Lawrence G. McDonald – www.lawrencegmcdonald.com

“I remember when all you had to do was figure out the correct p-e for an industrial. Now you need to be a German Oliver Wendell Holmes”

Jim Cramer

1st Half 2012 Review and 2nd Half Outlook

Risk on? Risk off? Where is the market going??

I must say I have not felt this convictionless about the market’s short to medium term direction in a long time. In speaking to clients, I don’t know if it’s the holiday hangover from the 4th or the noticeable, swift drop in the market’s correlation, which has people scratching their heads.

Is Chinese GDP the new Libor?

Picture in your mind two giant oceans meeting one another, imagine the rip and chop. Ultimately, I think the market is trying to digest colossal growth dislocations globally; the US, Europe and China. The data is changing at a very fast clip.

With almost as much influence, since the EU Summit we’ve seen a dramatic decline in tail risk. My 17 Lehman systemic risk indicators have sharply moved lower, best improvement since January. While at the same time we’ve seen a spike in traditional economic risk to the markets.

Investors as a whole are obviously confused, the Weekly Advisor Sentiment, better known as Investors’ Intelligence, Bulls fell to 43.6% from 44.7% last week, while Bears remain unchanged for the 3rd straight week at 24.5%.

What’s Twitter Telling Us?

Over the last few weeks, when I look at Twitter in the morning, I see a noticeably, less macro stream. In other words, the amount of Tweets with true market moving potential has dropped like a rock.

Europe Has Gone Silent?

Yesterday, at the Bernanke Senate hearing, there was virtually no discussion of Europe, the epicenter of global tail risk. Business Insider’s Joe Weisenthal, wisely asked, “Europe has gone silent?”

The Lehman Hangover Lingers

I think much comes down to the psychological impact the Lehman collapse still has on markets. When systemic risk drops, people feel good about investing, even in an anemic economy. It’s an amazing sensation of relief, like Fat Albert getting off the market. Systemic risk and the market’s direction sit at opposite ends of the seesaw, as one rises the other falls. The closer you are to such a blood curdling panic the likes of Lehman, the more you have to appreciate the impact of systemic risk on the markets. It could take 10 year for the markets to truly normalize. Right now they’re trying to.

Listen to Credit

A further sign of lower systemic risk, five year credit default protection on the four biggest banks in France and Spain has dropped anywhere from 10-20bps over the last week. Socgen has improved by over 100bps the last two months. While economically sensitive names like Caterpillar CAT, AK Steel AKS, Advanced Micro Devices AMD, Yum Brands YUM have moved wider by 35-200 bps in the last 45 days.

Bottom line, credit is improving in financials and deteriorating in economically sensitive names.

One Standard Deviation Risk vs. Two?

Normal markets, 1992-2000, 2002 – 2007, these were lovely times when sell offs were driven by “economic risk.” Those days are heavenly compared to systemic risk’s impact. As difficult as economically driven market sell offs are, they do not compare to 2011, 2008, 1929 and 1907. A look through history shows traditional economically driven sell offs range from 5-15%, or one standard deviation. Systemic risk sell offs, 2008 and 2011 are 25-50%, or two standard deviations. I believe within 10 years of Lehman’s collapse we’re living in a two standard deviation world. Meaning, when systemic risk is rising, lighten up on stocks and falling add to them. The stock market can climb the wall of worry looking at an economic slow down all day long, systemic risk can take its knees out. So many asset managers globally were burnt in 2008, I’ve met thousands of the scarred on the speaking tour, they’re more likely to de-risk today at Flash Gordon speed at the first sign of a “Lehman moment.”

Strange risk on?

Through July 16th, the S&P was up 6.5% from it’s June lows while the yield on the US 10 Year Treasury came in another 23bps the last 2 weeks, 43bps year to date. Last week’s auction showed the lowest yield ever printed at 1.45%. Recent history tells us, US Treasuries should not be this well bid in a true “risk on” equity rally?

