Jeffrey Sprecher, chair and chief executive of ICE, said the group has created an internal research and development group, called the AI Centre of Excellence, which is testing novel use cases and building appropriate governance guardrails to reduce or eliminate the risks inherent to artificial intelligence.

Sprecher said on the first quarter results call that ICE is increasingly being asked how the firm is incorporating AI into its business. He said developers are working on how to integrate AI models into products, to monetize ICE’s proprietary datasets and to improve its own productivity.

For example, ICE is investing in mortgage data and document automation through the extension of a product formerly called AIQ that it acquired with Ellie Mae in 2020 and also integrating property and loan level mortgage datasets with property-level climate risk metrics. Climate risk modelling is also being enhanced for existing municipal bonds and mortgage-backed securities products.

In addition the firm is investing in ICE Chat, the commodity chat platform, to improve actionable insights and also using AI models for pattern recognition in regulatory compliance activities.

On the call, Sprecher detailed some of the “lesser known” second order impacts of AI that are fuelling ICE’s growth.

He explained that when ICE launched, financial exchanges were largely open outcry venues and trading involved significant human involvement. The company’s thesis was that the increase of digital networks would require the creation of its own data centres and network channels.

Today ICE operates from 14 global data centres, and has built out ICE Cloud, a managed network connecting them to third-party trading and data venues and interconnecting major players across the global financial services industry.

“We made the determination that managing our own IT infrastructure and making it available to our customers directly and through an ICE-managed cloud offers us a competitive advantage, while providing for better intellectual property protection and creating an avenue for our connectivity and data revenue growth,” Sprecher added.

For example, customers can use their own code and equipment within the ICE global network and transmit their digital output across ICE Cloud, which is driving demand for access to ICE’s data centre and cloud.

“We have already received customer deposits for much of our planned year 2025 and 2026 network build outs and we have been working with our vendors to plan for continued expansion,” added Sprecher. “This customer interest in AI modelling should provide a multi-year tailwind to revenue growth in our data and connectivity business.”

Another second order revenue impact from the current interest in AI is the attention that ICE’s listed emissions offset markets and renewable energy markets are receiving from power companies and third party data centre developers as they plan for their future growth. ICE Benchmark Administration also manages the carbon market data service to companies seeking information about the voluntary carbon credit markets.

“Interest in these markets is surging as evidenced by corporate involvement more than doubling over the past six months to more than 250 firms,” said Sprecher. “We believe the backdrop for revenue growth in ICE’s environmental and renewable markets, attributable to AI model demand, remains bright.”

Fixed income and data services

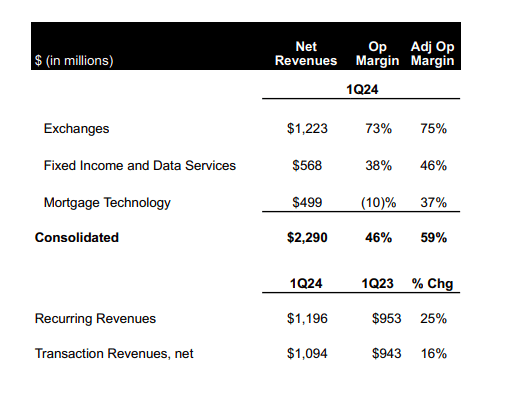

Fixed income and data services had record first quarter revenues of $568m. Transaction revenues for fixed income were $119m, driven by growth in corporate bond trading, especially in the institutional channel.

Ben Jackson, president of ICE and chair of ICE mortgage technology, said on the results call that ICE’s position as a leading provider of price and reference data has served as the foundation for becoming the largest provider of fixed income indices globally.

“A key driver of this growth is the increase in the passive ETF assets under management benchmarked to our indices, growing to a record of $593bn through the end of the first quarter from less than $100bn in 2017,” added Jackson.

Lynn Martin, president of NYSE Group and chair of ICE fixed income and data services, said on the call that the firm is “incredibly excited” about the opportunity to continue to build out institutional connectivity across fixed income and data services.

“Part of the reason we are so excited is because we have seen institutional in our municipal bind execution business which has grown with a 68% compound annual growth rate over the last two years and how we have deliberately curated our data assets,” she added.

Martin continued there has also been a re-engagement with fixed income funds, which have increased by about 7% from a year ago which makes ICE well positioned.

“Given the suite of assets that we have on end-of-day pricing, reference data, the modern tools we have rolled out, we see continued strong adoption and continued strong demand,” she said.

Financials

ICE reported record net revenues of $2.3bn for the first quarter of this year, up 21% year-on-year.

Warren Gardiner, chief financial officer at ICE, said on the call: “In the first quarter, we generated record revenues and record operating income. This performance not only reflects the strength of our balanced and diversified business but also the strategic investments that we have made to drive long-term profitable growth and to create value for our stockholders.”

The exchanges segment had record net revenue of $1.2bn in the first quarter, up 11% year-over-year driven by a 12% increase in the interest rate business and record energy revenues, which grew 32% from a year ago.

Average daily volume for global futures and options business increased 16% year -on-year to a record 8.1 million contracts in the first quarter, including records across commodities, energy and total options. Performance included a 28% increase in the oil complex, 42% growth in global natural gas revenues and 26% growth in the environmental business.

Jackson said energy revenues have nearly tripled since the same period in 2010. Through April, open interest across global commodities and energy markets remained at all-time highs, up 22% and 25% respectively versus last year.

“By combining the network and liquidity of our global energy platform with our leading environmental portfolio, we are well positioned to help our customers navigate the transition across global energy markets,” he added.