Paul Woolman, global head of equity products at CME Group, highlighted the growth in the exchange’s equity index suite despite muted volatility.

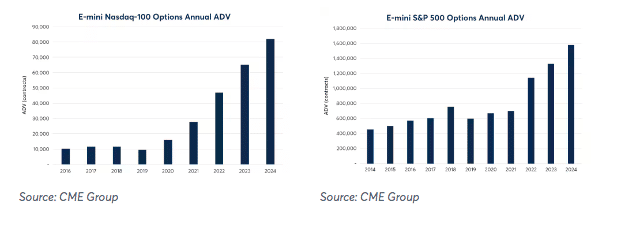

CME reported that equity index options had a record average daily volume of 1.7 million contracts in the first quarter of this year, up 28% over the previous all-time high in the first three months of 2023. The exchange’s total options average daily volume reached a record 5.9 million contracts in the same period.

Woolman told Markets Media: “There has been a continuation of the growth that we have seen in options over the last couple of years. We have seen auctions take off which has been really exciting to see.”

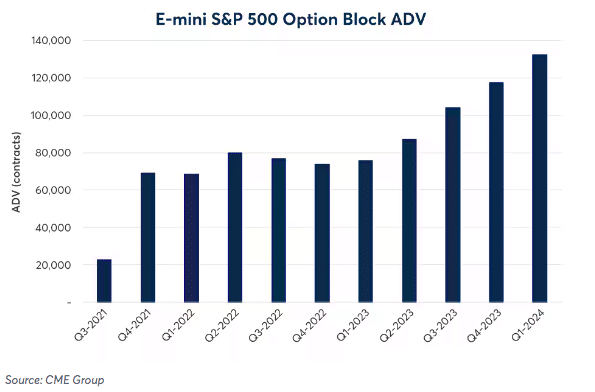

In addition, E-mini S&P 500 options blocks achieved a record trading day of 558,000 contracts on March 15. Equity options blocks average daily volume was a record 134,000 contracts in the first quarter of this year, which was the fifth-consecutive quarter that ADV has surpassed the prior record.

Smaller E-mini contracts allow market participants to achieve more granular hedging of their portfolios and more granular expires around potentially market-moving events.

Woolman said a great deal of liquidity is electronically executed through the order book but some clients want to use blocks, which is a relatively new functionality the CME introduced in 2021. He expects the use of this functionality to grow as more participants are becoming aware of how to use it.

“A block functionality provides certainty that market participants will be able to transact the whole size of a large trade,” added Woolman. “In contrast, using a cross means that liquidity providers are not guaranteed to retain all of trade, which can be frustrating.”

Block trades also allow market participants to achieve greater cost and capital efficiency as they are centrally cleared at CME. CME also introduced derived blocks a few years ago, according to Woolman, and he said open interest has been climbing. The price and quantity of a derived block depends on hedging transactions in an eligible related market such as stock baskets or ETFs.

Woolman said: “We have seen growth in what we call OTC [over the counter] alternative products, such as equity index sector futures that have been trading at record levels this year.”

For example, Woolman said there has been growth of between 75% and 80% in CME’s AIR Total Return futures in the first quarter of this year, which are an alternative to a total return swap in the OTC market. He explained that a driving force of the growth is that trading on an exchange is more capital efficient, which participants also gain comfort around screen liquidity and transparency.

Clients are much more sensitive to capital efficiency than in a zero rate environment and Woolman added that trading on exchanges enables lower margins than in the OTC market, and there is a secondary benefit of participants being able to net their total portfolio position.

“The OTC market is still very large and we have aspirations of providing more capital efficiency by coming up with new products,” added Woolman.

A new product that CME launched in January this year were options on S&P 500 annual dividend futures to manage US dividend risk, which Woolman said were trading over 500 contracts per day.

Another new product launched this year was CME’s E-mini S&P 500 equal weight futures. The S&P 500 Index is weighted by market capitalization, but the new contract allocates the same weight to all names in the S&P 500 index, allowing participants to trade the US benchmark with a different risk exposure.

“If E-mini S&P 500 equal weight futures gain traction, then we can consider what else might make sense,” said Woolman.

It is also possible that CME may launch more micro contracts, which Woolman said have been a great source of additional liquidity for both retail and institutional traders.

In 2023 CME launched Micro E-mini S&P MidCap 400 and Micro E-mini S&P SmallCap 600 futures, complementing the existing E-mini S&P MidCap 400 and E-mini S&P SmallCap 600 futures.

“We will be thinking about what other indices or contracts might make sense this year,” said Woolman.

Trading functionality

Basis trade at index close (BTIC) allows participants to trade futures at a fixed spread to the underlying index level at the close of the US equity market, and Woolman said trading has been at record level this year.

“The underlying index close is a very popular time of day to trade because there is an auction in the stock which is targeted by funds, “ he added.

Some participants want to trade at the close of the futures market. As a result, in 2023 CME launched the TMAC (trade marker at close) functionality across four major benchmarks, which Woolman said has started to trade actively this year.

“These functionalities are being increasingly adopted,” he said.