Lawrence Wintermeyer, executive co-chair of Global Digital Finance, a global not for-profit promoting fair and transparent markets for crypto and digital assets, said the market had its “Berlin Wall moment” when the US Securities and Exchange Commission authorised 10 spot bitcoin exchange-traded funds this year. He spoke at the Tokenization Summit 2024 hosted by City & Financial Global in London on 21 November. On 19 November 2024 there was further progress when Nasdaq listed the first options on BlackRock’s iShares Bitcoin Trust ETF (IBIT).

Wintermeyer said: “Cash on-ledger is the next big thing and will be the next killer app. Collateral mobility will be top of the list for asset managers in 2025.”

In addition, he expects privacy and composability to be important trends next year. In decentralized finance (DeFi), composability is the ability of protocols and applications to seamlessly interact with one another.

Caroline Pham, CFTC Commissioner, attended the conference virtually and said the US has, so far, regulated digital assets by enforcement and through more aggressive interpretations of the law. She said: “Outside the US the discussion is more dispassionate and more rational.”

Governments have issued digital bonds in Europe and Asia, there is more than $1.5 trillion notional volume in institutional repo and payments transactions on enterprise blockchain platforms outside the US and more efficient collateral and treasury management. Pham is sponsor of the CFTC’s global markets advisory committee (GMAC), which introduced the first US taxonomy for digital assets.

GMAC held a virtual public hearing on 21 November and the committee recommended that the use of non-cash collateral should be expanded through the use of distributed ledger technology. Importantly, the recommendation does not require any regulatory action or changes to collateral eligibility rules.

Pham said. “Now, we can finally begin to make progress on US regulatory clarity for digital assets with the GMAC recommendation on tokenized non-cash collateral. This marks a significant first step toward realizing these opportunities for our derivatives markets — with exactly the same guardrails and protections in place.”

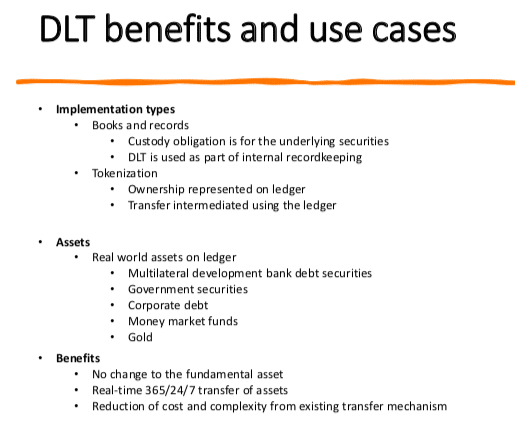

The recommendation said blockchain or other distributed ledger technology can help reduce or eliminate some of the operational challenges of using non-cash collateral without requiring any changes to collateral eligibility rules. In addition, the recommendation provides a legal and regulatory framework for how market participants can apply their existing policies, procedures, practices, and processes to support use of DLT for non-cash collateral in a manner consistent with margin requirements.

Ratings agency S&P said in a digital assets brief that the US election result is likely to shift the legislative and regulatory environment for crypto as the country has lagged behind other major markets. S&P expects developments relating to stablecoin legislation and custody early next year.

“The lack of a regulatory framework for stablecoins in the US has constrained the uptake of financial market use cases, such as tokenization in financial markets,” added S&P. “Although the tokenization of money market funds accelerated in 2024, regulatory clarity could spur investor confidence and help scale up these applications.”

The lack of US participation in global regulatory coordination efforts has also impeded blockchain innovation in traditional financial markets according to S&P. The ratings agency said stronger US involvement may allow already well-tested use cases to scale commercially, both domestically and globally.

In addition, the Security and Exchange Commission’s Special Accounting Bulletin (SAB 121) makes it prohibitively expensive for US banks to provide crypto custody. The custody market could expand if the incoming administration repeals SAB 121.

