions.

“We saw record net new sales of Aladdin, further underscoring its importance in periods of market volatility,” Fink added.

BlackRock is seeing strong demand for outsourced solutions and Fink expects this to continue in 2023. He said that in the last two years BlackRock has won several significant outsourcing mandates totalling more than $300bn in assets under management from existing and new clients.

.