In other words, the correlation between stocks, treasuries and the Euro are out of whack with recent “risk on” trades. The lack of correlation in itself is bullish and a sign that markets are trying to normalize. Case in point, the ICJ, CBOE’s implied correlation index is off 18% since June 12th, consistently making lower highs.

No Love for the Euro in this “Risk On”

Coming out of the systemic risk haze. Even with the rally in US stocks, the Euro is off almost 4% from its July highs, a two year low and has seen no love in the recent risk on trade. While the global equity markets were booming higher in January & February, the Euro was up almost 7%, low to high, not this time.

Again, we’ve seen a dramatic decline in systemic tail risk and s sharp spike in economic risk globally.

I think the main risk off drivers of market action are;

Reasons to be Bearish

1. Systemic Risk Issues still staring at the US markets. Spain, looking at a Keynesian Endpoint? Germany’s mounting risk, if you add up Target2 Liabilities + ECB bond buys + Greek Bailout + EFSF Guarantees + IMF component of EFSF / ESM, you get new $1 trillion of developing risk. Spanish equities as represented by the IBEX have moved 10% up and 10% down since June 26th, now well below pre EU Summit levels, while the S&P 500 is almost back to its recent highs.

Spain’s prime minister, Mariano Rajoy has established something of a reputation for contradicting himself of late, raising taxes after pledging to cut them. Spain told the world a month ago they needed ECB help with a bank recapitalization, it’s now very clear there were social / fiscal strings attached to getting Spain the cash for their limping banks. This is putting further pressure on an economy leaking oil. One has to ask, what does Mr Rajoy see now in Spain after looking under the financial hood? Last week, his government announced an estimated 6.5% of GDP fiscal tightening over 2.5 years, that’s €65bn of cuts whilst mired in one of its deepest ever recessions.

Stepping on those Green Shoots. A Cut in US Spending in March of 2009?

Imagine the USA trying to do what Spain has just pledged? It would be the equivalent of a March 2009, $875 billion CUT to USA annual spending. The worst choice is the only choice? Spain’s value added tax, VAT was raised by 3% to 21%. Interestingly, when both Japan and Australia pre-announced VAT hikes, it produced big spike in consumption ahead of hike, then collapse afterwards.

Ireland and Spain – Pay Me Now or Pay Me Later

Hello Spain! Ireland took the pain on their real estate mess 2 yrs ago, now GDP is rising, I believe markets need truth to move higher.

The quicker we get a full bank recapitalization in Spain the better it is for US stocks. This event will provide the real and lasting reduction in systemic risk we need. “Officially”, Spanish house prices down 2.5% in Q2. That’s 22% off peak, but less than half the total Irish fall. Hmm, I don’t recall housing prices in Florida falling half as much as Nevada 2005-9? These were USA’s two worst markets during the crisis. Could it be that after of the aggressive stress tests, led by BlackRock and a deep bank restructuring, Irish banks were more aggressive sellers of real estate than Spanish banks? I think so.

Truth Bleeding Out

Today, the Bank of Spain said bad loans totaled EURO 155.8 billion in May, its bad loan ratio rose to 8.95% vs 8.72% in April. Likewise, deposits at Spanish Banks were off by 5.75% in May. In my mind, Lehmanesqe risk still lurks in the valley’s of the Iberian Peninsula. It will rear its ugly head again.

One of the primary reasons for Japan’s lost decade was their government’s cover up of bank losses. The faster pain is taken, the faster return to healthy markets.

Ireland’s Economic Growth vs. Spain’s Decline

Spain’s GDP in September 2010 was a +0.4% vs a negative 0.4% in March 2012. Just look at Ireland’s GDP, in September 2010 she was +1% vs +1.2% in March 2012, per Bloomberg.

There’s no question “taking the pain” early has paid off for Ireland. Why Spain still has not completed their bank recapitalization while Ireland did so in 2010 is still beyond my ability to understand? I believe if Spain had taken the pain in 2010 like Ireland, US stocks would be higher today.

Cash is Squirming for Safety.