Katey Neate, chief operating officer, digital assets at BNY said at the conference that the firm is the first systemically important institution to receive an exemption from SAB 121 and is aiming to scale digital asset custody. She said the industry has developed products on separate islands and they all need to be knitted together.

Neate said: “This had been the year of money market fund tokenization. Next year will be about the mobility of assets and cross-pollination.”

UK regulation

Camille Blackburn, director of wholesale buy side at the FCA said at The Tokenization Summit that the UK is on the cusp of significant developments. The delivery of a digital gilt was a key recommendation of the Asset Management Task Force’s work on tokenization.

“The Chancellor has made a commitment to pilot a digital gilt which is a sign of things to come,” she said. “2024 was the year of experiments and white papers, and 2025 will be the year of increased product launches.”

The Asset Management Task Force has released a blueprint for fund tokenization and Blackburn said it has received significant interest. She continued that the FCA is hoping to enhance the model to help deliver commercial products.

The UK regulator’s sandbox for digital assets is also open and there has been significant interest according to Blackburn, with pilots including the use of tokenized money market funds as collateral, and increasing access to private markets.

The FCA has also launched The Digital Securities Sandbox (DSS) with the Bank of England to explore the use of developing technology such as distributed ledgers in the issuance, trading and settlement of securities in the UK.

“The DSS is a new way of sharing regulation and we are open to applications,” Blackburn added.

Sasha Mills, executive director for financial market infrastructures at the Bank of England, gave a speech Beyond Faster Horses: Wholesale Financial Markets in the Digital Age at the Tokenization Summit. She said: “To give a sense of the scale of the potential change, in twenty years we may look back and see parallels between the way the financial system works today and the way we used to travel in the 19th century.”

Mills compared tokenization and the adoption of new technology in financial markets to automated production lines for cars fundamentally altering our conception of what was possible in transportation.

The Digital Securities Sandbox has recently opened for applications and Mills described this as a “really significant milestone” for the UK including the digital gilt being issued in the sandbox. DSS gives the central bank the power to ‘turn off’ the rules, to allow industry to experiment with developing technologies, including tokenization, to issue, trade and settle both digitally native securities.

A combination of programmable transactions and distributed ledgers can unlock the potential for more precise simultaneous transactions that allow for securities to be pledged, borrowed or lent for short periods of time. Mills said: “For example, Digital Financing, a blockchain-based application built on JP Morgan’s Onyx (now Kinexys) platform demonstrated a 56% reduction in operational costs and faster alternatives to receive secured intraday funding without requiring balance sheet usage.”

Digital money

Mills said: “If tokenization of securities is like the move from horse and cart to mass-produced cars, the transformation of money and payments is like the creation of the railways.”

The Bank of England believes the singleness of money is fundamental to monetary and financial stability.

“For this reason we’ve indicated that we have a low-risk appetite for a significant shift away from current levels of settlement in central bank money to privately-issued forms of money like tokenized deposits,” added Mills.

Instead, the Bank of England is considering ways to preserve and enhance the usefulness of central bank money as a settlement asset for digital asset transactions and to develop a synchronization service. Synchronization could allow an asset to be transferred on an external platform, including one based on DLT, with the cash leg of the transaction taking place on the Bank’s existing real-time gross settlement system (RTGS).

The Bank has tested synchronization in experiments with the BIS’s Innovation Hub London Centre and other partners and is also considering the functionality needed for a wholesale central bank digital currency.

Firms are encouraged to use the sandbox to experiment with tokenized money market funds as securities, but the Bank does not consider these tokens as a form of money or as suitable for use as a settlement asset.

Mills concluded: “Much like the productivity of the worker in a car factory was transformed with the advent of the production line, the institutional investor’s experience of wholesale markets could prove to be simpler, faster and cheaper if the opportunities programmable ledgers and tokens present are realized. The tokenization of new types of assets could open up and develop new markets where infrastructure was previously cumbersome.”