Stablecoins could help ease the difficulties of fund managers outside the US completing their foreign exchange trades in time to meet the shorter settlement cycle for US securities that are being introduced in May.

Nick Philpott, co-founder and head of partnerships at Zodia Markets, told Markets Media: “I have had lots of interest in using stablecoins for the move to T+1 as firms can see the utility in crypto.”

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The use of a distributed ledger allows atomic settlement or instantaneous delivery versus payment for digital assets i.e on T0, the same day as a trade.

Stablecoins are a form of digital asset that can be used to make payments and are designed to maintain a constant or “stable” value by holding reserve assets, usually denominated in US dollars or another fiat currency at a fixed rate. Unlike fiat currency, which is held on a central record by a bank, stablecoins do not need to be created by a bank but can be issued by a technology company or a crypto-native firm.

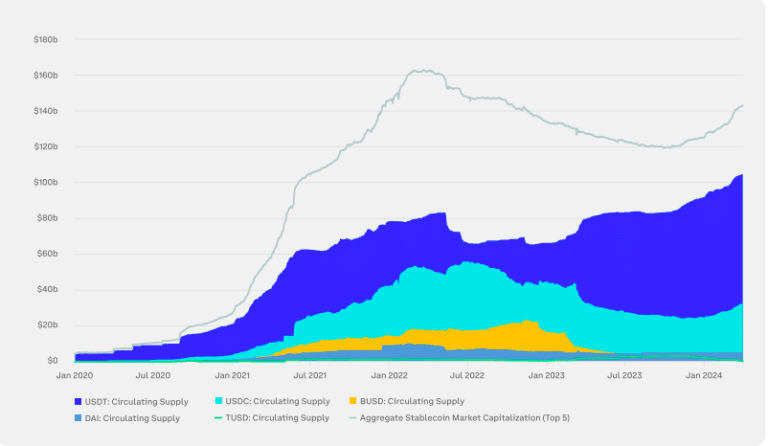

The supply of stablecoins rose more than 14% in the first quarter of this year according to the Q2 2024 Guide to Crypto Markets report from Coinbase Institutional and Glassnode, the on-chain analytics provider for digital assets.

The report said: “Stablecoin issuance rose meaningfully as market participants continue to find use cases for these novel assets.”

The challenges for asset managers outside the US, particularly in Asia Pacific, in meeting the shorter settlement cycle for buying and selling US stocks were discussed in a webinar hosted by financial services group Brown Brothers Harriman, Talking T+1: Solving for FX on 8 March 2024.

RJ Rondini, director at the Investment Company Institute, which represents buy-side firms across the globe, said on the webinar that an industry preparedness survey found that 70% of respondent firms said FX was the number one issue for them in T+1 and there were some issues around CLS [Continuous Linked Settlement].”

CLS is the FX settlement infrastructure that was set up to reduce settlement and counterparty risk and currently has 18 eligible currencies. An EFAMA survey of European fund managers in March estimated that 40% of daily FX flows will no longer be able to settle through the CLS platform after T-1, which could be between $50 and $70bn, but could rise to hundreds of billions of dollars in volatile markets.

CLS has said in a statement it will not make any operational changes ahead of the T+1 implementation date but will monitor the impact of the transition and update stakeholders at the end of June and September.

In March this year Zodia Markets and Fireblocks, which provides infrastructure for digital asset operations, announced a collaboration to enable clients to transfer funds more quickly than traditional fiat methods.

Philpott wrote in a blog that as stablecoins are on blockchain platforms that are available 24-7, an eastern hemisphere stablecoin can be settled synchronously to the US dollars that are needed to purchase equities. In addition, the FX hedge using stablecoins can be executed in European hours, for example 0900 UK time, for value T0 without the worry that the eastern payment cut-offs are between 1030 and 1200.

He also wrote that a further consideration, which would recreate CLS, would be to deliver eastern stablecoins for a USD stablecoin.

“If a broker and an investor use the same custodian, then the custodian will ensure that the USD stablecoin and the Asian stablecoin are settled at the same time, with one leg contingent on the other,” he added. “The USD stablecoin can be liquidated for USD in US hours. Excess Asian stablecoins can be sold off for settlement in the following Asian morning.”

Zodia Markets has observed that large corporations are increasingly using stablecoins for cross-border payments, selling goods and services and for internal treasury management according to Philpott.

“For example, an African client is an oil importer and using local banks to pay suppliers in the Middle East takes between two to five days,” he added. “Using a stablecoin, he can make the payment himself using Fireblocks in about four hours which is a massive cost saving.”

Richard Astle, VP business lead Fireblocks Network, said in a statement: “For some time now, we’ve witnessed a growth in adoption amongst our network to use stablecoins as a near-instant and cost-effective way to transfer value. As a global enterprise, the expansion to non-USD on/off ramps is also on the rise which makes this collaboration with Zodia Markets not just unique in its value proposition, but also marks the beginning of bringing FX on-chain.”

