Cboe Global Markets is aiming to wind down its digital asset spot market as it was losing money and due to the lack of US regulatory clarity related to the business.

On 25 April this year Cboe announced that it plans to transition and fully integrate its digital asset derivatives, currently offered by Cboe Digital, into its existing global derivatives and clearing businesses. The firm also plans to wind down the Cboe Digital Spot Market in the third quarter of this year, subject to regulatory review.

Fredric Tomczyk, chief executive of Cboe Global Markets, said on the first quarter results call on 3 May that the lack of clarity on the US regulatory front for the cash spot business, combined with a lack of any timeline to provide that clarity, has caused the change in strategic direction.

Tomczyk said: “We were losing money on this, so that creates a greater sense of urgency to come to a strategic conclusion.We also realised that we do not have regulatory clarity in the spot market and we do not see when we are going to have regulatory clarity.”

The company anticipates that the wind down of the Cboe Digital Spot Market operations will have an immaterial impact on net revenue this year. Expense savings are estimated to be between $2m and $4m in 2024, with savings expected to be in the range of $11m to $15m on a normalized annual basis.

“The steps we are taking in our digital business illustrate our intent to allocate our resources and capital to the areas where we see the best returns for our firm, which is the continued expansion of our global derivatives franchise,” added Tomczyk.

Cash-settled bitcoin and ether futures contracts will also move from Cboe Digital Exchange to the Cboe Futures Exchange in the first half of 2025, pending regulatory review and certain corporate approvals.

David Howson, global president of Cboe, said on the results call that consolidating Cboe futures onto one market will allow the firm to leverage the totality of the derivatives capabilities to grow the digital business, while creating efficiencies for market participants.

“Specifically, that means reducing complexity for clients by allowing them to connect to one global platform for all US futures trading,” Howson said. “We can accelerate the go-to-market timeline for products like options on futures and complex orders for digital products.”

Cboe will maintain ownership and operation of Cboe Clear Digital and plans to align the clearing arm of Cboe Digital with its European clearing house and continue to clear bitcoin and ether futures. Vikesh Patel, the current president of Cboe Clear Europe will now also oversee US clearing.

Howson said that adding Cboe Clear Digital to the global clearing umbrella provides a cohesive clearing approach that spans equities and derivatives in Europe to bitcoin and ether futures in the US.

“The result is Cboe having greater control of its product development destiny from ideation to clearing considerations across the firm,” Howson added. “We continue to leverage our core strengths and find pockets of growth in our cash, data and derivatives categories.”

Tomczyk continued that Cboe is in the heart of the process for its strategic review. The analysis of global trends, competitors, strengths and weaknesses has been completed and the management team is debating where to focus time and attention

“Then we have to review it with the board, which will first be in the summer and then a second round in October because there will be some questions,” said Tomczyk.

International business

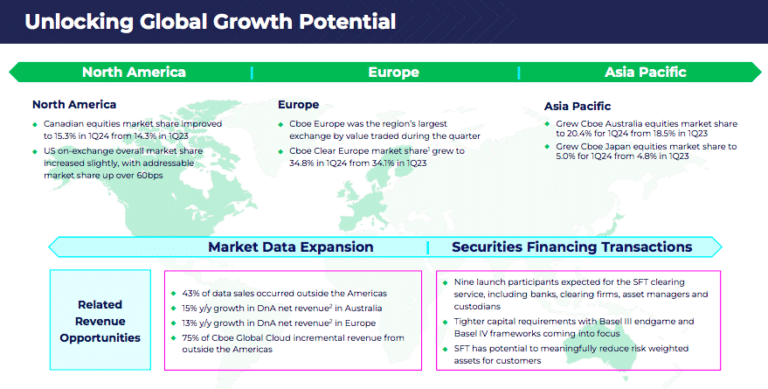

Volumes traded in US products during non-US hours continued to increase in the first quarter.

Howson highlighted that CEDX, Cboe’s European derivatives venue, hit notable milestones in the first quarter. CDEX’s total index derivative volumes hit record levels in March, beating the prior record by 26%, and at the end of March the venue increased single stock options available for trading to more than 300 companies across 14 European countries.

“On April 1 we initiated and revamped our liquidity provider programmes in the region,” said Howson. “We have got more market makers coming on board in the rest of the year.”

He added that Cboe is eagerly anticipating the launch of a major global retail brokerage platform in the coming months for European retail brokers that want to expand internationally as well as funds that are looking to deploy capital into Europe.

In addition nearly half, 43%, of the growth in the data and access solutions in the first quarter came from outside the Americas.

