Adena Friedman, chair and chief executive of Nasdaq, said the group’s index business had a stellar first quarter as assets in exchange-traded products linked to its indices reached more than $500bn for the first time.

Friedman said on Nasdaq’s first quarter results call on 25 February that the index business had exceptional momentum in the first quarter with revenue increasing 53% to $168m. Nearly three quarters, 70%, of revenue comes from the Nasdaq 100 franchise.

“The Nasdaq 100 reached record highs multiple times in the quarter and we are pleased to announce that our index business crossed $500bn in ETP AUM for the first time, finishing the period at $519bn,” she added.

Nasdaq indices had $46bn of net inflows over the last 12 months, including $21bn dollars during the first quarter of this year, and clients launched 29 new index-linked products.

“This momentum contributed to our index business delivering 53% growth, which represents 30% year-over-year core revenue growth in the quarter,” said Friedman.

She continued that Nasdaq is focussed on the fast-growing segment of index options. Volumes of index options grew 80% year- over-year and 15% quarter-over-quarter.

‘That’s definitely been a bright spot and we agree that we are just at the beginning of what we can achieve there,” she said.

IPOs

Friedman continued that Nasdaq has begun to experience an uptick in initial public offering activity in the first quarter as the US markets welcomed 39 operating company IPOs, which was the most in two years. Nine of these IPOs had market caps in excess of $1bn.

“As we referenced in our most recent Nasdaq IPO Pulse Index, we are seeing five out of six leading indicators of future IPO activity continue to improve, suggesting an improvement in the US public capital raising environment over the coming months,” she added.

Nasdaq has a healthy pipeline of companies preparing to enter the public markets, but Friedman said their timelines will be dependent upon continued strong economic and market performance.

Any improvement in the IPO market in the coming quarters will take time to translate into improving sales and revenue results for Nasdaq’s corporate solutions business according to Friedman.

Data

The analytics business reported high single-digit growth in the quarter. Friedman said the group continues to deepen its strategic alliance with Mercer as the global investment consultant incorporated Nasdaq’s new environment, social and governance (ESG) investment analytics for asset manager diligence and insights into its assessment process.

“We are excited about this expansion and see additional opportunity to deepen and expand our partnerships with the asset management community,” added Friedman.

She argued that Nasdaq’s proprietary data is a competitive differentiator across both analytics and corporate solutions. Nasdaq is developing innovative products in its Data Link offerings that are attractive to traders and the investment community and it has “solid growth” in the eVestment Market Lens product for asset owners.

Nasdaq is also enhancing products through using artificial intelligence according to Friedman. For example, the firm is collaborating with Microsoft’s AI incubation lab to launch a new capability that creates executive summaries for board members, and supports corporate secretaries in preparing and summarising board documents and is currently testing this feature with clients.

On 22 April Nasdaq said that its subsidiary Verafin had launched Entity Research Copilot to bolster its suite of financial crime management solutions. The copilot uses multiple automation technologies, including generative AI (GenAI), to automate compliance tasks and daily workflows to reduce operational costs and increase the efficiency of anti-financial crime programs.

Financial technology

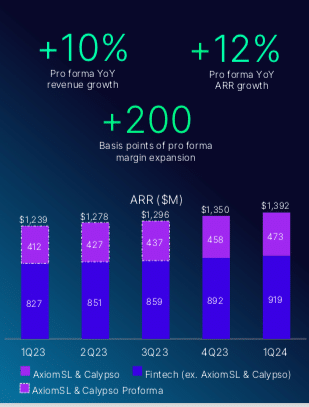

In November last year Nasdaq completed the $10.5bn acquisition of Adenza, which is now part of Nasdaq’s financial technology division.

Adenza provides capital markets risk and regulatory technology through two software platforms – Calypso’s front-to-back suite of capital markets risk management, treasury, cash, collateral management, and post-trade solutions; and AxiomSL’s regulatory reporting, global shareholder disclosure, capital and liquidity management, transaction and ESG reporting solutions.

Calypso had a particularly strong performance in the first quarter with 25 upsells and one new client sale.

