“We are undeniably a laggard on innovation,” said Brakebill, CIO of Tennessee Consolidated Retirement System. “We try to take the good ideas other people have done and vetted over a long period of time, and implement them in what we do.”

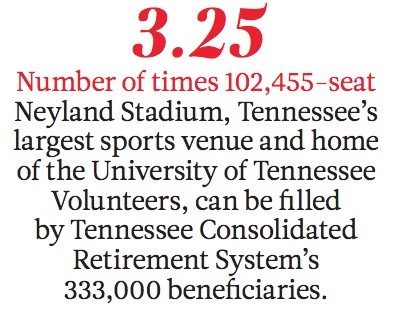

Established in 1972 via the rollup of seven separate retirement systems, TCRS manages about $38 billion for 210,500 active employees and 122,500 retirees, spanning state workers, public-school teachers, and political staffers. In a December 2012 letter to members, Tennessee State Treasurer David Lallard described TCRS’s investment program as risk-averse and designed to preserve capital in difficult environments.

That means mostly watching as some other state pensions try to goose returns by restructuring alternative investments such as hedge funds and private equity, trading more derivatives, or investing in lower-rated bonds.

“We manage a conservative portfolio,” Brakebill told Markets Media in a May 8 interview from his office in downtown Nashville, located a half mile from the Country Music Hall of Fame. “We have significantly less equity risk overall than peers — our lower-risk posture is a key hallmark of the fund.”

As of December 31, 2012, TCRS’s investment portfolio consisted of 41.7% North American equity, 28.8% U.S. bonds, 15.4% international equity, 7.2% inflation-indexed bonds, 4.7% real estate, 0.8% international bonds, and 0.6% private equity. That’s not far from the plain-vanilla 60% stock-40% bond allocation public pensions are historically known for, but the TCRS portfolio is evolving.

“We don’t shy away from adding risk, but we expect to see returns,” he said. “For example, our equity exposure is about the same as it was when I arrived five years ago and our risk posture is only slightly higher, but we’ve added emerging-market and Canadian equities, we lengthened the duration of the bond portfolio, and we moved into private equity and expanded what we do in real estate.”

Calmer Waters

Given TCRS’s low-risk portfolio strategy, its standard-deviation risk is typically 20% to 30% less than peers, and volatility is 10% or less, compared with 12% to 14% for peers, Brakebill said. “In normal environments we underperform because we have less risk, and conversely we outperform during challenging periods,” he said.

Brakebill, 49, joined TCRS in 2008 after almost 14 years at the Teacher Retirement System of Texas, where he last served as director of domestic equities for the $117 billion pension concern. Previously, he worked for IBM and other technology companies in Austin, Texas, after starting his career at investment-management consultancy Wilshire Associates.

Brakebill cited two main accomplishments since he joined TCRS in 2008: bolstering the full-time investment staff from 22 to 28, and methodically increasing the portfolio’s risk exposure. The plan manages a “large amount” of its assets internally, as opposed to some other public pensions that outsource a greater proportion of investments to outside managers

“The fixed-income team has typically utilized derivatives to modify exposures to duration and make adjustments on the yield curve.”

“Over the past five years we systematically added personnel to make sure the organization had backup in key areas,” he said. Brakebill cited support from higher-ups at the Tennessee state level. “Adding staff in a period with a lot of pressure on budgets was a big deal and I really thank the treasurer and the legislature for doing that in really rough time,” he said. “That took a lot of courage.”

On the portfolio side, “we believe we created a lot of value by taking advantage of higher-return opportunities,” Brakebill said. “We have taken a lot of incremental steps to improve the strategic returns of the portfolio. Each one of them is small, but we think all of them in aggregate will be pretty nice. We think we’ve increased the strategic return of the fund by well over 1%, maybe 1% to 2%.”

TCRS’s investment return was 5.6% for its fiscal year ended June 30, 2012, which the treasurer Lillard characterized as “one of the best results of any comparable pension plan.” The return, driven by the performance of longer-term bonds that gained in value when interest rates declined, beat its policy index, or long-term benchmark, by 32 basis points, or 0.32%. The Standard & Poor’s 500 equity benchmark gained only about 3% during the same period, as it was dragged down by market turbulence in the second half of 2011.

Longer-term returns are mixed. The composite annualized return of 6.38% lagged the benchmark by 72 basis points for the 10 years ended December 31, 2012, which included the bull-market years of 2003-2007. For the three-year 2010-2012 period, TCRS outperformed its benchmark by 14 basis points.

“The returns of the fund in the years before my arrival were satisfactory in an absolute basis, but they lagged the fund’s benchmark on a relative basis due to a systematic underweight to equities,” Brakebill explained. “Even with the underperformance, the risk-adjusted returns for the pension fund were very good.”

“Since my arrival, we have focused very carefully on the normal, or target portfolio. We make thoughtful tactical asset allocation moves,” he continued. “We feel the fund has done much better recently versus peers.”

Brakebill said that according to investment consultant Strategic Investment Solutions, TCRS’s investment performance was near the bottom of its peer group for the 10 years ended December 31, 2012, but five-year and three-year results were better than 87% and 73% of comparable funds, respectively.

