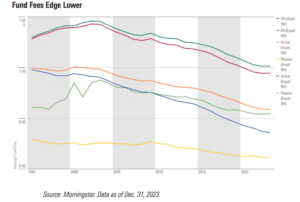

The average fee paid by US fund investors has more than halved in the last 20 years. The rate of decline slowed last year but asset managers’ revenues are still under strain on both sides of the Atlantic according to data providers Morningstar and ISS Market Intelligence.

Zachary Evens, research analyst for Morningstar, said in a report that the average fee paid by fund investors has more than halved from 0.87% in 2004 to 0.36% in 2023, saving investors $3.4bn last year.

However, the pace of the decline in fees appears to be slowing and there were more increases than cuts in 2023. The asset-weighted average expense ratio across US open-end mutual funds and exchange-trade funds fell 3.4% last year from 2022, less than the 7.8% decline a year earlier.

“New mutual funds are getting cheaper, and new exchange-traded funds are getting more expensive,” said Evens. “With many core strategies already commoditized, passive shops have barely decreased fees recently, if it all.”

Vanguard held the low-cost crown in 2023, with an asset-weighted expense ratio of 0.08% according to Morningstar. Other low-cost providers include SPDR State Street Global Advisors (0.14%), iShares (0.16%) and Dimensional Fund Advisors (0.24%).

Despite the slowdown in fee reductions and the commoditization of many ETF strategies, Morningstar highlighted that fee wars can still happen. The US Securities and Exchange Commission approved spot bitcoin ETFs this year and 10 issuers all launched products on 11 January.

“To not tip off competitors on where each might land, many providers opted to unveil their ETF fee only days ahead of its scheduled debut,” added Morningstar. “Even still, each lowered its fee at least once prior to launch.”

Growing revenues, not assets

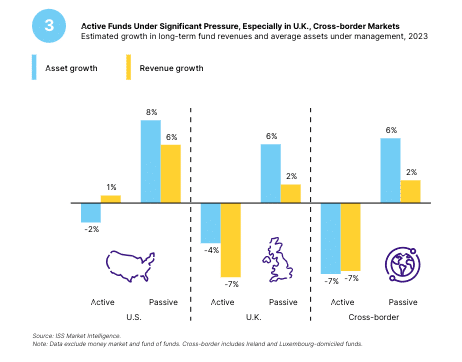

The continued fall in fees has led to the revenues of asset managers remaining under strain on both sides of the Atlantic according to ISS Market Intelligence. The data provider studied revenue growth trends across mutual funds and ETFs in the US, UK and the main European cross-border markets in a whitepaper, Growing Revenues, Not Assets, New Name of the Game.

ISS Market Intelligence estimated that revenues last year from long-term funds barely grew in the US, and shrunk in the UK and the main European cross-border markets. Estimated revenues for active managers fell 7% for UK and cross-border managers and 2% for US managers.

“Index funds’ growing market share, aided by the proliferation of ETFs, coupled with weak growth of their books of business, left fund managers struggling to grow their revenues,” said the paper. “In the US, ISS MI estimates revenues generated by long-term active funds fell 1.9% as revenues from index funds rose 5.7%.”

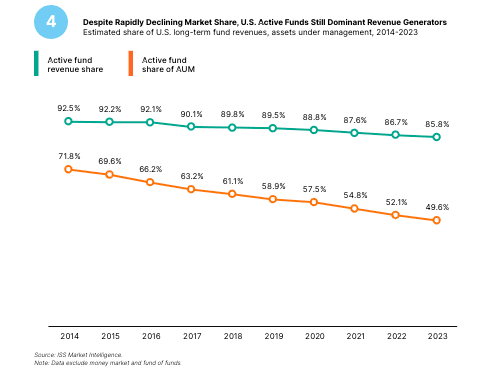

However, although the market share of active funds fell below 50% in the US for the first time last year, they still generated 86% of the revenues generated by long-term funds.

“As in the US, active management will remain dominant revenue generators, but the industry will need to cut costs to maintain profitability,” added ISS Market Intelligence. “Expect significant consolidation, shrinking the oversupplied active fund market and shifting product development toward ETFs.”

In order to increase organic growth, many managers have acquired or built capabilities in high-demand asset classes that should be more resistant to passive competition such as private markets, and turned to active ETFs.

However, ISS Market Intelligence warned that alternatives may only move the needle modestly for larger firms, while active ETFs are more likely to supplant, rather than create, new demand for active management.