Eurex, the derivatives arm of Deutsche Börse, has launched weekly STOXX Europe 600 index options as open interest in options has nearly tripled over the past year.

Dr. Randolf Roth, member of the executive board at Eurex Frankfurt responsible for equity & index derivatives, told Markets Media that open interest in options has grown to €23bn, up from €9bn a year ago.

“Liquidity attracts liquidity, so there has been more client interest,” he added.

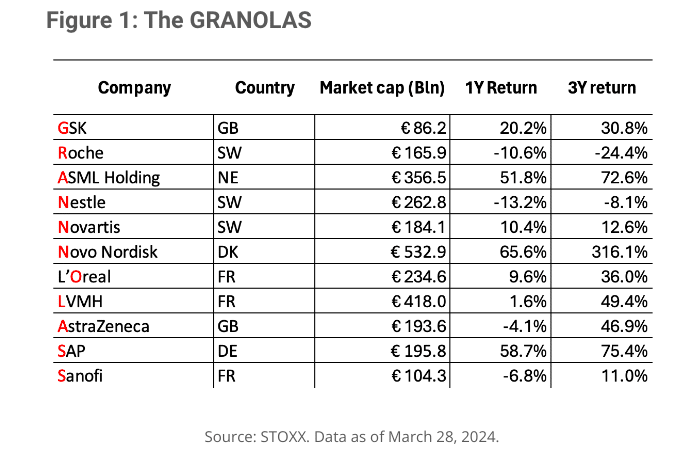

The largest trading volumes at Eurex in equity indices are for contracts on the Euro STOXX 50 index according to Roth. However, he said STOXX Europe 600 index options have become increasingly popular as it is a broader index, which includes the 11 “GRANOLAS.” The latter term was coined by Goldman Sachs in 2020 for a group of 11 companies with strong earnings growth, low volatility, high and stable profit margins, and solid balance sheets.

STOXX said in blog in April this year: “The GRANOLAS account for a combined 21% of the STOXX Europe 600 but were responsible for 60% of the benchmark’s gains in the past year, and have even beaten the Magnificent Seven on a risk-adjusted basis.”

As investors have become more interested in the STOXX Europe 600, Eurex introduced six index options with a weekly term and three contracts with a month-end term, which began trading on 24 June. Roth said more than 25 million STOXX Europe 600 index futures were traded last year.

“This year options volume rose by 150%,” he added. “As a result we expect more than four million options to be traded this year.”

Eurex reported a 13% year-on-year increase in traded contracts for May 2024 to 161.3 million contracts. Over that period equity derivatives grew by 15%, while index derivatives fell 12% to 54.5 million traded contracts.

Robbert Booij, designated chief executive of Eurex Frankfurt, said the exchange is seeing structural growth in equity products. He added: “Daily options are really picking up, so I think that provides a good alternative for short term risk management.”

It is possible that daily expiries could be introduced for the STOXX Europe 600 index options at a future date.

Booij spoke on a panel of exchange leaders at the FIA IDX conference in London on 19 June. Booij joined the executive board of Eurex Frankfurt on 1 May this year and will succeed Michael Peters as chief executive on 1 July 2024. He joined from ABN Amro Clearing Bank, where he had been CEO Europe since March 2018.

Exchange leaders panel

In May interest rate derivatives at Eurex grew by 41% year-on-year. Booij said Eurex is benefitting from the uncertainty around the timing of the normalization of interest rates, which are not following a linear path.

“We are benefiting in terms of our fixed income strategy to be the home of the Euro yield curve,” Booij added. “We believe that we provide a very good liquidity pool across all maturities and can clear in one CCP, which provides capital efficiencies and margin optimization.”

There is also lots of interest in Eurex’s total return futures and ESG contracts according to Booij.

Chris Rhodes, president of ICE Futures Europe, said on the panel that volumes had risen 61% year-on-year in April and open interest has increased. He agreed that the divergence in interest rate paths is also boosting ICE’s fixed income business in Swiss francs, sterling and euros.

“We are the home of the European yield curve across multi-currency interest rates,” added Rhodes. “I have been most pleased by our €STR business.”

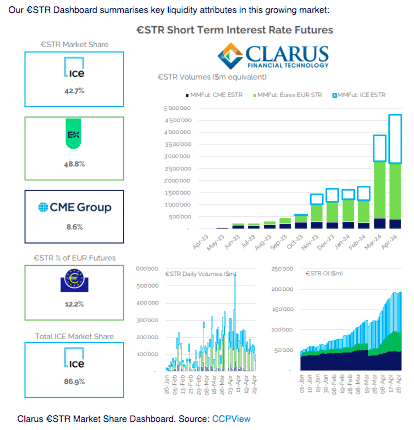

In November 2023 ICE entered the competition for market share in futures on €STR, the Euro risk-free rate, with CME Group and Eurex.

Chris Barnes at derivative analytics provider Clarus Financial Technology, said in a blog that volumes and open Interest of €STR futures were continuing to increase in April, up to $200bn equivalent from $50bn at the start of 2024. Average daily volume also increased to $200bn in April, up from $80bn in February.

“ICE is now leading the way at over $100bn of open interest, with both Eurex and CME at about $50bn,” wrote Barnes. “ICE saw their largest days ever in €STR volumes in April, with over $375bn traded in a single day.”

In terms of trading volumes, Barnes said Eurex had 49% in April, ICE 43% and CME the remaining 8%-9% of volumes

ICE has also had “tremendous” growth in its options complex in commodities according to Rhodes, as open interest has grown threefold in three years to 50 million contracts.

Stéphane Boujnah, chief executive and chairman of the managing board at Euronext, was also on the panel and highlighted that the exchange group has diversified its business, with 60% of total revenues are unrelated to trading volumes.