One bright spot, Spain’s 10 year bond yield is now back to 6.82% vs. 7% early last week. Yet, the French 2 year yield at hit a fresh record low at 0.08% yesterday. This week, the German 2 year hit a record ‘negative’ yield. Even Italy’s one year paper is trading at 2.73%, down from 4% in June and 8% last November. Barclays expects 12-month Italian yields to move below 2.5% in the near term.

Remarkably, the yield on France’s 2 year bond has moved from 0.93% in April to 0.08% today? The market is begging the question, could the FOMC cut interest on “excess reserves” in the near term as the ECB did recently? Swiss 2s are at -40 bps, Germany -5 bps, Finland’s 2 year note yield fell below 0% for 1st time today. These bonds makes US Treasury’s 2 year notes look cheap at +23 bps yield.

This Bond’s Begging to be Shorted?

France’s 2 year bond has moved from Novembers’ 1.88% to 0.93% in April, to 0.08% today. I thought a BIG government socialist President is supposed to be bad for bond prices? Bond bears who despise Washington’s spending habits are in awe of France.

The Road to Zero: France’s 2 Year Bond Yield

Something’s Wrong Here?

On June 1st, the last time the yield on the 10 year treasury below 1.5%, the VIX was 26 on June vs. 16.11 today.

In terms of market volatility, the VIX was down marginally last week but has declined more than 40% since June 1st. The VIX has been below 17 six times since January, each time has led to a sell off in stocks and higher volatility. You can make the argument that one of these is wrong? A VIX under 17 and a 10 year treasury at 1.46%, risk aversion and lack of volatility together? Usually they’re miles apart? This gets back to my point of rising economic risk with falling systemic risk, when these waters meet in force, strange things happen.

2. The recent slash of sluggish economic data coming out of the USA. The ISM Manufacturing index recently printed below 50 for the first time since July 2009. Employment growth has slowed significantly compared to Q1 2011 and 2011, off 65%.

A Soft Consumer

ICSC Chain Store Sales Trends is a monthly report on the U.S. retail industry’s sales performance, they’re off 8% from Q2 2011 to Q2 2012. Overall, Retail Sales plunged by 0.5% falling for a third month and negative in 9 of 13 categories, the last time breadth was this unfavorable was back in March 2009. When you think about 3 consecutive negative reports, my fiends at the Liscio Report point out, since 1947 there have been only 29 instances of three consecutive negative reports and all but 2 have ended in recessions.

GDP Coming Down at Barclays, Goldman

Reflecting softer consumption, net trade and inventory accumulation, Barclays lowered their US Q2 2012 real GDP forecast to an annualized to 1.5% from 2.5%. Monday, Goldman Sachs took its Q2 GDP forecast down to 1.1%. They note real consumer spending appears to have slowed to about 1.7% in Q2, down from 2.5% in Q1.

Earnings: Falling Expectations

In October, Wall St consensus expected earnings were expected to rise 14% in the latest Q2,

now that number down to +5.8%. The FT reported this weekend, earnings warnings from May 2012 on were at “a rate not seen in more than a decade.”

Take out funny accounting in the US financial sector “Q2 S&P earnings growth comes all the way down to – 0.6%.”

3. Economic slow down coming out of China and the BRICS. This week, China’s imports rose less than anticipated in June, pushing the trade surplus to a three-year high and adding pressure on the government to support demand as the global economy slows. Inbound shipments increased only 6.3% from a year earlier, the customs bureau said in a statement yesterday in Beijing, compared with the 11% median estimate per Bloomberg. More and more investors are starting to question the Chinese math on GDP. “Power production shouldn’t be a zero growth when heavy industry is growing at near double digits,” BNP Paribas recently asked. Likewise, last week China said its Q2 GDP slowed to 7.6% from 8.1% in Q1 and 12% in 2010. Barclays notes their soft industrial production point to a number more like 7.15%.

China Action in the Second Half of 2012?

