by Sarah Butcher, eFinancialCareers

When it comes to psychological resilience, it seems trite to compare the mental challenges of a finance career with those of a first responder, but experts suggest there are parallels. “There are some careers that are intrinsically pressured and stressful,” says Doug Strycharczyk, of psychometric test providers AQR. “Job in the emergency services, for example, and jobs in banking and finance.”

AQR offers a ‘mental toughness test’ which Strycharczyk says has been used to select the highways officers who are first on the scene at road accidents, The test is also popular with financial services firms. “It’s used mostly for development,” says Strycharczyk. “It helps to determine why people are responding to pressure in a particular way.”

Mental toughness or ‘resilience’ has been gathering steam in financial services ever since Goldman Sachs introduced a ‘resilience week’ in 2010. In a resilience-related presentation from 2012, the firm described spiraling behavioural problems, with mental health related absences more than doubling in the previous two years. Goldman didn’t respond to a request to comment for this article, but three years ago it said employees faced, ‘multiple challenges to their resiliency’ – including the ‘barrage of negative media coverage’, the difficulty maintaining work/life balance, and the pressure to maintain productivity, ‘in an environment of expense management.’

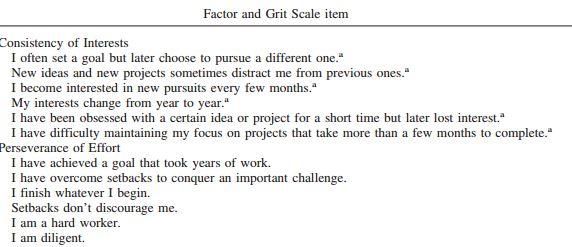

The definition of mental toughness or resilience depends upon who you ask. Strycharczyk defines it as, “the ability to deal with stress, pressure and challenge irrespective of circumstance.” Diane L. Coutu, a senior editor at the Harvard Business Review, says it comprises three things: a staunch acceptance of reality, a deep belief that life is meaningful, and an uncanny ability to improvise. More recently, US academic Angela Duckworth, has coined the concept of ‘grit’, defined as ‘perseverance and passion for long-term goals’.

“Grit entails working strenuously toward challenges, maintaining effort and interest over years despite failure, adversity, and plateaus in progress,” writes Duckworth, Her research shows that grit and self-control are strongly correlated with lifetime educational attainment and career success. Duckworth’s interviews with people working in investment banking suggest many see grit or, ‘sustained commitment,’ as crucial to their progress in a highly stressful, heavily over-subscribed, industry.

You can take Duckworth’s grit test for free by clicking here. Strycharczyk’s test is only available to paying users, but asks respondents to agree and disagree with statements such as, ‘I often wish my life was more predictable,’ ‘I generally can be relied upon to complete the tasks I’m given’, and ‘Even when under considerable pressure, I usually remain calm.’

If you strongly disagree with the first statement and strongly agree with the second two, you might think you’re tough enough for a banking career – although to be sure of this you’d need to answer the remaining 45 questions in Strycharczyk’s test.

Not everyone agrees with the accepted wisdom on psychological robustness, however.

Don’t deny your emotions

“In finance, there’s been an over-emphasis on the need to be mentally tough and and an under-emphasis on the importance of emotions,” says Denise Shull, a New York City-based coach for traders in investment banks and hedge funds. The concept of mental toughness can get in the way in trading, says Shull: “Instead of denying emotions, it’s about accepting that emotions are an integral part of the decision making process, recognizing that you’re experiencing them and separating out the intuitive feelings which you want to act upon, from the impulsive feelings which you don’t.”

As an example, Shull cites confirmation bias – or the tendency to seek out information that reinforces a hypothesis. She says this isn’t a rational error, but an emotional one: “It’s about wanting to be right and being scared to be wrong. You need to recognize that you have that feeling, that you’re afraid to look stupid.”

In Shull’s world, the most mentally tough traders are therefore those who are have the fluffy quality of being ‘in touch with their feelings’ but are able to override them where appropriate.

Shull is in the process of developing a new test for traders that measures not the ability to sideline emotions in pursuit of goals, but ‘cognitive empathy’ – the ability to recognize what you’re feeling and to recognize and predict the feelings of others. “This is what the research on mental toughness in trading is moving towards,” she says.

In the meantime, banks have been acting pragmatically. Goldman Sachs hired a psychologist for its London health centre and its senior staff have featured in videos discussing their ‘personal resiliency practices.’ The emphasis at the firm has been on destigmatizing mental health issues and making help more accessible. After five quarters of onsite presence, the clinical caseload of its employee assistance practitioners increased by 75%.

How gritty are you?

Source: University of Pennsylvania

Read the original article on eFinancialCareers. Register now on eFinancialCareers to get access to all the latest finance jobs. You can also check out eFinancialCareers on Facebook and Google+. Copyright 2015. Follow eFinancialCareers on Twitter.