Northern Trust has integrated digital assets with the firm’s traditional asset servicing infrastructure in its Matrix Zenith blockchain platform, which it believes is critical to institutionally scale the nascent asset class.

Pete Cherecwich, president of Asset Servicing at Northern Trust, described Matrix Zenith in a statement as an asset- and market-agnostic platform that allows the firm to support clients’ digital asset strategies.

Matrix Zenith is part of Northern Trust’s digital assets and financial markets group which combines the teams responsible for supporting the digital asset markets and those responsible for providing market access and insights across the traditional securities services markets.

Justin Chapman, global head of digital assets and financial markets at Northern Trust, said: “Matrix Zenith supports the digital asset lifecycle from asset creation, trading, pricing and custody to reporting using blockchain technology. The platform integrates with our core traditional asset servicing infrastructure to support digital and traditional assets side-by-side.”

Chapman told Markets Media that he gave his first presentation on digital assets to the Northern Trust board in 2015. Two years later Northern Trust deployed blockchain technology for private equity. In 2019 Northern Trust collaborated with BondEvalue to integrate fractionalized ownership of fixed-income bonds for the BondbloX platform, followed by partnering in the launch of institutional-grade crypto asset custodian Zodia Custody in 2020/21.

“Since the end of last year we pulled all the pieces together into Matrix Zenith to form one application suite that deals with multiple asset classes for digital assets,” Chapman added. “In the last seven years we have learned how to evolve the platform and constantly add in products.”

When Northern Trust first deployed blockchain in 2017, reusability was about 20%. However as the technology has evolved, reusability has risen to above 80% according to Chapman.

“We are not reinventing the wheel each time we look at a new digital asset class,” he said.

In addition, Matrix Zenith connects clients to the traditional Northern Trust stack and its capabilities to combine the traditional and the digital environment into one set of applications.

Chapman argued that it is fundamental to have a trusted entity working in both the traditional and digital environment, and to bring the risk and control framework of the traditional custody product to digital assets.

“The important thing is to allow our clients to mix traditional and digital versions of the same assets in the same environments,” he added. “If you are not in both camps, it becomes very hard to do.”

Northern Trust is focussed on giving clients access to digital assets without having to navigate a number of private blockchains and connectivity points. Clients want to derive the benefit of a digital asset, usually information and data, but can also want to access traditional channels according to Chapman.

“If we connect clients to different digital initiatives with different methods, we lose the aggregation, efficiency and transparency of data,” he added. “If I can connect clients to the digital environment but deliver information in existing methods, that is a real win.”

Northern Trust Carbon Ecosystem

One sample of the use of Matrix Zenith is the launch of the Northern Trust Carbon Ecosystem. In September this year the firm said in a statement it had formally launched the voluntary carbon credit ecosystem with the first live transactions to enable institutional buyers to digitally access carbon credits from leading project developers.

Northern Trust first deployed blockchain technology for private equity in 2017, where the market is opaque and suffers from a lack of infrastructure. Chapman argued that the use case in voluntary carbon markets is equally strong, for the same reasons.

“You can bring these markets up to a good standard quite quickly by introducing traditional principles on new technologies,” he added.

Ethan Gilmore, co-founder at CUT Carbon Distributed Technologies AG, said in a statement: “CUT Carbon Distributed Technologies AG is incredibly excited to be able to register and settle our carbon credits on Northern Trust’s institutional platform and we look forward to bringing more of our inventory to The Northern Trust Carbon Ecosystem.”

Buyers can purchase digital carbon credits directly from project developers on-chain and retire them against their emissions footprint.

Cherecwich said in a statement that the ecosystem’s seamless and secure settlement experience is designed to give project developers and institutional buyers confidence in their carbon credit transactions, with Northern Trust as the custodian. Northern Trust acts on instruction to record, transfer and settle digital carbon credits in its capacity as the designated custodian. He will take on the newly created role of chief operating officer on 1 October 2024 to focus on ensuring operational excellence and resiliency, effective risk management and controls, and scalable growth.

Tokenization

Further transactions on the Matrix Zenith platform are planned for 2024. Chapman highlighted that in addition to carbon credit, any other commodity could operate the same way on the platform under current legislation.