My friends at ACG Analytics believe Beijing is prepared to take additional policy measures to encourage economic growth in the second half of 2012, including further cuts to interest rates and reserve ratios. They note reserve ratio cuts could occur within 1-2 weeks. On July 15th, Chinese Premier Wen Jiabao said, “the country’s economic rebound is not yet stable, and economic hardship may continue for a period of time.”

Brazil and Cheap the EMs

Brazil Industrial Production continues to spiral downward, from 20% year over year growth in January 2010, 5% in 2012 to -5% today. In fact, over the last 12 months the S&P 500 has outperformed emerging markets by 26% & the MSCI EAFE (big mkts outside USA) by almost 24%. It makes sense if your long US equities to buy emerging markets here, a 10% move higher in the over the last 12 months has provided us with an attractive entry point to EM.

4. The fiscal cliff, as I said in my spring 2012 letter, “US equities are facing a wall of political uncertainty that they’ve rarely faced before.” First, there’s an overhang of unanswered questions about what Congress will do next year to reduce the national debt and improve the economy. Letting the Bush / Obama tax cuts (including the payroll tax cut) fall off the ledge will increase taxes on an average American household by $3,000 in 2013 alone. That’s a sharp 5% cut in after tax incomes hitting an economy struggling to get back the 5 million jobs lost since the failure of Lehman Brothers. 31 million families will be hit with an alternative minimum tax AMT is President Obama is reelected. The good news is almost all investors know of this uncertainty.

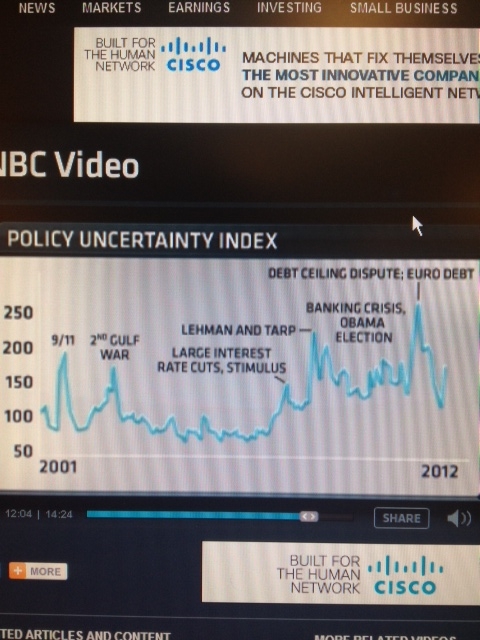

The Political Uncertainty Index

Steven J. Davis, Professor of International Business and Economics at the University of Chicago Booth School of Business has come up with a brilliant Political Uncertainty Index. As you know, I’ve been more than vocal about the importance of following US and EU political policy to manage risk in today’s markets. I’ve said “we’ve never had a higher level of political uncertainty impacting the value of stocks and bonds.” Now there is hard data to prove this point. Most striking, the bottom of our recent cycle is in line with the top of the September 2011 cycle. The Index covers a period from 1985 – 2012, and the last 6 months have been the highest period on record. More important, the Booth data shows if we were just back to the level of political uncertainty we experienced in 2006, we’d have 2.5 million more jobs in the US economy today. We have self inflicted pain of unprecedented levels coming out of Washington and Brussels.

Chicago Booth School of Business Political Uncertainty Index

And today a BofA/Merrill equity strategy is cutting EPS forecast for S&P 500 saying bottom up not accounting for Euro crisis, fiscal cliff and China. Hmm.

And Risk on;

Reasons to be Bullish

1. We have seen a dramatic reduction in systemic risk, over all my 17 Lehman risk indicators are in 65% better shape than they were a year ago.

2. Easy Money: During the first half of 2012, the S&P 500 had a total return of 9.5%, best first half since 2003. We’ve had over 200 monetary & policy easings this year & over 30 in June, according to ISI’s Ed Hyman. More telling, in the last 5 weeks, the Federal Reserve, European Central Bank, the Peoples Bank of China, Bank of Japan, Bank of Korea, Central Bank of Brazil and the Bank of England all have eased monetary policy. The world is bathing in a sea of cash. Even more doves, Federal Reserve Open Market Committee minutes showed “a few” members said more stimulus would probably be needed.