“TCRS traditionally has maintained a more modest asset allocation,” said Keith Brainard, research director for the National Association of State Retirement Administrators (NASRA). “That predictably has left their investment returns higher than all or most of their peers when markets are down, and lower when equity markets are strong. It seems to have worked well for them, as their funding level has been relatively high.”

Yield Scarcity

While beating benchmark and peer returns is an achievement, the problem for pensions is that even being best-in-class at a time of persistently low bond yields may not be enough to meet their own liabilities. For instance, TCRS’s 5.6% return for its fiscal year 2012 fell almost 2 percentage points short of the plan’s 7.5% assumed annual return.

The 6.4% annualized return over 10 years “has not met our actuarial targets,” Brakebill said. “However, if one looks at what we should have expected going forward 10 years ago, 6.4% is well within the bounds of what we should have expected. This is because in constructing a portfolio we develop a mean return estimate and an estimate of standard deviation. The portfolio performed within the bounds one should have expected based on statistics.”

“Overall, we feel like we’ve done pretty well,” he said. “Our low-risk portfolio had good relative performance through the financial crisis versus peer funds, and we also happily have had good performance since the big rise starting in March 2009.”

“The lack of economic traction in the face of such huge monetary stimulus gives us confidence that rates will stay low for a long period of time.”

TCRS’s aggregate funded status was 92% as of June 30, 2012, ranking it 11th-best of the 100 largest U.S. public pension plans, according to The Milliman Public Pension Funding Study. “TCRS is very well-funded,” Brakebill said. “The fund is secure.”

After hovering near historic lows for months, yield on the benchmark 10-year U.S. Treasury note surged about 50 basis points in May to a 13-month high of 2.15% amid signals that the U.S. Federal Reserve may wind down its bond buying. The May bond rout cut the value of U.S. government debt securities by about 2% in aggregate, spotlighting what had been a latent risk for pensions and other institutional bond investors.

Still-low bond yields “creates a difficult situation for pensions,” Brakebill said. Aside from TCRS shifting the stance of the portfolio to generate more return from assets, the plan’s decision makers have moved to reduce costs on the liability side as well.

“We have gone forward to restructure the benefit structure in response to the high degree of uncertainty in delivering returns necessary to meet the needs of the current plan,” Brakebill said. “The Tennessee legislature has approved a plan to create a new hybrid benefit package which would consist of a defined-contribution plan and a defined-benefit plan. This plan is structured to provide a fair retirement income, while eliminating the risk of large unfunded liabilities for employers.”

The plan would kick in for new employees hired after June 30, 2014.

TCRS’s asset allocation is in-line with the plan’s targets and does not reflect a strong opinion on the pace of global economic expansion or other market influences relative to consensus expectations. “We basically have neutral exposures to the asset classes,” Brakebill said.

“Overall, our view is that high-quality fixed-income assets are pretty rich — most people would say that — and conversely, equities appear more moderately valued,” he continued. “However, we also believe the world economy is in a deleveraging process which dampens economic and earnings growth, and increases risk aversion in equity markets. So we are concerned there.”

Befitting a conservative investor, TCRS’s core equity holdings are decidedly large-capitalization: its largest stock positions as of mid-year 2012 were Apple, ExxonMobil, Microsoft, Chevron, IBM, and General Electric.

Not Convinced

Brakebill is wary about the ongoing economic recovery, especially given the unprecedented activism of central banks worldwide. “Economic growth is tenuous and we think it will be for a long time,” he said. “The lack of economic traction in the face of such huge monetary stimulus gives us confidence that rates will stay low for a long period of time, and we can maintain our fixed-income portfolio as is.”

Recently acquired emerging-market and Canadian equities are a counterbalance to TCRS’s fixed-income portfolio. “Our view is that if the world economy recovers, those investments will do well and maybe our bonds will lag, and conversely if the world economy suffers, those won’t do well and our bonds will do well,” he said. “We’re looking for diversification.”

Brakebill hails from Crosbyton, Texas, a northwestern Texas town of about 1,750 people, located about equidistant from the New Mexico and Oklahoma state lines. A saddle in the corner of his Nashville office is from his father’s horse in Crosbyton.

As CIO, Brakebill works with colleagues on the investment staff and the TCRS Board of Trustees to shape the investment portfolio into more of a docile steed than a bucking bronco.

“TCRS has a layered approach to risk management with the Investment Policy statement as our primary risk-management tool,” TCRS Deputy Chief Investment Officer Andy Palmer wrote in an e-mail to Markets Media. “We have a conservative investment policy mix that provides protection in rough markets, and the high proportion of assets managed directly by staff allows for a daily assessment of risk and return at both the portfolio and individual security level.”

“We have taken a lot of incremental steps to improve the strategic returns of the portfolio.”

Continued Palmer, “staff seeks to provide alpha, and it is that search for alpha that enhances our appreciation for risk in markets and helps inform our medium-term tactical positioning.”

