Non-deliverable forwards could be an effective way for institutional investors to use crypto products within their existing regulatory and compliance frameworks according to a survey from Coalition Greenwich.

The consultancy said in a report that NDFs are relatively easy to manage because of their over-the-counter nature, flexible 24 hours a day access and the ability for contracts to expire on bespoke days. NDFs are derivatives that are used to hedge or speculate against currencies where exchange controls make it difficult for overseas investors to make a physical cash settlement, for example, the Chinese renminbi.

*New* Cryptocurrencies: The Road Ahead May Not Be Cryptic Anymore https://t.co/UiUNLQdIoC via @CoalitionGrnwch by #SubodhKarnik, @davidstryker

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) November 2, 2021

Subodh Karnik, head of client intelligence marketing at Coalition Greenwich, said in a statement: “Virtually all large liquidity providers would be able to hit the ground running with NDFs and make markets.”

Other crypto derivatives have started trading. The CME Group has introduced bitcoin and ether futures and exchange-traded funds on the bitcoin futures have listed in the US although Coalition Greenwich noted they come with challenges. For futures, the high volatility of crypto assets creates margining and netting issues. ETFs have a create/redeem process which requires smooth access to the physical market and hedging ETF price-making may be difficult during volatile periods

Therefore, NDFs could support institutional buy-side interest in cryptocurrencies.

Duncan Trenholme, TP ICAP

Duncan Trenholme, co-head of digital assets at TP ICAP, told Markets Media in July that the firm is expanding OTC derivatives for crypto assets such as in foreign exchange. He said: “If you come from an FX department you naturally look at a Bitcoin/US dollar pair through the lens of your other FX products and an NDF (non-deliverable forward) is very familiar.”

In June this year TP ICAP announced it is aiming to launch a wholesale trading platform for cryptoassets in collaboration with Fidelity Digital Assets, Zodia Custody and Flow Traders, subject to registration with the UK Financial Conduct Authority.

However the survey said that one of the challenges to wider NDF adoption is participants’ preference for transacting crypto on central limit order books and exchanges.

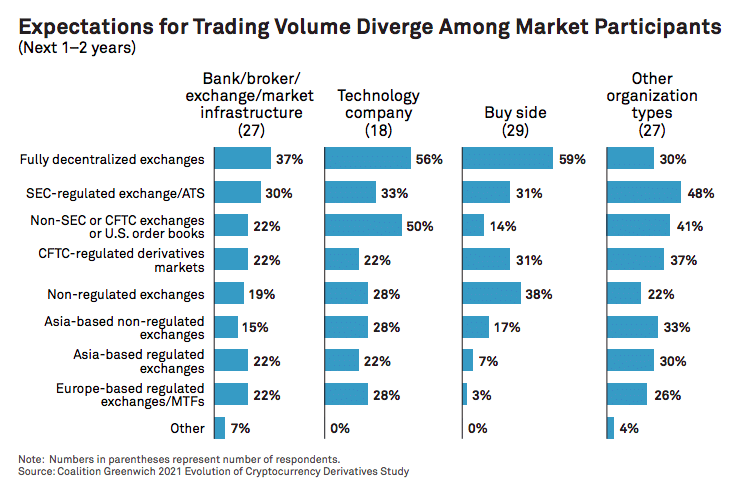

Banks and brokers in the survey expect a third of crypto volume in the coming years to be executed on fully decentralized exchanges, while the buy side thinks under 15% will be handled by non-SEC/CFTC venues. In contrast, fintechs expect about half the volume to go through that channel.

Source: Coalition Greenwich.

Coalition Greenwich expects a move to multilateral venues or an aggregated central limit order book before bilateral trading takes off. The consultancy believes that first movers in providing platforms will gain significant advantage.

In the survey Dmitri Galinov, chief exchange of 24Exchange, told Coalition Greenwich that the firm and its partner banks are adapting the NDFs for cryptocurrency. He said 24Exchange is in a strong position as a first mover with a crypto derivatives exchange license from the Bermuda Monetary Authority.

“The large market participants we spoke with are inclined to choose NDFs as the most likely derivative instrument for that to happen,” added Coalition Greenwich. “But client demand for neutral platforms with reliable staging capabilities will lead these venues to be the choice for market makers and liquidity consumers looking for their transactions to be matched off and order books to be managed.”

FTX US Derivatives

On November 2 FTX US announced that Mark Wetjen, former CFTC commissioner, has joined the US-regulated cryptocurrency exchange as head of policy and regulatory strategy.

Wetien was previously chief executive at MIAX Futures, where he focused on crypto-derivative products and strategic initiatives. He was also a board member of LedgerX, the first licensed crypto-native derivatives exchange in the US. FTX US completed the acquisition of LedgerX in October and the exchange has been rebranded as FTX US Derivatives.

Brett Harrison, president of FTX US, said in a statement: “We’ve created FTX US Derivatives with the intention of becoming the first US-regulated crypto exchange to provide crypto derivatives trading to our user base, and Mark’s experience and guidance will be instrumental in achieving this goal.”

The acquisition gave FTX US a CFTC-regulated designated contract market (DCM), swap execution facility (SEF), and derivatives clearing organization (DCO). These will be available to both retail and institutional investors 24×7 and offer block trading and algorithmic trading opportunities for institutional investors.

big day at FTX US Derivatives:

– options trading is 2x faster (again) ?

– our board member @MarkWetjen is joining FTX US to head up policy & regulatory strategy

– lowered our #btc withdrawal fees (more to come!)— Zach Dexter (@zachdex) November 2, 2021

Zach Dexter, chief executive of FTX US Derivatives, said in a statement: “As the regulatory environment in the crypto ecosystem continues to evolve, we look forward to acting as a resource and an example of how the protections afforded by proper regulatory oversight and licensing can boost consumer confidence and facilitate safe and reliable exchange platforms. The most important facet of this acquisition of LedgerX is that it allows us to do that.”