A Bernanke Kiss

Fed chairman Bernanke is testifying before the US Congress this week, I’m looking at the language relative to last week’s Fed minutes to look for more QE clues. First look, he’s more dovish than the minutes.

German Stocks Outperform the US

S&P 500 was basically unchanged last week, while the German DAX continued its recent outperformance, up 6%. In credit, a better leading indicator than equities, investment grade names in the financial risk epicenter that is Europe have been griding tighter. The iTraxx Main basket of bonds has moved to 166 bps, 16 tighter since June 10th.

3. US stocks are cheap, the net indicated yield on the S&P 500 is 2.02% with one year dividend growth of 10.73%, per Bloomberg. It’s PE is 13.53 and 11.45x 2013 expected earnings. In a bullish sign for stocks, we’ve seen nearly $100bn in equity outflows since the start of 2009. Both high yield and investment grade bonds have experienced over $500 billion of inflows during the same period. We’re seeing IG yields at record lows and HY yield dancing near the 7% level. Like a rubber band, when this trend reverses, it will set up a super bull market.

Price to Earnings Ratio on the S&P 1955 – 2012

– From 1958 to 1973 stock were more expensive than today, likewise 1989 – 2009.

European Stocks are Cheaper

European stocks are a buy for the long haul, “cheapest relative to US shares, in 40 years,” according to BCA data. Barron’s noted over the weekend, the Vanguard MSCI Europe ETF VGK “trades at just 6.6x 2012 earnings, and offers a

6.7% dividend yield.” Remember, the SPY ETF (S&P500) trades at 13.55x earnings with a 2.02% dividend yield.

Jack the Knife

Analysts are cutting European profit forecasts at the fastest pace since the dark days of 2009. According to a Bloomberg poll of thousands of analysts, Euro Stoxx 50 companies, the biggest equities in the EU, are now expected to earn at a lame 6.8% growth rate over 2011, a robust 19% gain was expected by analysts in January.

As cheap as USA equities are, they’re twice as expensive as stocks in Europe.

4. A Romney win in the White House and a GOP victory in the Senate while keeping the House, sets up a colossal wall of pro business, pro market policy. Above all, this would take the markets out of the quicksand of uncertainty they’ve been in, we all know, uncertainty kills job creation, economic performance and stock performance. I think the S&P 500 would trade north of 1430 (1372 today) if this outcome starts to come into view.

Intrade Data

Obama 55%

Romney 41%

Democratic President + Democratic Senate + Democratic House after 2012 elections 7%

Democratic President + Republican Senate + Republican House after 2012 elections 17.5%

Democratic President + Democratic Senate + Republican House after 2012 elections 31%

Republican President + Republican Senate + Republican House after 2012 elections 30%

5. Lower Oil Prices, crude is down 25% since March, You’re talking about roughly $110 – $130 billion in extra consumer spending power, according to most Street estimates I follow. This money is flowing directly into the US economy.

6. Since 2008, Natural Gas prices are off 72%. Coal prices are off 30% since 2010. For the first time we can see off on the horizon, an energy independent USA. There are so many emerging technologies in this space. U.S. reliance on imported oil is down 7% since 2010, but leading US scientists believe the discovery of the largest natural gas find in the history of the world, the Marcellus Shale, spanning from Marcellus, N.Y. through the Appalachian Basin, will be the key to American energy independence.

7. Performance? During tough times is the best of times to invest in hedge funds. It’s turning into another difficult year for the hedge fund industry. Data from GlobeOp found that, in June, funds suffered the largest withdrawals in assets since October 2009. The Economist notes hedge funds suffered their fourth consecutive month of negative returns in June; in the first half of the year, they eked out a return of 1.3%, compared to a 3.7% gain for the MSCI World index. That follows a 3.6% decline in 2011.

