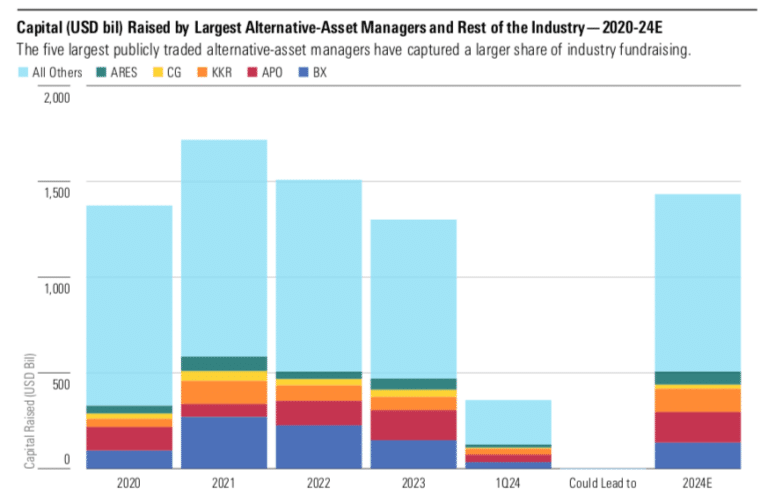

Private capital fundraising this year is set to exceed 2023 based on results from the first quarter, according to data provider Morningstar .

The firm said in its report, US Asset Manager Industry Pulse: Q2 2024, that it expects this year to not only surpass 2023, but also quite possibly 2022. Private capital fundraising was $1.5 trillion in 2002, the second-highest annual total behind the $1.7 trillion in 2021.

“While 2023 fell short of being another record year of fundraising for the private capital markets, with the industry raising an estimated $1.3 trillion, there was a meaningful uptick in the back half of the year as investors anticipated a shift in the Fed’s short-term interest rate policy from one of increases to one more focused on cuts in the near to medium term,” added the report.

Morningstar continued that while older vintage funds have deployed capital the past several years, there is still close to $4 trillion of dry powder which is expected to be unleashed once conditions improve.

The five largest publicly traded alternative-asset managers have increased their share of both total capital invested and dry powder since the pandemic, according to the report.

“At the end of March 2024, these firms – Blackstone, Apollo Global Management, KKR, Carlyle Group, and Ares Management – accounted for 21% of total capital invested, as well as the industry’s dry powder, due to their large fundraising hauls in 2019-22,” added Morningstar.

Private equity accounts for the majority, 57%, of total fundraising on average in the past four years. Private debt was second at 17% between 2019 and 2023, but accounted for one quarter, 24%, of all fundraising last year.

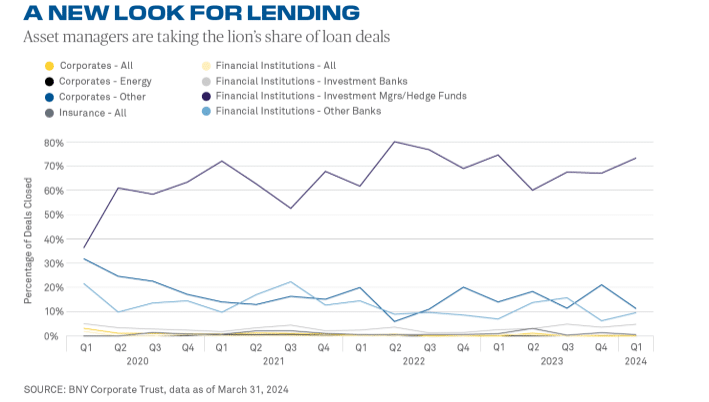

BNY said in its latest Aerial View that its Corporate Trust division saw private debt deals account for two thirds, 65%, of its newly added loan servicing mandates last year, up from 40% in 2021.

“The vast majority of loan deals serviced by the team now come from deal appointments from investment managers rather than banks, and those firms’ share of deal flow on the corporate trust platform has grown to 73% as of March 31 this year from 36% four years ago,” added BNY.

Traditional managers

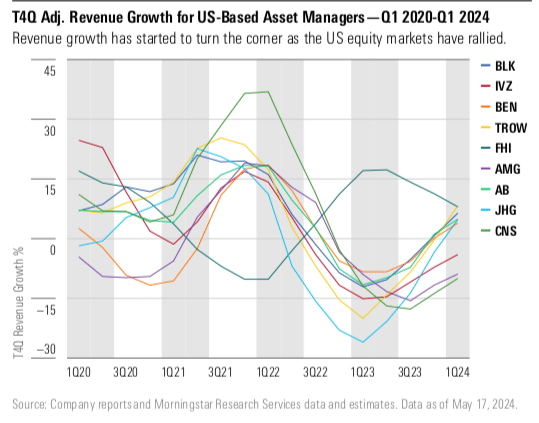

Amongst traditional asset managers, Morningstar said the rally in the US equity markets since October 2023 has lifted valuations closer to its fair value estimates.

“At this point, we think that most of the good news on the cyclical front is already baked into stock prices, while some of the secular issues facing the firms – like ongoing outflows driven by the growth of passive, which only adds to the fee and margin compression the industry is facing – are being ignored,” added Morningstar.

The report highlighted that active equity funds remain in net outflow mode, and that active equity funds across all nine Morningstar categories lag the 3- and 5-year performance of their average fee-paying passive peers.

“Historically, the bestselling active fund shops have been either boutiques or specialized managers with outstanding performance, which has been the case the past year, but JPMorgan also continues to be a top flow generator via its wealth management arm,” added Morningstar. “Too many active fund managers in our coverage made the list of worst selling active fund shops the past four calendar quarters, with T. Rowe Price, BlackRock, Franklin, and Invesco showing up on the list because of their uninspiring active fund performance.”

Morningstar expects the outflows from active equity funds and inflows to passive equity funds to continue which will hamper asset growth. However, both active and passive bond fund flows should improve once short-term rates decline with some of the capital in money market funds moving to bond funds.

“Revenue growth will not fully recover until these managers see their assets under management revert to pre- 2022 levels, which in most cases won’t happen until late 2024 or early 2025,” said Morningstar. “With ongoing fee compression providing an additional drag on top-line growth, there will be a dampening effect on profit margins going forward, given the operating leverage that is inherent in the business models of the traditional asset managers.”

.