Kelly Mathieson, chief business development officer at Digital Asset, said financial services is moving from “plumbing to wiring” as the blockchain solutions provider completed a pilot with DTCC to demonstrate that tokenization can improve collateral mobility and capital efficiency.

On 23 September 2024 Digital Asset and The Depository Trust & Clearing Corporation, the US central clearer, said in a statement that the U.S. treasury collateral network pilot, conducted in June and July, proved that tokenization can enhance collateral mobility and unlock liquidity as participants successfully executed more than 100 transactions.

The pilot was extended to include default, which Jenny Cieplak, partner at law firm Latham & Watkins, said is crucial because to ensure that secured parties can take legal possession of collateral in the event of a default.

Cieplak said in a statement: “This demonstrates blockchain’s potential to support the full lifecycle of financial transactions, beyond just execution.”

Mathieson told Markets Media that collateral mobility is critical because only $25 trillion of securities are currently being used for collateral, out of a potential pool of $230 trillion, according to trade body SIFMA.

Canton Network

In the U.S. treasury collateral network pilot Digital Asset, four investors, four banks, two central counterparties, three custodians/collateral agents, and a central securities depository operated fourteen Canton nodes and connected four types of cross-application transactions through ten distributed applications. DTCC’s LedgerScan was used to support dynamic tracking and governance of the assets involved in the transactions.

The U.S. treasury collateral pilot followed the Canton network pilot that Digital Asset completed with a group of market participants including institutions with blockchain applications in production, including BNY Mellon, Broadridge and Goldman Sachs. In March 2024 Digital Asset said the pilot demonstrated the interoperability of 22 independent distributed ledger applications (dApps) in the capital markets domain and executed over 350 simulated transactions to exchange tokenized securities, money market funds and deposits across applications.

Mathieson described the Canton network as the first true unified ledger where different entities can bring their tokens to settle against each other.

“Canton network’s role is to provide on and off ramps for all traditional financial assets, so they can interact with each other and be used with increased fidelity and utility,” she added.

Mathieson also described the Canton network as public and permissioned.

“The industry grew up as private permissioned chains and public permissionless chains, which implies these are the only two flavors that exist,” she added. “In reality, it’s more of a grid.”

Clients can establish a network that is entirely public, entirely private or in-between, like Canton. Institutions can use functions in Canton to meet their regulatory compliance requirements, to decide who can become a client of their organization and which products and services they can be offered.

“Canton is unique because it gives each regulated entity sufficient control to tokenize traditional regulated assets into the network, but retain that atomic settlement capability,” Mathieson added.

Blockchains allow much faster atomic settlement, which is the simultaneous release of cash and securities at a predetermined time, once all the relevant conditions have been met. Clients can lock an asset at a location, such as a custodian on the Canton network, and represent the asset digitally as a token, which can then move globally and is not bound by settlement cut-off times.

The U.S. treasury pilot used existing registry and margin applications from the Canton network, with the network’s global synchronizer ensuring synchronization to enable atomic transactions across applications and parties.

Bernhard Elsner, chief product officer at Digital Asset, compared the global synchronizer to the equivalent of the architecture that provides the backbone to the internet. Elsner told Markets Media that the internet has highly permissioned internal networks, such as a bank, but anyone can connect via a public backbone that enables the transmission of encrypted messages.

In the Canton network, the global synchronizer is a connector that coordinates between the permissioned regulated entities and other market participants. The global synchronizer was launched in July 2024 following ten years of development and nearly a year of extensive testing.

“I could do something on my end, and you could do something on your end,” added Elsner. “The global synchroniser will change both as long as they are fully in agreement.”

Using the global synchroniser means that each counterparty can maintain their own standards and controls, but tokens are interoperable across the Canton network. The Linux Foundation supports the Global Synchronizer Foundation under an open governance model that fosters trust and neutrality.

Tokenizing real world assets

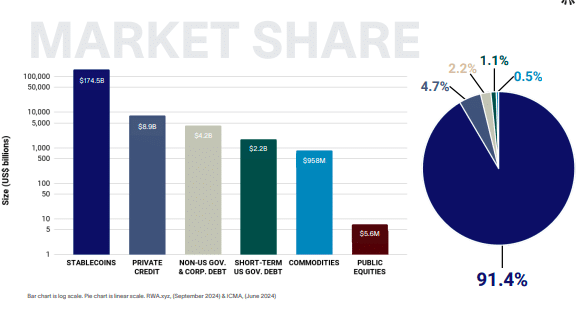

This year has been significant for asset tokenization, with total market capitalization increasing by a third, 32%, according to the Tokenized Asset Coalition’s 2024 State of Tokenization Report.

Tokenized real world assets (RWAs) classes have experienced rapid growth, and represent $176bn today, or nearly $15bn excluding stablecoins, across more than 150 asset issuers on more than 20 public blockchains according to the report.

“The size of tokenized Treasuries has surged by 179%, private credit by 40%, and commodities by 5%,” said the report. “Evolving regulatory approaches in jurisdictions such as the United States, the Middle East, and Hong Kong have led to greater experimentation among legacy financial institutions, sparking a level of institutional interest previously unseen in the industry.”

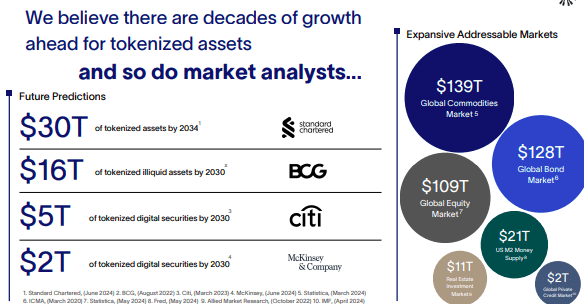

Mathieson said institutions and regulators have an increased level of comfort around tokenization and that most of Digital Asset’s conversations on tokenizing real word assets revolve around bonds and funds.

“For example, we are having a conversation with a large UK asset manager about the progression of mutual funds to ETFs, and now to digital tokenized funds or tokenized share classes,” Mathieson added.

She explained that the mutual fund market is still largely driven by transfer agencies, which have heavy manually-intensive processes. This results in asset managers not launching certain products because they are not cost effective. Blockchain allows institutions to contemplate products and services that would previously have been impractical, or even impossible to design, according to Mathieson.

“You can be much more tailored and offer bespoke hedging tools, which will please regulators,” she added. “Fund managers can also reach more clients by being able to lower the minimum investment threshold.”