8. Housing has made a bottom. If you look across Warren Buffett’s portfolio at Berkshire Hathaway, it looks like he’s getting longer and longer a play on a substantial recovery in housing.

All In?

Back in January 2011, even with a large stake in Acme Brick and a 7% ownership position in Wells Fargo, Buffett made additions to Berkshire’s “brick-and-mortar” portfolio by buying Jenkins Brick. Last month, Berkshire tried to expand its real-estate brokerage by making a $3.85 billion bid for a mortgage business and loan portfolio from bankrupt Residential Capital, LLC. Berkshire has also made a play on commercial property through an entity owned jointly with Leucadia National.

Strong Housing Starts

Buffett must be smiling at today’s 6.9% jump, brought the number of housing starts to the highest since October 2008. U.S. homebuilders jumped to the highest level in five years.

Per Realtor.com, the total US for-sale inventory of single family homes, condos, townhomes and co-ops, came in at 1.88 million units for sale in June, down -19% compared to a year ago, and -39% below its peak of 3.10 million units in September, 2009.

At the end of the day, Germany won’t pool debts from the north until sovereignty, tax collection and state budgets are pooled in the south. Just how much market pressure is needed to force Eurozone leadership to do the right thing will dictate market performance in the 2nd half. If systemic risk starts to move north again, she’ll take US stocks and equities globally lower.

Markets are Not Functioning

800% Increase in Problem Loans from 2011

ECB loans to Spain’s troubled banks rose 17% €337.2 billion in June, according to the Bank of Spain compared to May of €287.8 billion and €42.2 billion in April 2011.

If and when the ESM can lend directly to banks in Spain, it will be a game changer, but this is not likely until Q2 2013. This is where the risk lies for the market.

The Wall Street Journal’s reported this week, the ECB has altered their view and that Senior Bondholders in financial institutions in wind-down should face losses as part of a bail-in structure of a bank represents another significant shift in Eurozone crisis policy solutions.

This change in ECB position represents a sharp reversal from the precedent set in Ireland where the ECB has insisted that senior bondholders be repaid in full. ACG Analytics notes, only 2 days before the EU Summit on the 28th/29th June 2012 and only 11 days before the President of the ECB reportedly stated the ECB’s altered position on senior bondholders, €600 million of IBRC (Anglo Irish) non-government guaranteed senior bonds were repaid in full.

Impact on French Bank & Italian Bank Debt?

There’s a creditor domino effect across the bond market with this type of move. Imposing losses on Senior creditors in Spanish banks is politically beneficial for Germany, Netherlands and Finland. It’s the bank debt of France and Italy which will suffer in contagion. This is why finance ministers of Eurozone countries have yet to support the ECB’s measure.

According to RBS, Spanish banks in likely need of aid have $42 billion in subordinated debt, $30 billion senior secured paper, of which $10 billion matures before 2014.

ACG notes, it’s unlikely the ECB would risk agreeing to the imposition of losses on senior note holders unless it was sufficiently comfortable over the short term with increasing monetary authority reliance both in Spain and across the Eurozone potentially through introduction of a 3rd LTRO.

A Big Date in September

Yesterday, the ECB’s Joerg Asmussen said German approval of ESM bailout fund is the key, and negative court judgement would mean ESM “failed.”

Germany’s Constitutional Court will keep the world waiting until September 12th for its verdict on whether the new tools for fighting the eurozone debt crisis comply with German law or violate parliament’s right to decide on national budget issues.

The precious systemic risk reducer, the ESM, which was expected to boost the firewall against debt crisis contagion to €700bn, had been due to come into effect on July 1st.

Bottom line, I don’t think losses will be imposed on senior bondholders in Spanish banks until the ESM is set up and can lend directly to banks, this will not happen until the second quarter of 2013. Market pressure is needed to get the ESM back on track to its much needed time table.

Will Mr. Market patiently wait for the extended political calendar to feed her, no way.