Coinbase Institutional views 2025 as a pivotal year for growth in tokenization, which involves representing real world assets such as real estate, art, equities, and bonds as digital tokens on a blockchain.

The US-listed crypto exchange’s 2025 Crypto Outlook said improved tokenization technology, better compliance tooling, and potential improvements in the regulatory landscape under the incoming US administration will enhance the scalability and utility of tokenized real world assets.

The benefits of faster settlement, reduced transaction costs, and increased capital efficiency of tokenization have become abundantly clear to institutions, according to the report. For example, institutions are experimenting with using tokenized assets in the derivatives market, which could streamline operations for managing margin calls and collateral, and mitigate risk.

“Although the broader market impacts may remain limited in the near term, we think the cumulative effects of sustained investment and technological refinement in 2025 may set the stage for tokenization to emerge as a cornerstone of the next crypto market cycle,” said Coinbase.

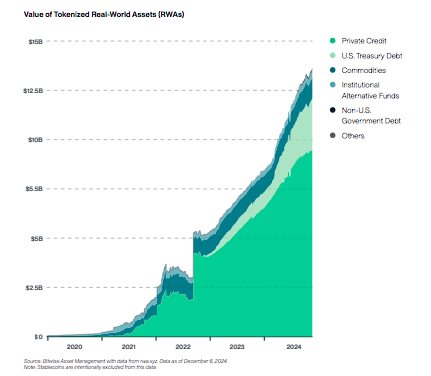

Tokenized real world assets grew over 60% from $8.4bn at the end of 2023 to $13.5bn by 1 December 2024, excluding stablecoins, according to the report, which cited data from rwa.xyz. In particular, onchain US Treasuries have more than tripled from $760m to $2.6bn as of 1 December 2024, which was driven primarily by three new tokenized treasury funds including BlackRock’s BUIDL.

“Projections suggest this sector can grow to a minimum of $2 trillion and a maximum of $30 trillion over the next five years – potentially a nearly 50x increase,” said Coinbase.

Bitwise, the digital asset exchange-traded fund issuer, has predicted that the value of tokenized real-world assets will exceed $50bn as one of its 10 Crypto Predictions for 2025.

Three years ago there was less than $2bn of tokenized real-world assets, according to Bitwise. This grew to $13.7bn in 2024 which Bitwise said was due to the advantages of instantaneous settlement, significantly lower costs than traditional securitization, and 24/7/365 liquidity while increasing transparency and access to nearly every asset class.

Coinbase continued that the tokenization trend is expanding beyond assets such as US Treasuries and money market funds and gaining traction in private credit, commodities, corporate bonds, real estate, and insurance. The report highlighted that Figure, a US home equity line of credit (HELOC) lender, has more than $8.8bn of active loans, which account for 92% of the total onchain private credit market.

“Figure is a prime example of a traditional financial (TradFi) institution expanding into the tokenization realm, rather than a crypto-native firm venturing into the tokenization of TradFi assets,” added Coinbase.” This is a trend we think will pick up as blockchain education continues to increase and more firms recognize the bottom line improvements to operational costs that this technology enables.”

However, Coinbase also said there are major challenges to using public blockchains for tokenization including the technological risk of smart contract exploits or private key leaks; custodial and infrastructure buildout risks as many firms are ill equipped to handle public and private keys for blockchains; and most importantly, the need to comply with know your customer and and anti-money laundering regulations. For example, many tokenized US Treasuries on public chains currently meet compliance requirements by handling KYC offchain and whitelisting a select number of known wallets.

“We think this wallet verification process will improve meaningfully in 2025 as onchain attestations gain traction,” said Coinbase.

Crypto ETFs

David Duong, head of research at Coinbase Institutional, said in the 2025 outlook that the cryptocurrency market is poised for “transformative growth” with increasing institutional adoption and expanding use cases.

“In just the past year, spot ETFs were approved in the US, tokenization of financial products increased dramatically, and stablecoins saw massive growth and greater integration into the global payments framework,” he added.

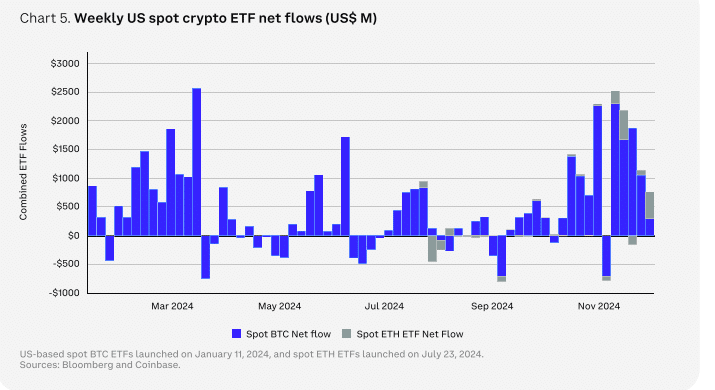

Coinbase described the approvals of spot bitcoin and ether ETFs in the US in 2024 as “watershed” moments for crypto. In the first 11 months of trading they attracted net inflows of $30.7bn., far more than the $4.8bn of flows into the SPDR Gold Shares ETF in its first year after launch in October 2004. Almost every institutional type now holds these products, including endowments, pension funds, hedge funds, investment advisors and family offices, said the report citing the latest regulatory filings.

Although there could be more ETF launches on addition cryptocurrencies, Coinbase said it is more interested in regulatory approval of allowing staking in ETFs or allowing in-kind creations and redemptions of ETF shares. Allowing just cash creations and redemptions creates a time lag between onscreen ETF share prices and the net asset value (NAV) and widens spreads.

Another of Bitwise’s 10 predictions for 2025 is that bitcoin ETFs will attract more inflows than the $33.6bn they gathered in 2024. Bitwise said the first year is the slowest for ETF inflows and that the largest wirehouses, such as Morgan Stanley, Merrill Lynch and Wells Fargo, have yet to allow their army of wealth manager to access the products.

“We believe that will change in 2025, and the trillions of dollars these firms manage will start flowing into bitcoin ETFs,” said Bitwise. “We also suspect most of the investors that bought bitcoin ETFs in 2024 will double down in 2025.”