Magnus Haglind, head of product management at Nasdaq Market Technology, said a big trend from the Covid-19 pandemic is firms being much more confident in buying software-as-a-service solutions.

Nasdaq commissioned consultancy Celent to survey chief information officers and senior technology leaders of market infrastructure operators worldwide to understand their focus, priorities, and investments around the creation of their future technology platforms.

Gathering data from CIOs & senior technology leaders in global market infrastructure, @Nasdaq's report with @Celent_Research gives insights on the priorities & investments surrounding the future of market infrastructure technology.

Learn more: https://t.co/yr1cQ11p0A pic.twitter.com/yxBTiDpcpX

— Nasdaq Tech (@NasdaqTech) June 1, 2021

Brad Bailey, research director at Celent’s capital markets division, told Markets Media that when the consultancy carried out a similar survey in 2018 many of the discussions were quite theoretical.

Brad Bailey, Celent

“The big difference since then is that the cycle of technology keeps accelerating as do the demands from clients and internal stakeholders as more data is produced each day,” he added.

The COVID-19 pandemic, the shift to remote working, increased volatility and volumes have been a stress test on capital markets infrastructure and the survey showed increasing demand to move to more agile technology, microservices, and data models.

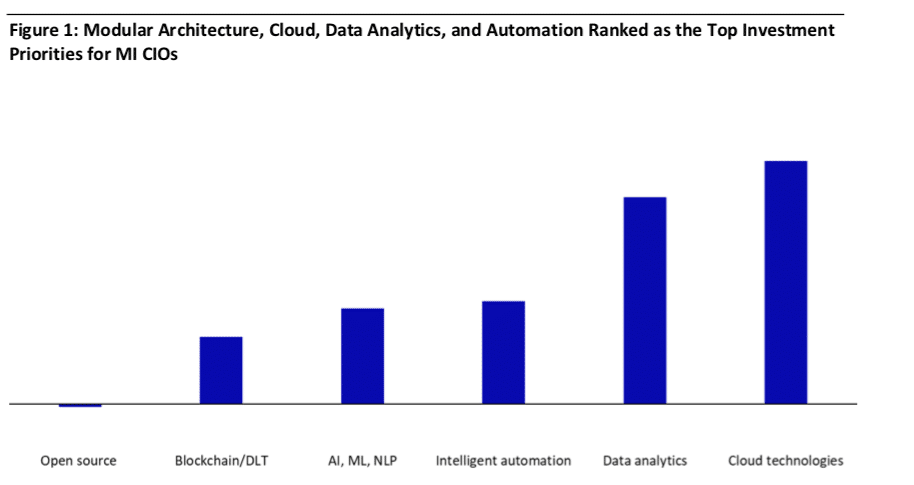

Market infrastructure CIOs plan to increase their investment in modern technology and nearly two thirds, 65%, see cloud technology as a fundamental and expanding part of their software development. Researchers estimate a 27% increase in cloud-ready applications between 2021 and 2025.

Source: Celent

Haglind told Markets Media that Nasdaq Financial Framework, the firm’s cloud-based enterprise technology architecture, was deliberately designed to be able to run on different infrastructures.

“We have done a good job of investing in capabilities in the Nasdaq Financial Framework,” he added. “From a technology platform perspective, infrastructures need to have open APIs, scalability and resilient messaging infrastructure.”

Firms cannot just move from on-premise one day to the cloud so the Nasdaq Financial Framework creates a layer in between enabling a hybrid operating model which is instrumental for a step-wise transformation according to Haglind.

They are also increasingly open to partnering with third parties in accessing and provisioning technology and services with one third, 31%, planning to move more components to third-party providers in the future.

Haglind continued that there is a convergence between industries that are all dealing with the same challenges.

“Financial services and capital markets have gone from building proprietary technology stacks to moving into more innovative technologies such as the cloud,” he added. “The technology has matured to a point that it can be used to create a competitive advantage, and we can learn from other industries that have gone through similar transformations.”

