By Max Artemenko, Founder and CEO, Silec Software Solutions

Max Artemenko, Silec Software Solutions

What happens to long term portfolios when an unpredictable event such as the Brexit vote or the Trump election rocks markets?

The same thing that happens to all portfolios not well positioned for a low-probability outcome—a spike in volatility. Short-term spikes in volatility might not matter to long-term investors—after all, they have a long enough investment horizon that they can weather the storm. However, what if, instead of ignoring stormy markets, they could ride these waves to greater returns?

That’s where systematic trading comes in. To protect profits and keep investors from fleeing, many fund managers like to hedge their long positions so that they are prepared for whatever swing the market decides to take next. However, critics of hedging often point to a potentially lengthy time commitment and expensive trading costs. As is the case with all discretionary hedging options, it is not always easy to select the appropriate investment instruments to adjust to the changing markets. Futures and options lose value to time decay, and changes in volatility will quickly eat at net returns. Further, expected corrections and political uncertainty will often leave fund managers sitting at the edge of their seat, anxiously reassessing position closing and hedging options.

While long term discretionary portfolios are subject to near-term uncertainty and volatility, their long-term views and targets generally remain unchanged. On the flipside, systematic traders can thrive on short-term volatility and uncertain market conditions. Many systematic, fully automated trading systems employ various types of analysis and forecasting. These traders rely on sophisticated computer algorithms and machine learning technologies, which are capable of crunching through thousands of pieces of data in fractions of a second, to forecast market movements. While these algorithms tend to struggle making accurate predictions far into the future, they generally excel at producing accurate results over short time frames.

For example, quantitatively-driven hedge funds and CTAs were among the best performers in the moments following the Brexit vote and the Trump election, in large part because they were able to act quickly to rebalance their portfolios. Meanwhile, the investors that waited for the markets to rebound missed out on a potential return opportunity. We think there’s a better way.

When strategies combine

According to Man Group Plc’s February 2017 research paper “Man vs. Machine: Comparing Discretionary and Systematic Hedge Fund Performance,” which analyzed 9,000 funds, it was found that volatility in discretional trading hedge funds has accounted for as much as 1.87% loss on annual performance, while only accounting for 0.65% loss at systematic hedge funds.

Utilizing short-term systematic hedging in long-term portfolios could be one of the most efficient methods to hedge against any kind of unforeseen market conditions, especially volatility spikes.

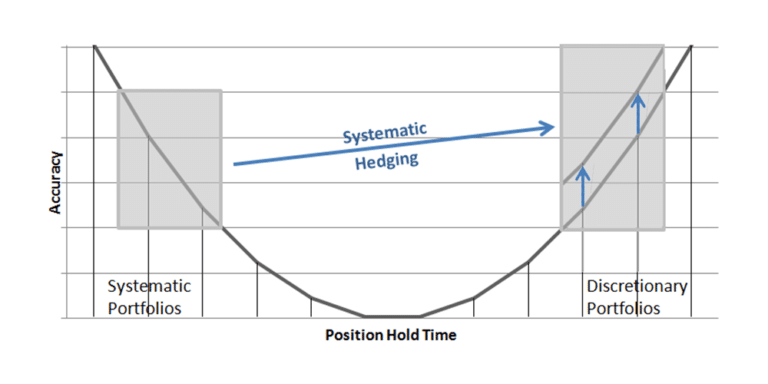

Combining the two types of strategies takes advantage of the strengths of each approach. Independently, systematic portfolios tend to perform best over short term periods when there is a finite amount of data and therefore limited noise. Meanwhile, long-term discretionary portfolios tend to benefit from increased holding times and lower trading costs. Together, these two strategies allow long-term focused investment managers to take advantage of market volatility, both lowering portfolio uncertainty and increasing profitability.

Figure 1

Figure1 depicts how trade accuracy can be increased in discretionary portfolios with systematic hedging

Systematic hedging explained

To illustrate how systematic hedging works, let’s consider a recent example involving Trump and his famed health-care bill. Initially, the stock market rallied on his campaign promise of a more market-friendly health care bill. However, when the bill failed the Dow fell by nearly 240 points (a roughly 1 percent drop) as investors began to question how many of his pro-business policies would ever be implemented. These types of volatility spikes affect entire sectors, regardless of the financial strength of individual companies. Thus an investor holding long 1,000 shares of Apple would experience roughly a 1% drop, for a daily loss equal to nearly $1,440.

However, with the implementation of automated hedging systems, such volatility spike combined with other market balance indicators instantly trigger an automated hedge. Though generally the hedge amount is dynamically calibrated to the volatility of the underlying asset as well as to its weight in the portfolio and the volatility of the portfolio, a typical hedge could be around 60% of the asset or 600 Apple shares. With the utilization of such automated hedging the loss is cut to only 400 remaining shares, or just $576. The saved amount of $864 may not seem extensive initially, however when taken across the full weight of each asset in a portfolio – over the course of a year – tremendous profit improvements from automated hedging systems become evident.

…Why it matters

With systematic hedging, hedge funds can substantially increase returns when compared with the same, non-hedged assets. This can all be done without disruptingthe portfolio on a standalone platform or in a different account. Here are some beneficial by-products of real-time hedging against volatile events:

- Improves profitability of long term positions

- Instantly hedges against political and market risks

- Minimizes drawdowns

- Saves extensive amount of time and labor when hedging manually

- Ensures accuracy, taking the “guess work” out of hedging

Unlike live traders, automated hedging systems can scan thousands of data streams and sources at a time, apply sophisticated calculations, forecast stochastic volatility, detect risks and instantly make appropriate trades in the underlying asset or any of its derivatives.

By leveraging the speed and accuracy of the machine learning technology found in systematic trading, fund managers can sit back and focus on generating alpha while the systems take care of managing external market risks.