Stablecoin regulation

As there are many stablecoins that have been issued, an important metric is the amount and nature of reserve assets they hold. Philpott said Zodia Markets does not provide advice, but can point to frameworks and analysis that the market is starting to adopt for reviewing fiat-backed stablecoins.”

“For pound sterling we have Poundtoken, which is one of the safest, best structured stablecoins we have seen,” he added. “The reserves are at ClearBank, a narrow bank, which means they are ultimately at the Bank of England.”

Philpott described Poundtoken as almost like a central bank digital currency, but one step removed, which has the hybrid of internet utility, accessibility and low cost.

Timothy Massad, former chairman of CFTC and former Assistant Secretary at US Treasury, wrote in a blog at Brookings that stablecoins are in some respects similar to Eurodollars as they are U.S. dollar-based liabilities with origins outside the regulated banking system.

Massad wrote that U.S. policymakers initially paid little attention to Eurodollars because the market was small but it grew, and Eurodollars ultimately helped cement the international role of the dollar. He asked if stablecoins could undermine that leverage.

“As with the early days of the Eurodollar market, stablecoin use is minimal today, and so their national security risk may also be minimal,” said Massad. “But just as Eurodollar use grew quickly and unexpectedly, stablecoins could also grow.”

He continued that while stablecoins are currently used mainly to trade other crypto assets, they could become a more widespread means of payment, and that growth could come even if the U.S. does not take action.

“That is because many other jurisdictions are creating frameworks to license stablecoins, including Europe, the UK, Japan, Singapore and the UAE,” said Massad. “While those frameworks may lead to stablecoins in native currencies, they could also give rise to new dollar-based stablecoins.”

Philpott agreed that few jurisdictions have stablecoin regulations at the moment. He said that, from a regulatory perspective, serving the United States is beyond Zodia Markets’ risk appetite for now but the firm continues to work on the issue.

“I have every faith that the US system will get there as it’s a hugely innovative economy,” Philpott added.

Growth strategy

Zodia Markets provides institutional crypto trading and is backed by Standard Chartered and OSL Group, an Asian public fintech that is the world’s first SFC-licensed and insured digital asset platform.

In July 2022 Zodia Markets received its registration with the Financial Conduct Authority, the UK regulator, and commercially launched in September 2022 to target institutions, but this was just ahead of the crypto winter.

Management realised that many counterparties struggled with access to basic banking services, even in US dollars, and that the quality of the foreign exchange that some of them were getting from their existing providers was very poor. Zodia Markets gets preferential foreign exchange rates from Standard Chartered, and putting that together with crypto has proven to work very well according to Philpott.

“It took us a while to open accounts and get everything tested, especially as the move to T0 settlement is not trivial,” he added. “We started executing these trades at the beginning of this year and it has been very successful.”

As Zodia Markets is owned by a bank, in contrast to crypto-native competitors it cannot hold crypto on the balance sheet because of capital requirements according to Philpott. However, he argued that being deeply plumbed into a global international bank is a real differentiator.

“We can act as a bridge between the traditional finance world, which is Monday to Friday, 9 to 5 with T+2 settlement and crypto which is T0 and 24/7,” he said. “The crypto industry is also crying out for balance sheet access.”

Zodia Markets’ growth strategy involves adding more currencies and deepening the integration of our existing currencies. The firm currently only trades spot but Philpott said it wants to expand into digital bonds, other securities and derivatives.

Zodia Markets has an entity in the UK, registered with the FCA, and an entity in Ireland registered with the Central Bank of Ireland, which Philpott said is designed to serve the EU in the fullness of time.

In April this year Philpott relocated to Abu Dhabi to expand the company’s executive leadership in the region. He joined Mark Matthews, chief risk officer, and Giovanni Miano, chief technology officer, who are already based in the United Arab Emirates, alongside Ayad Butt, who heads up sales and trading across Africa and Middle East.

Zodia Markets said in a statement that it has experienced record growth with clients across the region who value the bank-grade institutional offering and its multi-currency stablecoin trading capability.

“The real magic is when you have a stablecoin and digital security on the same rails on the blockchain,” said Philpott.

He gave the example of digitising a bill of lading for 50,000 tonnes of oil on a ship. Under the Electronic Trade Documents Act, the bill of lading can be turned into an NFT (non fungible token) on the Ethereum blockchain and a stablecoin can be the means of payment on that chain to eradicate counterparty risk.

Philpott believes the migration of money and finance to the open internet has an air of inevitability, particularly in an age when more people have smartphones than bank accounts.

“Imagine if Gmail would not let you email someone with an Outlook address. That would be ridiculous and yet money operates along those lines,” he added. “This will allow a lot more people to access the financial services network, which I think will be more transformational in terms of global poverty than anything we have seen before.”