The origins of the Derivatives Market Institute for Standards (DMIST) go back to the Covid pandemic in 2020 when a massive backlog of exchange-traded derivatives built up between February and mid-March. Central counterparties (CCPs) were asked to extend their clearing windows, but there were long delays in the allocation and give up process and, in some cases, it took many days to correct trades that were in the wrong place.

Don Byron, head of global industry operations and execution at FIA and executive director of DMIST, told Markets Media that the industry body for exchange-traded derivatives (ETD) got involved in helping through that period. The FIA’s board of directors then started to digest the lessons that could be learned.

“Most of the issues were not new but were amplified during that period of high volume and volatility,” added Byron.

Joanna Davies, head of trade processing at OSTTRA, which provides post-trade solutions, highlighted that the unprecedented volumes and volatility in exchange-traded derivatives during Covid have been followed by ever-increasing volumes. For example, in May this year a record 17.9 billion contracts were traded worldwide

“The FIA acted incredibly quickly in recognising that systemic risk existed in the current ETD workflow and it was likely that further significant volume from geopolitical and macro concerns would likely occur,” she added. “This kicked off the desire to minutely understand the predominant areas of risk, where the workflow was broken, and DMIST was born.”

In November 2021 the FIA produced a strategic blueprint for change and the recommendation to form a standards body was published in March 2022, with the first sponsor board meeting held in July of that year. Samina Anwar, global derivatives operations director at Cargill, has been appointed chair of the DMIST sponsor board.

“The consensus was for the industry to come together to try to solve as many problems as possible without the need for a regulatory mandate,” said Byron. “One theme was the lack of interoperability between platforms, systems and workflows.”

Davies agreed that it was clear that collaboration in the ETD industry was an imperative to solve the historic issues in the industry’s workflows, and OSTTRA is an ambassador for the DMIST community.

Timeliness standard

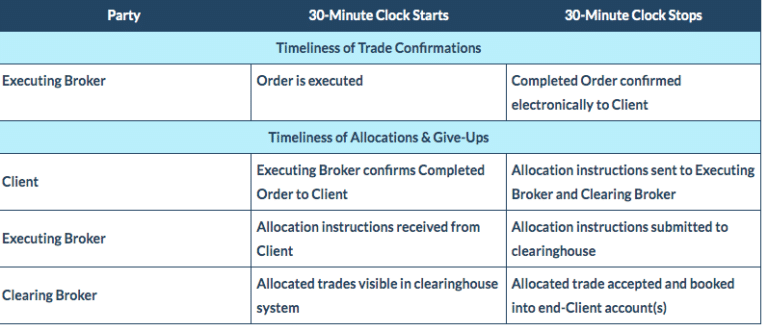

Following a consultation period, DMIST published its first final standard for Improving Timeliness of Trade Give-Ups and Allocations in June 2023. The ’30/30/30’ standard establishes 30-minute timeframes for completing steps in the allocation process and a 30-minute clock from confirming orders to booking trades.

Jeff Arnold, chief operations officer at ABN Amro Clearing USA, said in a statement: “The 30/30/30 proposal is a major step forward in supporting efficient markets while reducing clearing risks. The adoption of these timeframes will increase efficiencies throughout the lifecycle of an allocated trade.”

The financial industry has historically struggled with timely trade allocations, particularly with give-up trades and one of the big challenges was that give ups and allocations were all bunched together towards the end of the day. DMIST came up with the phrase ‘right trade, right account, right time’ to speed up this process with a standard around timeliness.

“We debated the numbers, but the consensus was that 30/30/30 is the initial goal, and hopefully that becomes even faster,” said Byron. “30/30/30 was a great place to start to lay the foundation of what DMIST is trying to do.”

A year after the timeliness standard, DMIST published the Average Pricing Standard in June 2024. DMIST’s second standard calls for CCPs globally to adopt certain minimum standard average pricing functionality as the lack of standardization was cited as one of the issues that prevents transactions being processed on trade date. Average pricing is being used extensively in ETD markets as electronic trading allows firms to break large trades into many smaller orders to minimize market impact.

Data

Davies said OSTTRA supports the timeliness standard and has a proven real-time solution to help the industry meet the requirements. OSTTRA has since focused on the data underpinning the process.

She added: “You can meet the timeliness standard, but will the right trade be in the right account? We created standardized datasets with fellow DMIST members to allow the bulk of members to clear trades accurately within the standard’s timeframes.”

When DMIST was working through the average pricing standard, the organization also looked at data and information according to Byron. As part of that process, DMIST will soon announce that it has more standards in the pipeline and Byron believes a universal order ID will be very impactful.

“The current identifiers and tags used in the industry do not fit the purpose of being able to track an order across the full workflow from front to back,” added Byron. “We know that is not an easy undertaking, but we hope to publish an initial consultation paper in the coming months.”

Position transfers is another standard DMIST wants to get into the pipeline as they are being increasingly used by the industry, and Byron said existing rails cannot handle the volumes.

DMIST is also potentially looking at self-match prevention as different exchanges offer different ways of supporting that process; and also execution source code, otherwise known as Tag 1031, that records how the trade was executed throughout the value chain, which allows fees to be calculated accurately according to Byron.

Tracking adoption

DMIST spent a lot of time on developing an eight-step process for standards. Byron said the final step is that every standard should have a feasible way to be measured so that FIA can track adoption and implementation.

“We will also be constantly looking at the standards to see if they need to be updated which will be a very helpful way to encourage implementation and adoption,” he added.

For example, DMIST has spoken to some CCPs that offer average pricing and he said they reached out to understand where their current functionality fits into the standard, which he described as encouraging. Some CCPs are also providing metrics on 30/30/30 and having bilateral conversations with DMIST members. DMIST wants firms to create their own individual metrics but Byron acknowledges that will take time.

In addition, DMIST wants to create an implementation guide for non-DMIST members and to continue to raise awareness.

“We are very happy with how DMIST has developed,”added Byron. “We wanted to create an open, collaborative environment for sharing information across participants and that has happened.”

Davies agreed that the industry needs to continue to work together to drive the implementation of any standards, to affect real wholesale change.

“The FIA has done a good job in driving the level of collaboration and conversation within the futures industry, long may that continue,” she said.