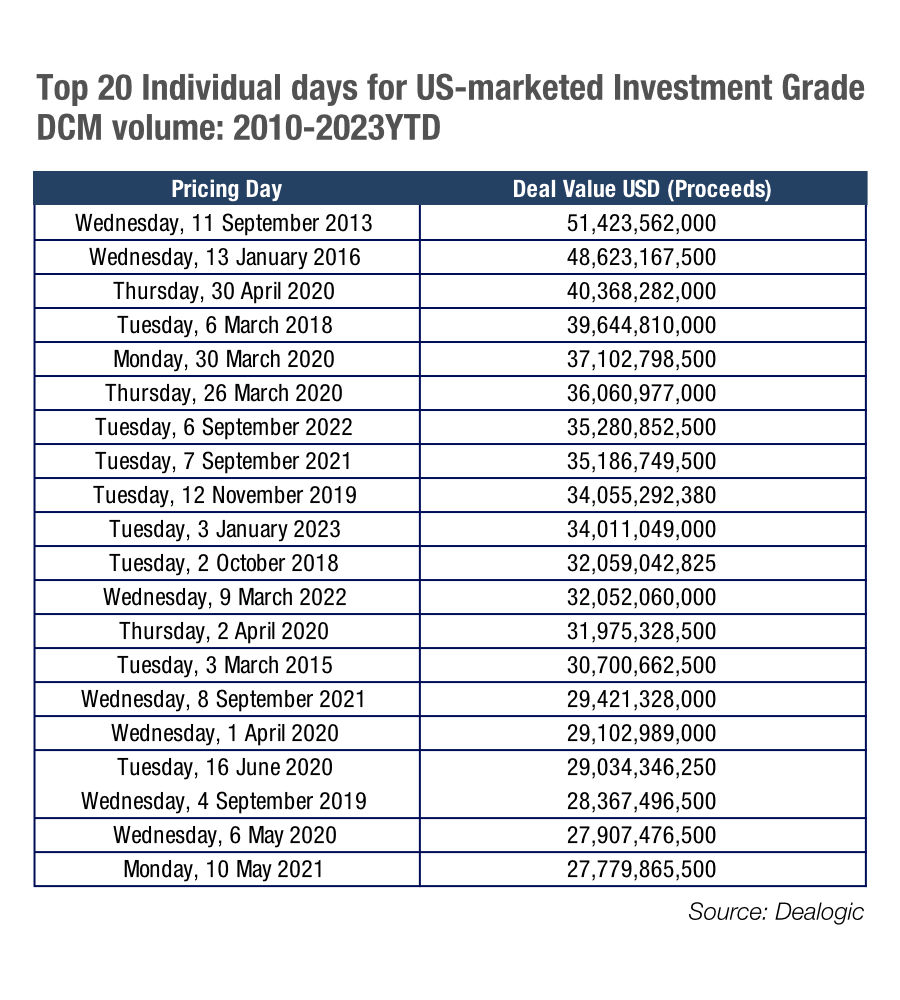

Bond issuance for US investment grade on 3 January 2023 was the tenth largest day on record, according to data from Dealogic.

While January is typically the greatest month for bond issuance volume, with financing and refinancing arranged earlier rather than later in the year for most corporations, this has taken investors somewhat by surprise as it suggests much greater comfort with the economy in 2023 than had been expected.

The latest US employment data also indicates that the economy may being doing better than expected by many – although some harbour scepticism about the figures.

Higher bond issuance can take out one whole trader on a team for a day as they manage the process of engaging with portfolio managers and bank syndicate desks, without the trader adding much value to the process themselves.

As a result, desks may struggle be effectively resourced this year. Even as bond funds become more interesting to end investors, and therefore fixed income teams generate better returns, the linear increase in resourcing is a slow one – up to 24 months – and therefore it is unlikely that desks will be adding headcount any time soon.

More likely is an increased use of electronic trading and automation – where possible – to lower trading workloads by processing more straightforward trades with as little manual intervention as possible.

Although there have been advances in electronification of primary markets, these are still fragmented and not fully subscribed to leading to dissatisfaction with the situation so far.

Consequently the takeaway is likely to be a call for more resource onto trading desks, or greater stress upon the teams.

This article first appeared in The Desk, a Markets Media Group publication.

©Markets Media Europe 2023