Pan-European exchange operator Euronext reported that revenue for MTS, its fixed income business, were a record in the second quarter and that it has completed the migration of the MTS data centre.

MTS operates regulated electronic fixed income platforms for European rates, credit and money markets. Euronext said in its second quarter results on 25 July that fixed income trading revenue rose by 40.7% from a year ago to a record €35.6m, driven by the supportive economic environment, positive volatility, and the sustained level of issuance.

In May this year MTS concluded the migration of its production data centre from Milan to Bergamo in Italy, where Euronext’s core data centre is located. The facility is 100% powered by renewable energy and the migration also led to a 30% reduction in gateway-to-gateway latency on all MTS cash market order books.

Stéphane Boujnah, chief executive and chairman of the managing board of Euronext, said on the analyst call on 26 July: “This strategic move enables customers to access MTS Markets’ trading and data services through the same facilities as all Euronext trading venues, thereby enhancing efficiencies in European capital markets.”

MTS was founded in 1988 by the Italian Treasury to enhance liquidity for investors and optimise funding costs for the government, and Italian debt is still the most significant part of its MTS business.

However, Boujnah explained that since MTS became part of Euronext, a cross-marketing program has made MTS closer to the debt management offices of many more countries. For example, the quality of the dialogue with France has significantly improved and Boujnah is confident that MTS will get more deployment of French government debt on the platform.

MTS has also been appointed as the platform for secondary trading of the European Commission’s NextGenerationEU program which aims to issue between €700bn and €800bn of new debt.

“Volumes are growing and we have just started to charge clients at the beginning of July,” added Boujnah. “So you will start to see revenue contributions from European sovereign bonds being traded on an MTS in the third and fourth quarter.”

Microwave network

In order to improve the efficiency of trading on Euronext from London, the group has launched a new microwave wireless network. EWiN debuted in July this year in collaboration with McKay Brothers, the independent microwave network provider.

Boujnah said: “We became the first exchange in Europe to offer “plug & play” order entry in London via microwave technology, which will significantly enhance the speed of order transmission and offer unparalleled improvements in latency.”

EWiN reduces latency between London and Bergamo by half to less than 4 milliseconds, provides full straight-through processing and the service is fully resilient with 100% fibre back-up. Goldman Sachs and Morgan Stanley have been using the new network since it went live.

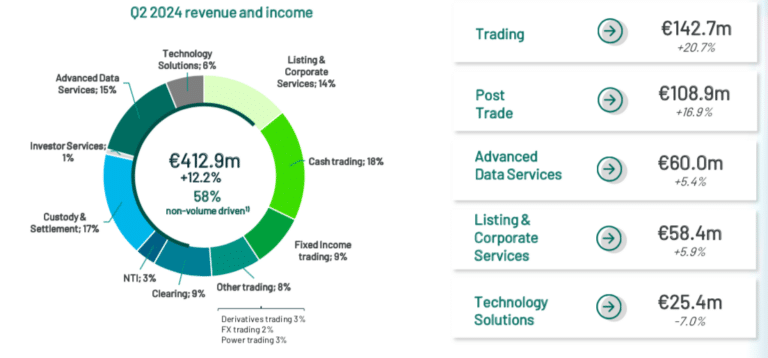

Overall trading revenue for Euronext grew 20.7% in the second quarter from a year ago to €142.7m.

Boujnah continued that there is also a focus on Mid-point Match, which has been increasing volumes month after month. Mid-Point Match is a suite of dark, mid-point and sweep functionalities embedded within Euronext’s central order book. The offering was introduced on the Brussels market in March 2024 and extended across all Euronext markets in the following month.

Borsa Italiana Group integration

In April 2021 Euronext completed the €4.4bn acquisition of Borsa Italiana Group which added new capabilities in fixed income trading through MTS and post-trade activities, including a multi-asset clearing house and a central securities depository.

