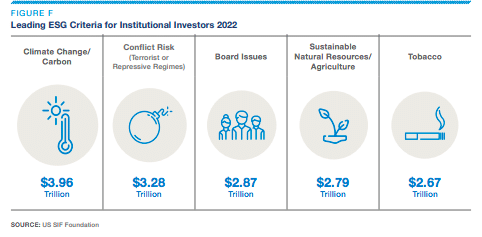

Climate change was the leading environment, social and governance factor for institutional investors in terms of assets for the first time according to US SIF Foundation’s latest biennial report.

The US SIF Foundation’s 14th edition of the Report on US Sustainable Investing Trends said institutional investors had $4 trillion of assets related to climate change.

“Both money managers and institutional asset owners cited climate change/carbon emissions as the top issue they addressed in ESG incorporation, with each group saying it applied to more than $3 trillion of the assets under their purview,” added the report.

Change in methodology

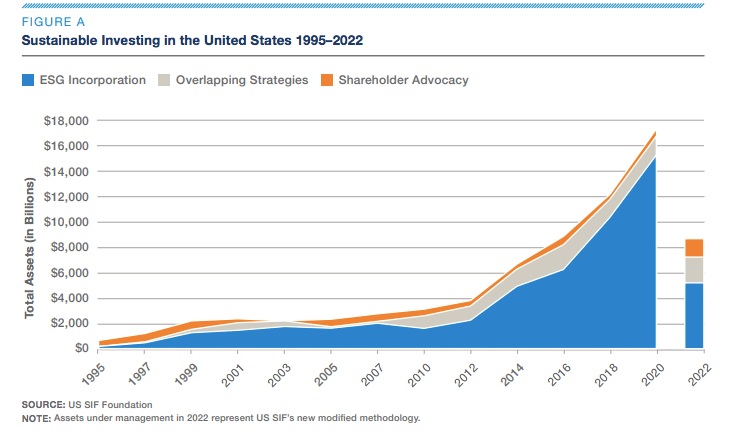

There were $8.4 trillion in total US sustainable investment assets under management at the beginning of 2022, representing 13% of total US assets under professional management. This is much lower than the $17.1 trillion identified in the previous report for 2020 which the foundation said was due to a change in methodology.

“This phenomenon is similar to what occurred in Europe after the EU’s Sustainable Finance Disclosure Regulation required enhanced disclosure on sustainable investment products,” added the report.

The US Securities and Exchange Commission has made two proposals to provide greater transparency on ESG funds and avoid allegations of greenwashing – one to prevent misleading fund names and the second to require greater clarity around funds’ consideration of ESG factors.

“The US SIF Foundation believes that these SEC proposals are motivating asset managers to be more circumspect in what they consider to be assets that incorporate ESG criteria,” added the report. “The organization supports the intent of the SEC proposals and submitted comments that it believes will lead to more effective rule makings.”

Therefore, the US SIF Foundation modified its methodology to require more granular information regarding the incorporation of ESG issues in order to be included in the tally of sustainable investment assets as ESG integration has become mainstream and applied across trillions of dollars, but with limited disclosure on specifics.

The report now excludes the assets under management of investors who stated that they practice firm-wide ESG integration but did not provide information on any specific ESG criteria they used (such as biodiversity, human rights or tobacco) in their investment decision-making and portfolio construction. As a result multiple money managers reported a modest to steep decline in ESG assets under management compared to the previous report which the foundation believes is a reaction to the SEC’s release of the fund disclosure proposal.

Diederik Timmer, chair of the US SIF board, said in a statement: “US SIF has raised the bar by modifying its methodology. US SIF’s strategic goals include a focus on advancing best practices in the field, and we believe the shift in the Trends report methodology contributes to this goal.”

Shareholder proposals

Between 2020 and the first half of 2022, 154 institutional investors and 70 investment managers collectively controlling nearly $3 trillion in assets filed or co-filed shareholder resolutions on ESG issues, the majority from public funds.

The leading issue raised in shareholder proposals, based on the number of proposals, was on ensuring fair workplace practices, and particularly on ending de facto discrimination based on ethnicity and sex.

A surge in shareholder proposals on climate change that began in 2014 has continued, as investors have wrestled with whether US corporations are doing enough to assess their climate risk or to meet the greenhouse gas reduction challenges laid down by the Paris Climate Accord. The study found that the proportion of shareholder proposals on social and environmental issues that receive high levels of support has been increasing.

During the proxy seasons of 2014 through 2016, 2% of shareholder proposals on environmental and social issues received majority support, but this rose to 14% from 2020 through mid-2022.

@US_SIF Foundation Report on US Sustainable Investing Trends is particularly interesting this year. Modified methodology + @SECGov release of a proposal on ESG disclosure by funds and advisors = impact on the total US sustainable investment AUM. #USSIF_Trends2022 #sustaininvest https://t.co/K6ghMQhJnB

— Lisa Woll (@LisaWoll_USSIF) December 13, 2022

Lisa Woll, chief executive of US SIF Foundation, said in a statement: “Money managers and institutional investors are using ESG criteria and shareholder engagement to address a plethora of issues, including climate change, conflict risk and anti-corruption as well as labor and equal employment opportunity, corporate political activity and human rights. With new issues such as biodiversity being added to the Trends Report survey, we are confident that there will be continued growth in the ESG issues that investors will consider in the future.”