Digital assets

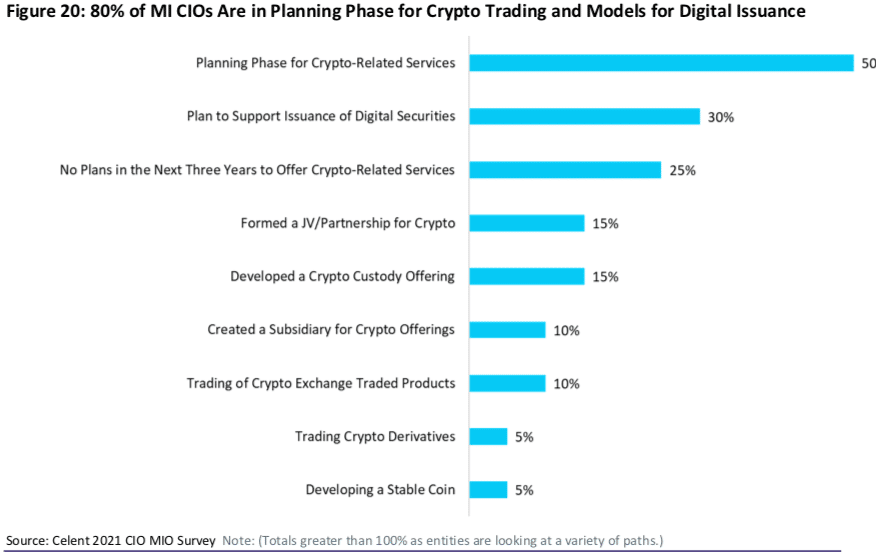

Bailey continued that digital assets will be a major part of capital formation with tokenization, central bank digital currencies and crypto.

“Institutions of all types have to be thinking about this and what it means for the movement of money, trading and clearing,” he said.

Source: Celent

The survey found that some form of blockchain is seen as having the potential to revolutionize recorded keeping systems for securities, and more than one-third of market infrastructures have already created a joint venture or subsidiary for digital assets.

“A minority of leading market infrastructures are way ahead of rivals, many of whom have yet to embark on a proof of concept,” said the report.

The survey also said there are strong differences emerging in the approach to digital models between traditional market infrastructure and newer players.

“61% of market infrastructure CIOs are considering outsourcing either services or technology,” added the report.

Future proofing

Bailey continued that the big challenge is how to develop market infrastructure that won’t be legacy as soon as it is ready.

“It needs to be built for future needs, be safe, meet regulatory requirements and the demands of partners and clients,” he added. “Market infrastructures need to determine what is their special sauce and what are the things that other people are doing better.”

For example, if other firms are spending billions of dollars a year on security they potentially offer better solutions.

.@Celent_Research Research Director Brad Bailey & @Nasdaq Head of Product Management Magnus Haglind join @JillMalandrino on @Nasdaq #TradeTalks to discuss Celent’s Market Infrastructure CIO Survey. https://t.co/TZKrxJGoWI

— TradeTalks (@TradeTalks) June 1, 2021

Bailey said: “The different players across market infrastructure all recognise that this transformation is happening faster than they anticipated and that they will look very different in the next four or five years.”

Haglind highlighted that one of the most interesting findings from the survey is that people recognise the challenges of transformation but they have a lot of ambition.

“The scale of the change that we were going to see requires capabilities you cannot build in 12 months so there needs to be a long-term strategy,” he added.

As a result client attitudes have changed from seeing transformation as a vision to asking for advice on how to execute and plan.

Magnus Haglind, Nasdaq

“We are excited to go from a 10-year perspective to providing real advice and solutions that can help them to change,” said Haglind.

He expects a confluence of market infrastructures, service providers and exchanges in three years time.

“We are going to see a lot of innovation in a way that we haven’t seen in this industry before,” added Haglind.

.