TCRS’s investment policy is fairly comprehensive. There were 24 bullet points listed in the 2012 annual report, including a provision that limits the fund to no more than 50% in U.S. equities, another that restricts bond purchases to investment grade, and others that cap real estate and private-equity holdings to 10% and 5%, respectively.

Additionally, “we continually monitor our internal processes to improve our focus on risk control,” Brakebill said. “We monitor the portfolio performance extensively — performance is reviewed by staff, our investment consultants, our investment advisory council, our investment committee, and the board. We go through it in detail.”

The Tennessee treasurer and legislature recently signed off on a plan for TCRS to hire a director of risk management. Brakebill and colleagues are currently fleshing out the specifications for the position and formalizing the job description, and a search is expected to commence by early in the fourth quarter.

TCRS dabbles in derivatives, and its usage of futures and options is holding steady after ratcheting up a few years ago. After a small-cap equity strategy using derivatives underperformed and was discontinued, the pension plan has focused its deployment of derivatives on fixed income.

“What (derivatives) allowed us to do two years ago was make the transition to a longer-duration benchmark,” Brakebill said. “That would have taken us forever in the cash market, so it did facilitate us making that transition.”

“The fixed-income team has typically utilized derivatives to modify exposures to duration and make adjustments on the yield curve, also they have internally managed portable alpha strategies that are small, but within the fund as well,” he continued. “We use them for incremental returns — I don’t know if that’s specifically in response to the low-yield environment or not, but it is a way to incrementally add value and seek liquidity.”

Trade Handlers

In the 2012 fiscal year, TCRS’s stock trades, spanning domestic and international exchange-traded shares as well as program trades, generated about $18.5 million of commissions for broker-dealers. Dallas-based Capital Institutional Services earned more than $2.2 million from handling TCRS trades; other oft-used brokers included Barclays Capital, J.P. Morgan Chase, Cowen, Bank of America Merrill Lynch, and Credit Suisse.

“We’re a moderately active trader in equity and fixed income, but it depends on a portfolio-by-portfolio basis,” Brakebill said. “We work with our trading partners on the trading desk and each individual fixed-income portfolio manager to look for liquidity and monitor trading costs. On the equity side, we work with (Transaction Cost Analysis provider) Abel/Noser to evaluate our trading costs, analyze executions and figure out how we can do a better job.”

Bloomberg is a workhorse tool for information management and trading; TCRS also uses FactSet for equities and Yield Book and Citigroup’s Point for bonds. “Those are systems we rely on heavily,” Brakebill said. “Technology is a big thing and it’s changing a lot that we do.”

While TCRS isn’t a first mover on new ideas, the pension plan can warm up to emerging methodologies over time. One example of this is in the area of risk parity, an investment-management approach that focuses on the allocation of risk, rather than the allocation of capital, to boost efficiency and resistance to market downturns.

“Without moving either to a full implementation at the portfolio level or utilizing external managers to create a specific risk-parity sleeve within the portfolio, we think we can use that framework and understanding of the broad risks of a fund and balance the risk internally,” Brakebill said.

For example, “most practitioners understand equity risk is the overwhelming risk embedded in a typical institutional portfolio,” Brakebill explained. This “led us to feel comfortable in increasing our credit and duration exposures, and also in pushing out into areas that are non-equity risks. We see equity risk as the pro-growth posture, and we’ve been using other areas to increase other risks.”

Brakebill earned an undergraduate degree in mechanical engineering from Texas Tech University in Lubbock, Texas, and an MBA from the University of Texas. Married with two daughters, he enjoys bicycling, spending time with his family and attending sports and music events.

Going forward, reaching for the 7.5% annual hurdle will continue to be a slog, given that most bond yields are just one half or even one third of that number.

“As long as interest rates stay as low as they are, that’s going to challenge portfolio managers who are heavily invested in bonds,” said Nasra’s Brainard.

Brakebill expects to boost TCRS’s staff to 32 by the end of 2013, and increasing the portfolio’s private-equity and real-estate investments are ongoing, long-term initiatives. “We can move into emerging-markets equity and Canadian equity — really anything that’s liquid — fairly quickly, but the private classes take a while.”

“As long as interest rates stay as low as they are, that’s going to challenge portfolio managers who are heavily invested in bonds,” said Keith Brainard, research director for the National Association of State Retirement Administrators.

Bigger-picture, Brakebill offered some ideas on the future for public pensions and institutional investment management more broadly.

“There are a lot of pension plans out there that aren’t as fortunate as we are” with regard to funding status, he said. “They face really high negative cash flows. I think the investment time horizon on those funds is falling because they have to liquidate to fund benefit payments in the near term. This will impact is how much they can invest in the liquid classes such as private equity or real estate, because they just can’t do that and meet benefit payments.”

“Institutional asset management will always be with us, and it’s always going to be a hard business,” Brakebill continued. “Public pension plans are currently growth markets for alternative-asset providers, for example private equity and real estate…There’s a lot of pressure on public pensions, and given the pressure on those plans it might cap the growth of the alternative space.”

Added Brakebill, “what may happen is that as pensions become capped, or as they begin to suffer sizable withdrawals, then they will be unable to accept illiquid, long-term, investment risks. They will be forced to stay with more liquid assets.”