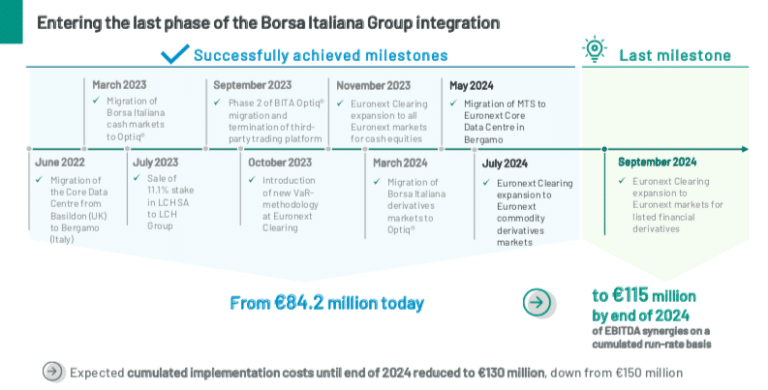

In July this year the group completed the first phase of its derivatives clearing migration to Euronext Clearing with commodities. Boujnah confirmed that the second and final phase of migrating financial derivatives will take place in September this year.

“We are entering the last phase of the Borsa Italiana Group integration,” added Boujnah. “This last step will complete our integration across all value chains.”

Since the acquisition of the Borsa Italiana Group, Euronext has incurred €109.1m of accumulated implementation costs, with €3.2m in the second quarter of 2024. The final migration is expected to reduce overall implementation costs until the end of this year to €130m, which is €20m lower than the €150m guidance in May 2022, and €30m lower than estimated in November 2021.

Anthony Attia, global head of derivatives & post-trade at Euronext, said on the analyst call that Euronext clears cash equities, repo and now, commodity derivatives.

“Competition with other CCPs mainly happens on cash equities, and through our value proposition on fees and our risk model we have managed to retain a very strong market share,” Attia added. “In listed derivatives the clearing house captures flows from our own market and to grow this business we need to grow volume and our set of products.”

Boujnah said the strategic expansion of the clearing house creates an integrated market infrastructure that further contributes to the defragmentation of the European post-trade landscape. The completion of the integration will also be the final step in reaching the targeted €115m of run-rate EBITDA synergies by the end of 2024.

“Now that the integration phase is coming to an end, the expansion of our clearing house will unleash new innovation capabilities and strategic, organic growth opportunities,” added Boujnah.

Financials

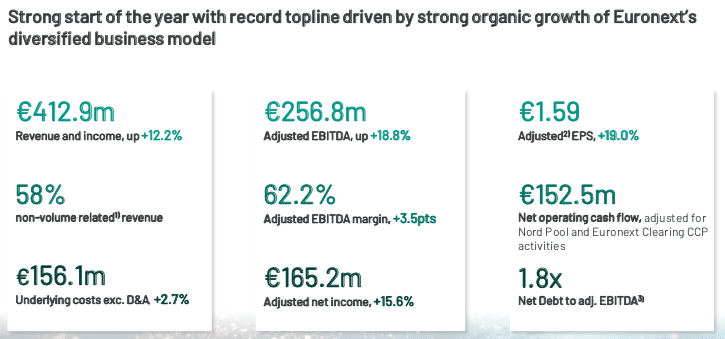

Euronext reached record revenue and income of €412.9m in the second quarter of 2024, an increase of 12.2% from the second quarter of last year. More than half, 58%, of total revenue and income came from non-volume related businesses.

Boujnah said: “This very good performance was boosted by solid growth in non-volume related businesses combined with strong growth in clearing and, especially, fixed income.”

Clearing revenue grew by a third to €39.2m in the second quarter after Euronext Clearing expanded to European equities in the fourth quarter of last year.

In order to continue to diversify the group’s business mix, Euronext completed the acquisition of Global Rate Set Systems (GRSS) in June this year. Euronext said this positions the group as a leading player in the calculation and administration of interbank offered rate (IBOR) indices and enhances its index franchise.

Boujnah said: “This bolt-on acquisition will further strengthen Euronext’s non-volume related revenue growth.”

He continued that Euronext is always monitoring for bolt-on acquisitions that can accelerate growth, increase diversification and meet the required hurdle for capital allocation.

Analysts asked Boujnah about the possibility of acquiring Nasdaq’s Nordic power trading and clearing business. In June this year the European Energy Exchange (EEX) terminated its agreement to acquire that business from Nasdaq. Boujnah said Euronext was monitoring the situation closely and exploring how to offer clients solutions that are appropriate for their needs in this sector.

Euronext is in the process of building a new strategic plan. Boujnah said the strategy will be focused mainly on organic growth and presented on the investor day on 8 November 2024.