He continued that Northern Trust is having many conversations around fixed income, which he described as ripe for improvement in terms of data flow and efficiency.

“Fixed income and carbon together could end up with a green bond strategy,” he added.

For example, green bond investors want to trace the attributes of underlying debt instruments in terms of ESG, which is more efficient on-chain.

Northern Trust is also involved in lots of conversations around tokenizing money market funds, which become more attractive on-chain due to new capabilities such as using the tokens for collateral, to improve liquidity and risk management.

BlackRock issued its first tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), on the Ethereum blockchain in May this year. The fund is available to investors by subscribing to the fund with Securitize, the platform for tokenizing real-world assets, and reached $500m in a record time of less than four months.

Franklin Templeton, also launched a tokenized money market fund back in 2021, represented by a BENJI token. In September this year Janus Henderson Investors said it will manage Anemoy’s Liquid Treasury Fund, a fully on-chain, tokenized fund issued on Centrifuge’s public blockchain that provides investors with direct access to short-term US Treasury bills.

I am increasingly convinced that the RWA trend is the early stages of getting the traditional financial system onto blockchains in a way that we have not seen yet.

Some of the world's largest financial institutions are already putting tokenized funds on-chain, and I think we are… pic.twitter.com/OxIHuT3mwf

— Sergey Nazarov (@SergeyNazarov) September 24, 2024

Chapman acknowledged that fragmentation is a challenge in the digital market ecosystem, particularly of liquidity pools for secondary trading.

“For tokenization to scale, we need connectivity in the back end on the secondary market side,” he said. “We need interoperability to have the liquidity pools come together.”

For example, in the carbon markets Northern Trust is open to moving cabin credits between registers, which is not currently supported by the market and makes the market less liquid.

Market participants who are considering adopting DLT and/or blockchain has risen to 38% this year, from 29% in 2023, according to the OMFIF Digital Monetary Institute’s latest annual Digital Assets 2024 Report.

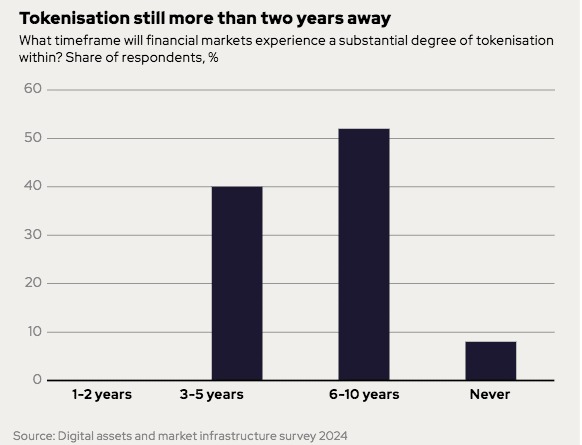

Nearly all, 92% of the survey respondents were also confident that financial markets will experience a substantial degree of tokenization at some point, although all said that it is at least three years away. The largest share of respondents, 52%, believe that substantial tokenization will occur within six to 10 years.

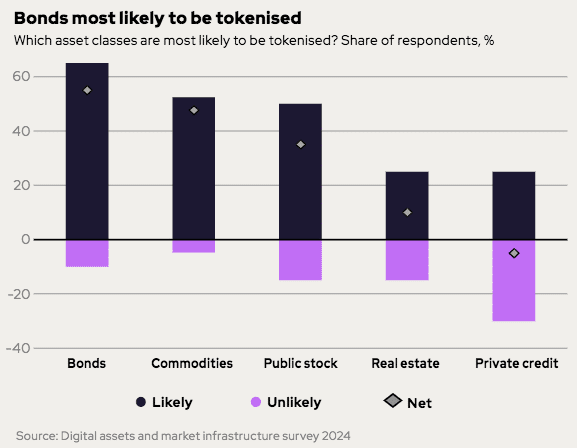

Two thirds, 65%, of survey respondents believe that bonds are prime candidates for tokenization. Survey participants also expect commodities, 52%, and public stock, 50%, to be tokenized.