“While we are early in our journey of unlocking the cross-sell opportunities across the division, executed with a client who was looking to adopt a data connector between Calypso and AxiomSL which highlights the synergies between these two products,” said Friedman.

Nasdaq has set a target to achieve at least $100m in incremental revenue through cross-sell opportunities by the end of 2027.

There are three cross-sell campaigns across the financial technology division- bringing more of Calypso’s risk management collateral management capabilities into Nasdaq’s market operator clients; bringing more of AxiomSL’s capability into capital markets firms as the face new regulatory obligations such as the Basel end game requirements; and cross selling treasury management capabilities to Verafin clients.

Sarah Youngwood, chief financial officer at Nasdaq, said on the call that AxiomSL and Calypso contributed combined revenue of $151m in the first quarter, an increase of 20% versus the same period last year. She said the businesses had a high level of upfront renewal revenue, higher cloud-based revenue and slightly lower professional services revenue.

Market services

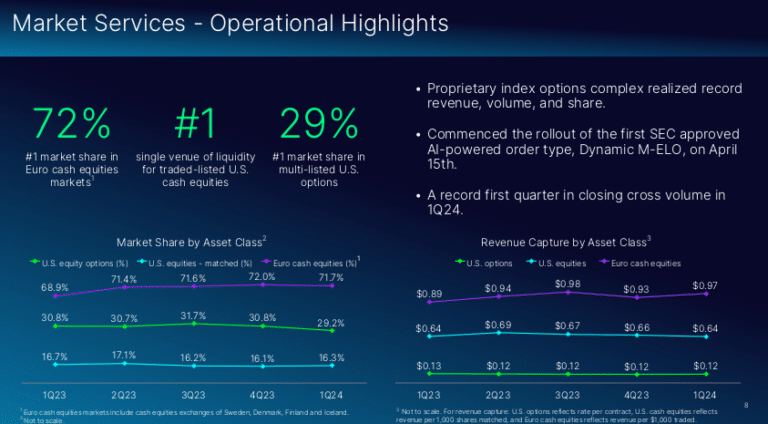

The US options business had a lower revenue quarter which Friedman said was due to lower volatility compared to the prior year quarter.

“Despite these headwinds, Nasdaq maintained its market share lead over the number two operator in US multi-listed equity options and our proprietary US index options products,” she added.

After the end of the first quarter, on April 15, Nasdaq started to roll out Dynamic Midpoint Extended Life Order (M-ELO), the first AI-driven order type approved by the US Securities and Exchange Commission. The roll out is scheduled to be completed by the middle of May.

Nasdaq has offered a midpoint extended life order (MELO) order type for several years. MELO introduced a fixed holding period to gather order interest before application for clients seeking larger trade sizes at the midpoint. After extensive testing and consultation, Nasdaq found trade execution could be improved under certain market conditions by applying adaptable holding periods.

Therefore, Dynamic MELO uses AI to adjust the length of holding periods throughout the trading day on a stock-by-stock basis to improve fill rates and reduce market friction. This new order type analyzes more than 140 data points every 30 seconds on a symbol-by-symbol basis to detect market conditions and optimize the holding period prior to which a trade is eligible to execute.

Nasdaq futures and options volumes increased 5% year-over-year, also contributing to revenue growth.

Borse Dubai ’s sale of Nasdaq shares

In March this year Borse Dubai sold 5% of Nasdaq’s common stock for $1.6bn. Friedman said there was strong investor demand, resulting in an oversubscribed transaction, and that Borse Dubai continues to hold just over 10% of Nasdaq. In addition, Essa Kazim, governor of Dubai International Financial Centre and chairman of Borse Dubai,Borse will remain a board member of Nasdaq.

“Our relationship with Borse Dudai is multifaceted and spans many years,” Friedman said. “Nasdaq continues to be a trusted technology provider and brand partner of Borse Dubai. We look forward to their continued support as their insight and contribution will continue to shape our path ahead.”

First quarter 2024 net revenues were $1.1bn, an increase of 22% over the first quarter of 2023, and up 6% organically.

Youngwood said, “Nasdaq’s financial performance in the first quarter underscores the growth profile and durability of our business model. We are making disciplined investments while achieving meaningful progress executing on our expense synergy target and our deleveraging plan.”