Sabih Behzad, global head of digital assets & currencies transformation at Deutsche Bank, said the firm is in discussions with a number of corporates about issuing digital bonds. He spoke on a panel, The Next Wave of RWAs: Bonds and Beyond, at the Blockworks Digital Asset Summit in London on 20 March.

Tokenization of real world assets (RWAs) transforms physical assets into a smart contract on a blockchain, which becomes the system of record.

Behzad highlighted that the development of digital bonds was demonstrated by the recent $800m sovereign debt issue from the Hong Kong government.

“The size was impressive and it was oversubscribed with orders from more than 50 investors,” he added.

In February this year the government of the Hong Kong Special Administrative Region of the People’s Republic of China sold HK$6bn of two-year digital green bonds denominated in Hong Kong dollars, renminbi, US dollars and euro.

The Hong Kong government said in a statement that it streamlined the issuance process by issuing in a digitally native format, adopted the International Capital Market Association’s Bond Data Taxonomy – a standardised and machine-readable language that was developed to promote market efficiency and interoperability, and integrated green bond disclosures in HSBC Orion, a digital asset platform. International investors could also access the digital green bonds via their traditional accounts with Euroclear or Clearstream.

Mr Eddie Yue, chief executive of the HKMA, said in a statement: “This second digital issuance includes multiple innovations that broaden investor access, support interoperability, and improve transparency and efficiency. We hope this issuance would promote the development of the digital securities market and encourage the wider adoption of digitalization technology.”

Addressable market

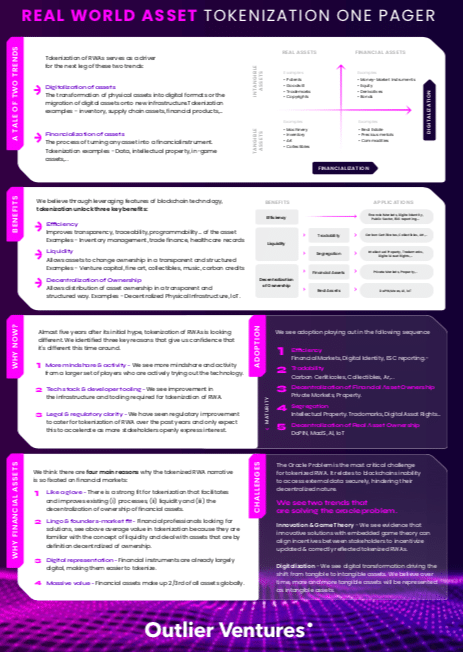

Jasper De Maere, research lead at Outlier Ventures, has estimated in a blog that the total addressable market will reach $20 trillion by 2030 as new markets are created around tokenized RWAs.

De Maere said the current excitement about tokenization is different from the previous cycle between 2019 and 2020 due to the increased participation from institutions, rather than retail investors.

“Today, these institutions bring substantial asset pools and deep expertise, speeding up the adoption of financial asset tokenization,” he added. “Secondly, technological advancements in blockchain have increased scalability, security, and interoperability, complemented by improved developer tools and standards.”

In addition, De Maere said regulation is evolving for RWA tokenization, which provides a solid framework for institutional engagement. He added: “The synergy of progressive regulation, technological advancements, and better transmission mechanisms is promising for the future adoption of RWA tokenization.”

Behzad continued that the benefits of digital issuance include making existing flows cheaper, faster and more efficient, which reduces counterparty risk. However, financial markets will need to run two sets of systems- the traditional and the digital – before the “promised land” of purely digital is reached.

Another benefit is the development of new business models, for example, digitally native securities can be issued continuously. Or coupon payments, which are currently semi-annual due to the time taken to process payments, could become more frequent, even hourly, due to the programmability of smart contracts payments.

“Once tokens can be used as collateral there will be a snowball effect,” he added. “That is starting to happen.”

Amar Amlani, head of EMEA digital assets at Goldman Sachs, agreed on the panel that, in the early days, the traditional and digital systems will be running in parallel.

Amlani said one of the benefits of tokenization is risk reduction, as today’s financial markets are fragmented while digital assets can be settled 24/7, which reduces capital requirements and costs. He also agreed that tokenization can enable new business models, such as building books for new issues in real time and issuing bonds that pay intra-day coupons.

He highlighted that Goldman Sachs has been transacting intra-day repos with JP Morgan since 2021, and now transacts repos to the “nearest minute.”

JP Morgan developed intraday repo transactions using an in-house blockchain application which supports instantaneous settlement and maturity of the transaction in hours, as opposed to days. Both collateral and cash legs of the repo transaction are settled using blockchain, with the cash leg settles using JPM Coin, the bank’s stablecoin.

Digital cash

“Investors are asking us how they can digitize the full trade lifecycle of a bond, and for that we need digital money as fiat cannot settle 24/7,” added Amlani.

Rajeev Bamra, head of DeFi & digital assets strategy at ratings agency Moody’s Investors Service, agreed on the panel that the missing link for tokenizing the full value chain is digital cash.

Bamra highlighted that in addition to the development of technology infrastructure, the legal and regulatory infrastructure needs to be developed. For example, regulation means some data related to commodities and real estate cannot be put on-chain. He also gave the example of a property being tokenized and then being damaged – where would the insurance payment be made ?

De Maere also highlighted that standardization is critical for ensuring compatibility, regulatory compliance, and investor trust in blockchain-based finance.

“However, the decentralized nature of blockchain and the need to address legal and technical challenges make achieving universal standards a complex task,“ De Maere added. “Overcoming these challenges is crucial.”

Moody’s is building models for digital assets which will incorporate data as it becomes more available according to Bamra. He added: “The token economy could eventually affect the value of RWAs.”

Private vs public chains

Another challenge is that regulated financial institutions cannot use public blockchains. As a result they are currently using permissioned private ledgers, which need to become interoperable in order for tokenization to provide maximum network benefits.

Amlani expects the gap between public and private blockchains to eventually be bridged, as regulators become more comfortable that the technology can answer some of their concerns about risks.

Behzad said: “Most institutions want to drive on the public highway but there are currently barriers in place. We have to make sure the technology decisions we make now do not preclude using public chains.”

Ash Arora, partner at venture capital firm LocalGlobe, said on the panel that middleware is being developed to securely bridge public and private chains. She said: “This is needed to take the tokenization of RWAs mainstream.”

Arora added that LocalGlobe is investing in firms involved in the tokenization of commodities and real estate, and there is also huge demand from the Middle East to put metals on-chain.