“We believe future growth will be fuelled by strengthening our distribution capabilities through areas like cloud, expanding our index capabilities and providing greater access to our markets around the world,” said Howson. “The continued progress we make in these markets has the potential to add additional revenue streams in tangential areas around growth in North America.”

He continued that Cboe remains on track with the final overseas technology integration, the migration of the Canadian market to Cboe technology in early 2025, subject to regulatory review.

Cboe Clear Europe, the Amsterdam-based clearing house, also remains on track for a third quarter launch of securities financing transactions clearing services, subject to regulatory review, according to Howson.

“With the introduction of stricter capital requirements, we believe now is the right time to leverage our clearing capabilities to bring a solution to the market with the potential to meaningfully reduce risk-weighted assets for customers,” he added.

Cboe has the backing of nine key industry participants for the launch across banks, clearing firms, asset managers and custodians.

In Asia Pacific, Howson said that as the technology integrations have been completed, Cboe looks forward to competing more aggressively in the region to expand transaction and non-transaction revenues.

Since Australia migrated to Cboe technology, for example, data and access service revenues in the country have risen 15% year-on-year. Using a common platform allows API access and clients can then find a myriad of other data points and expand interest across Cboe’s 27 markets, which brings activity back into the core US complex.

Volumes

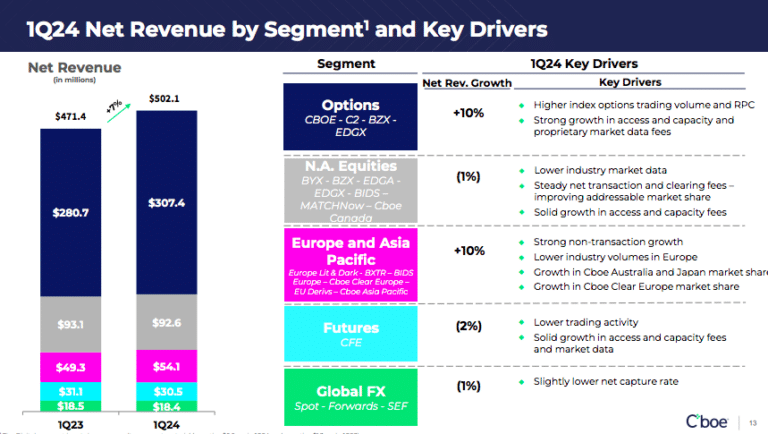

Tomczyk said Cboe delivered record quarterly net revenue, led by the derivatives franchise and the proprietary index option products, continued expansion of the data and access solutions business and disciplined expense management.

“The second quarter is off to a strong start, and I look forward to building on that momentum going forward,” added Tomczyk.

Jill Griebenow, chief financial officer, treasurer and chief accounting officer at Cboe, said on the call that the firm is confident in its ability to deliver on its 7% to 10% targeted net revenue growth.

There were strong volumes across the S&P 500 index (SPX) options suite with SPX trades increasing 70% year-over-year to 3.2 million contracts. The volatility product suite also had a solid performance according to Tomczyk, and VIX futures and options volumes have accelerated in April.

Howson added that average daily volume of SPX options was up 17% year-over-year to 3.2 million contracts, just shy of the all-time high set in the fourth quarter of last year.

“In fact January and February ranked as the second and third highest SPX volume months on record through the first quarter,” said Howson. “We believe investors took advantage of the low levels of volatility to hedge their portfolios more cheaply.”

In addition, in January Cboe launched Tuesday and Thursday expiries for Russell 2000 index options, completing the set of daily expiries for small-cap stocks.

“While still early days, Russell 2000 index options volumes hit a five-year high average daily volume in February,” added Howson.

The share of zero-days-to-expiry volume also increased and Howson said the rise of retail options trading is another secular trend. In addition, more funds, more strategies, and more systematic strategies are trading at the shorter end of the curve.

“We are approaching the second anniversary of adding the Tuesday and Thursday expirations so there is a tremendous amount of data now being used by institutional and systematic funds in order to be able to train models,” he added.

In the retail market, more platforms are coming online for index options trading later this year giving retail investors expanded access to Cboe products.

“To that end, we are thrilled to see our margin relief plan approved by the SEC recently, which we believe will make it easier for investors to overwrite index options on ETFs that track the same index,” said Howson.

He continued that Cboe has been able to turn attention towards technology and enhancements in the core platform and improving access this year and into next year.

“We think that will represent incremental value that customers are willing to pay for, and should also enhance our competitive position within those venues themselves, in particular, in the US options and equities landscape,” he added.